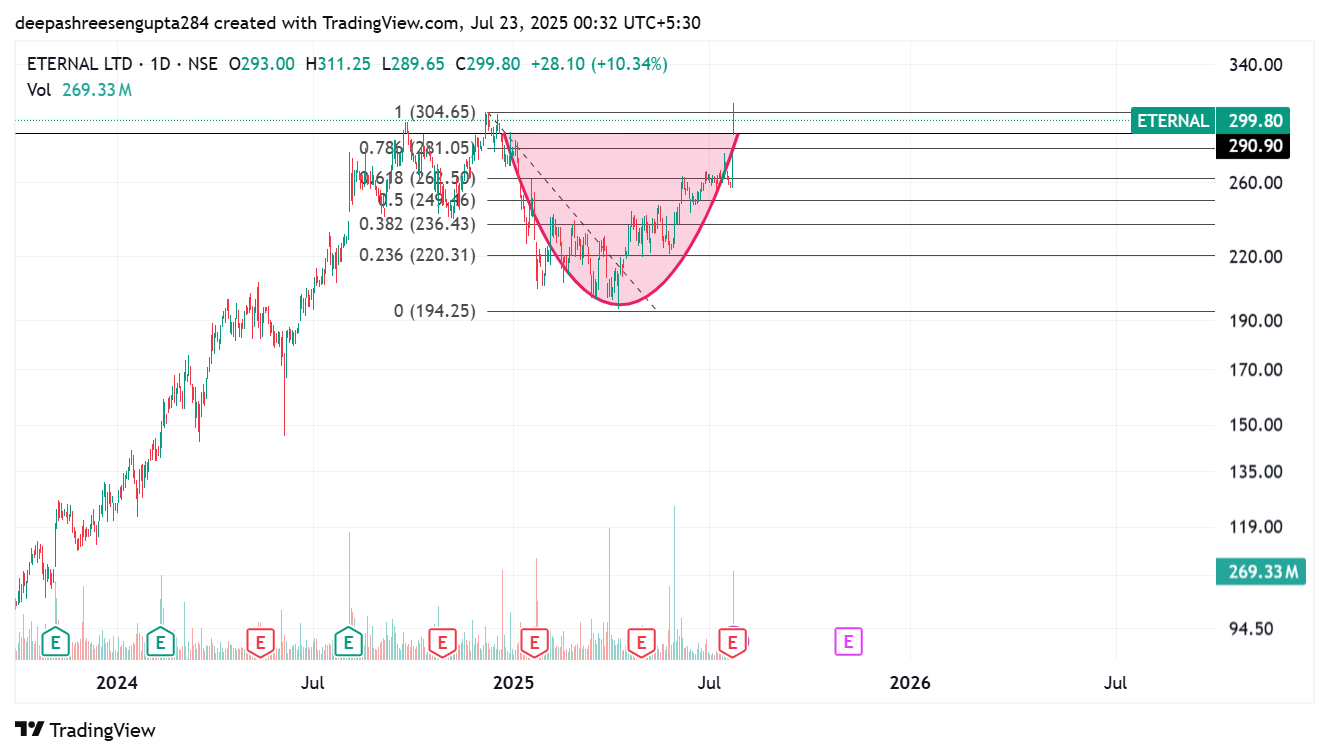

On July 22, 2025, Eternal Ltd (NSE: ETERNAL) delivered a breakout performance on the daily chart, surging by 10.34% to close at Rs. 299.80. This move not only signaled a technical breakout from a rounded bottom pattern but also saw the stock cross its previous weekly high of Rs. 277.75 by an impressive 7.94%—a clear signal of renewed bullish interest. The breakout was accompanied by a massive surge in volume and delivery, reinforcing the conviction behind this move.

Key Price Action Highlights

- Closing Price: Rs. 299.80

- Price Change: +Rs. 28.10 (+10.34%)

- Previous Week High: Rs. 277.75

- Breakout Margin: +7.94%

- Day’s Range: Rs. 289.65 – Rs. 311.25

- Volume: 269.33 million shares traded

- Volume Surge: 8.9x 5-day average

- Delivery Volume Surge: 6.2x 5-day average

Technical Analysis: Bullish Confirmation

Cup and Handle Breakout

Eternal Ltd’s price structure over the past few months formed a textbook “Cup and Handle” pattern—a classic bullish continuation formation. On July 22, the stock broke above the lip of the cup, piercing through the resistance zone at Rs. 294–Rs. 304.65 with heavy volume. This signals a strong bullish reversal and breakout momentum.

Fibonacci Retracement

Fibonacci retracement plotted from the previous high of Rs. 304.65 to the low of Rs. 194.25 showed:

- Break above key resistance at the 0.786 level (Rs. 281.05)

- Retest and reclaim of the 0.618 and 0.5 zones (Rs. 266.50 and Rs. 249.46)

- Potential target: ~Rs. 335–340 in near-term if momentum sustains

RSI Signals Overbought Momentum

The Relative Strength Index (RSI) surged above 70, indicating that the stock has entered the overbought zone. While this might trigger some caution for short-term traders, in a breakout scenario, an overbought RSI can persist and push the stock into higher momentum territory.

Strategy Signal: Cannon (Momentum) Strategy

As per the One Day Bullish Cannon Strategy, Eternal Ltd qualifies as a high momentum trade candidate:

- Breakout above previous high

- Volume confirmation

- RSI surge

- Ideal setup for short-term momentum trading

Fundamental Backdrop

Company Overview

Eternal Ltd is a large-cap player in the Information Technology sector, specifically focusing on e-commerce. The company’s market capitalization stands at Rs. 2,89,366 Cr., with an enterprise value of Rs. 2,85,752 Cr.. It has established itself as a tech-driven consumer platform with multiple growth engines.

Core Offerings:

- Food Delivery – Primary B2C service

- Dining Out – Restaurant discovery and table booking

- Hyperpure – B2B supply chain platform for restaurants

- Zomato Pro – Loyalty and engagement program

Each of these business lines enhances customer engagement through the AAAQ framework—Assortment, Affordability, Accessibility, and Quality.

Valuation Metrics

- PE Ratio (TTM): Not Applicable (Likely due to reinvestment in growth)

- Industry PE: 967.78 (indicating a highly speculative and growth-oriented sector)

- Book Value per Share: Rs. 31.50

- Price to Book Value: 9.52

- Dividend Yield: 0.00% (growth-focused reinvestment)

Sector Analysis

The Information Technology sector, particularly the e-commerce segment, has been undergoing rapid transformation post-COVID. Consumer habits have shifted permanently toward digital food ordering and service discovery. Eternal Ltd has been a direct beneficiary of this trend, with its app ecosystem gaining scale across Tier-1 and Tier-2 cities.

Technical Summary

| Indicator | Value | Signal |

|---|---|---|

| RSI | >70 | Overbought (Momentum) |

| Volume | 269.33M | Bullish Confirmation |

| Delivery % | >6.2x | Strong Accumulation |

| Pattern | Cup & Handle | Bullish Breakout |

| Price Action | +10.34% | Fresh Momentum |

Risk Considerations

- Overbought RSI: Traders should be cautious of sharp reversals or profit-booking if momentum cools.

- Valuation: With no earnings multiple available, the stock could be vulnerable to news-based sentiment shifts.

- Sector Volatility: E-commerce is highly competitive with margin pressures and regulatory oversight risks.

Trading Strategy

For short-term traders:

- Entry: Rs. 300–305

- Target 1: Rs. 320

- Target 2: Rs. 340

- Stop Loss: Rs. 285

For long-term investors:

- Accumulate on dips around Rs. 280–290 with a 6–12 month horizon

- Reassess around earnings and macro developments in tech

Conclusion

Eternal Ltd has delivered a strong technical breakout backed by both volume and structural setup. Combined with favorable sector dynamics and scalable business models, the company is well-positioned for continued bullish momentum. However, investors should monitor price action closely, especially given the RSI reading in overbought territory. For now, Eternal Ltd remains a stock to watch in India’s evolving tech and e-commerce landscape.

Company Website: Zomato

ALSO READ: Indian Markets Struggle Despite Bank Gains