In the mid-2000s, BlackBerry was the gold standard of mobile communication. Known for its secure email, tactile keyboards, and “CrackBerry” addiction among professionals, it dominated the global smartphone market. At its peak in 2009, BlackBerry held more than 20% of the worldwide share and over 50% in the U.S.

Yet within a few years, it had become a footnote in the smartphone industry. The rise of Apple’s iPhone and Google’s Android ecosystem caught BlackBerry flat-footed, and its leadership’s stubborn belief in its existing model prevented the company from adapting quickly enough. This is the story of how one of the most recognizable tech brands collapsed from market leader to niche player.

1. The Rise of a Business Icon

BlackBerry, developed by the Canadian company Research In Motion (RIM), launched its first devices in the late 1990s. These early handhelds offered secure, push-based email—a game-changer for business users. By integrating mobile telephony with corporate email servers, BlackBerry became indispensable for executives, politicians, and government agencies.

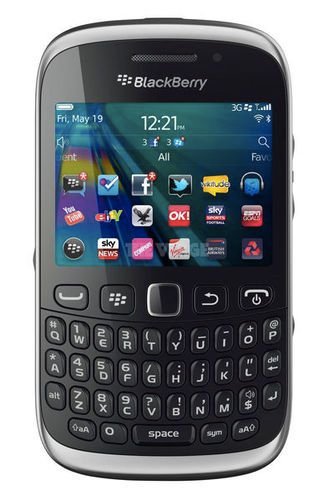

Its hallmark QWERTY keyboard, long battery life, and encryption made it a status symbol in corporate and government circles. The company’s fortunes soared, and by the late 2000s, RIM was one of the most valuable tech companies in the world.

2. The Warning Signs

In 2007, Apple introduced the iPhone, and in 2008, the first Android phones arrived. These devices emphasized large touchscreens, intuitive interfaces, and access to app stores offering everything from games to productivity tools.

BlackBerry’s leadership dismissed these as consumer toys, believing their core enterprise customers valued email security, physical keyboards, and network efficiency over multimedia features and apps. This misreading of the market’s trajectory would prove costly.

3. The Stubborn Bet on the Keyboard

While competitors embraced capacitive touchscreens, BlackBerry clung to its physical keyboard designs. Executives argued that touchscreen typing could never match the speed and accuracy of a physical keyboard—a view shared by many loyal users at the time.

But consumer demand—and increasingly, corporate demand—shifted toward larger screens for browsing, media consumption, and app usage. The keyboard, once a selling point, became a constraint on design and user experience.

4. Delayed Response to Apps and Ecosystems

Apple’s App Store and Google Play quickly became the core of their respective platforms, attracting developers and creating self-reinforcing ecosystems. BlackBerry’s app marketplace, BlackBerry World, lagged in both quantity and quality of applications.

Developers were reluctant to build for a platform with a shrinking user base, and the company failed to create incentives strong enough to reverse the trend. Without a vibrant app ecosystem, BlackBerry devices began to feel outdated—no matter how secure or reliable they were.

5. The BlackBerry Storm and PlayBook Missteps

In 2008, BlackBerry launched the Storm—its first touchscreen phone. The device was plagued by technical issues, including a problematic “clickable” screen meant to mimic keyboard feedback. Reviews were poor, and it failed to compete with the iPhone or top Android models.

In 2011, the company released the PlayBook tablet to compete with Apple’s iPad. Critically, it launched without a native email client—an astonishing omission for a company built on email expertise. The PlayBook was a commercial failure and highlighted BlackBerry’s disconnect from consumer expectations.

6. The BB10 Pivot—Too Little, Too Late

In 2013, BlackBerry launched its BB10 operating system along with devices like the Z10 and Q10. BB10 was modern, fluid, and touch-friendly, but by then, iOS and Android had cemented their dominance.

Switching to BB10 required developers to create apps for yet another platform—something few were willing to do. BlackBerry tried to bridge the gap by allowing Android app compatibility, but the solution was clunky, and the app gap persisted.

7. Market Share Collapse

Between 2009 and 2016, BlackBerry’s global market share fell from over 20% to nearly zero. In the U.S., where it once commanded more than half of the smartphone market, its share slipped into fractions of a percent.

Revenue plunged, and the company laid off thousands of employees. By 2016, BlackBerry stopped designing its own phones, licensing its brand to third-party manufacturers and shifting its focus to enterprise software and cybersecurity.

8. Leadership Miscalculations

Several leadership decisions accelerated BlackBerry’s decline:

-

Underestimating the consumerization of IT: As employees began choosing their own devices for work (the “bring your own device” trend), BlackBerry’s grip on enterprise accounts loosened.

-

Slow innovation cycles: Product development lagged behind competitors, meaning features like full-touch displays, competitive app stores, and rich multimedia were always late to market.

-

Poor product execution: Devices like the Storm damaged brand reputation for quality.

-

Platform isolation: Reluctance to embrace Android or integrate with other ecosystems early on left BlackBerry in a walled garden with shrinking inhabitants.

9. The Pivot to Software and Security

Recognizing it could not compete in hardware, BlackBerry transitioned into a software and services company. It focused on enterprise mobility management, secure communications, and automotive systems through its QNX platform.

While this pivot allowed BlackBerry to survive as a business, it ended its era as a major smartphone player. The brand still appears on some Android devices through licensing deals, but these are niche products with limited market impact.

10. Lessons from BlackBerry’s Collapse

Adapt Quickly to Disruption

BlackBerry’s slow response to touchscreen technology and app ecosystems let competitors seize the lead.

Consumer Trends Influence Enterprise Markets

Dismissing consumer preferences proved dangerous when those same devices entered the workplace.

Ecosystem Strength Is Critical

A strong app and developer ecosystem can be more important than hardware specs alone.

Execution Matters as Much as Vision

Late pivots and poorly executed products fail to regain lost ground in fast-moving industries.

11. Timeline of Key Events

| Year | Event | Outcome |

|---|---|---|

| 1999 | First BlackBerry email pager | Foundation of brand identity |

| 2007 | iPhone launch | Start of major competitive disruption |

| 2008 | BlackBerry Storm released | Poor reviews; failed to rival iPhone |

| 2009 | Market share peaks globally | Dominance in enterprise and U.S. markets |

| 2011 | PlayBook tablet launched | Commercial failure |

| 2013 | BB10 OS launched | Too late; app ecosystem gap remains |

| 2016 | Exits phone manufacturing | Brand licensing and software pivot |

Conclusion

BlackBerry’s fall from dominance was not the result of a single mistake but a series of strategic miscalculations rooted in overconfidence. Its refusal to pivot quickly toward touchscreens, robust app ecosystems, and consumer-friendly features left it vulnerable in a market that evolved faster than its leadership believed possible.

By the time BlackBerry embraced change with BB10 and later Android-based devices, it was too far behind. Today, the brand survives in niche roles and in the software space, but its story remains a cautionary tale for any company that assumes market leadership is permanent.