Tata Steel Stock Price Analysis: Tata Steel (NSE: TATASTEEL) stands as a stalwart in the global steel industry, renowned for its diversified product portfolio, robust market presence, and historical significance. This article delves into Tata Steel’s historical stock performance, recent trends, financial performance, and provides an investment outlook based on technical analysis and fundamental factors.

Historical Stock Performance

Tata Steel stock price has witnessed notable volatility over the years, closely tied to fluctuations in global steel prices and demand-supply dynamics. The impact of the COVID-19 pandemic in 2020 led to a sharp decline in Tata Steel stock price, reflecting the broader challenges faced by the steel industry. However, the subsequent year saw a strong rebound, buoyed by a recovery in steel prices and improving market conditions.

In recent months, Tata Steel stock price has demonstrated relative stability, reflecting robust steel demand in key markets such as India and Europe. The company’s focus on cost optimization and efficiency improvements has supported its profitability despite challenges like rising raw material prices. Tata Steel boasts a strong financial track record, characterized by consistent revenue and profit generation. The company’s market position, diverse product portfolio, and efficient operations contribute significantly to its financial performance. Moreover, Tata Steel’s proactive management of debt levels has bolstered its balance sheet and overall financial health.

Technical Analysis

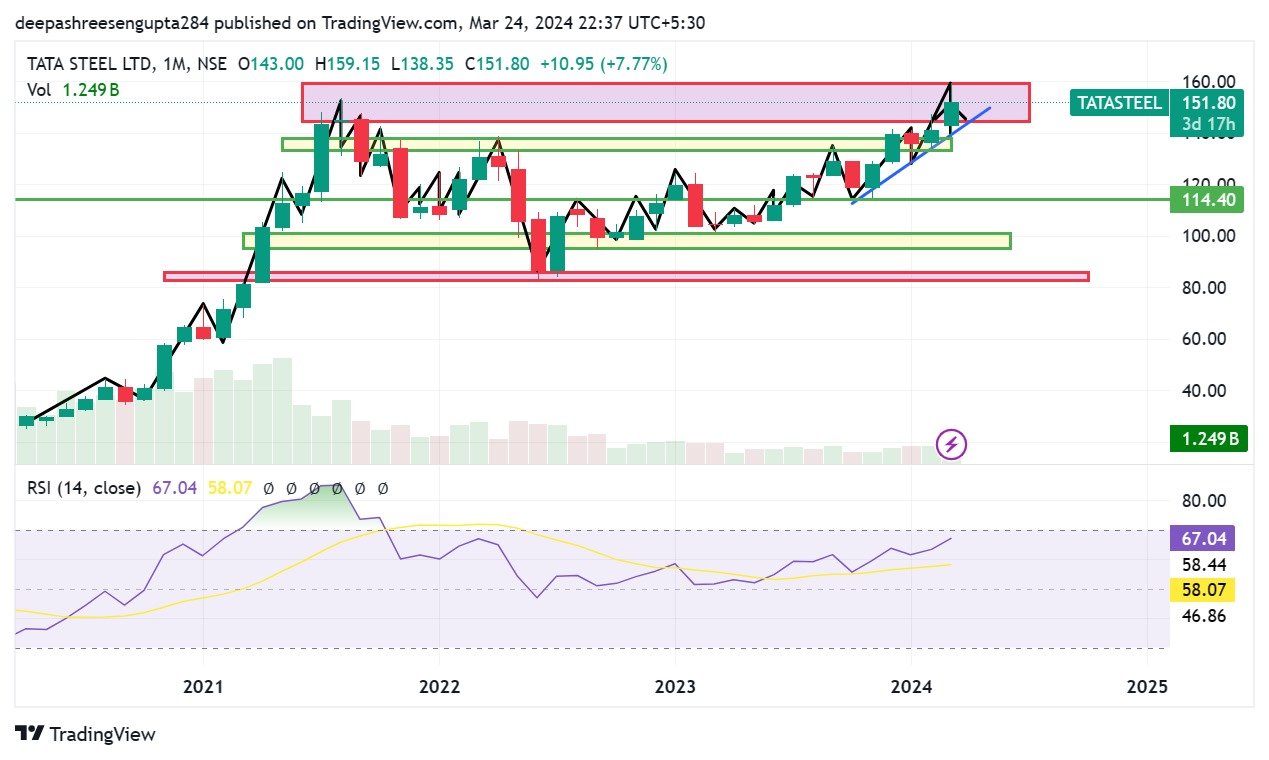

Technical indicators such as the Relative Strength Index (RSI) provide insights into Tata Steel’s stock performance. On March 15th, the daily RSI indicates upward momentum, with values increasing from 44 to 56.90. Similarly, the weekly and monthly RSIs stand at 63.04 and 67.04, respectively, all pointing towards an upward trajectory. Recently, the stock recently broke through a strong resistance level at 148.95, signaling potential bullish momentum.

On the last trading day, Tata Steel’s stock opened at ₹148.05 and closed at ₹145.7, with a high of ₹151.15 and a low of ₹147.9. The market capitalization was ₹187315.39 crore. The 52-week high was ₹159.5, and the low was ₹101.65. BSE volume reached 5496706 shares traded.

From August 2021 to March, there has been a noticeable development in Tata Steel’s stock price chart, particularly when observed on a monthly timeframe. During this period, a significant cup formation has emerged, indicating a potential bullish pattern in the stock’s price movement. This cup formation suggests a period of consolidation followed by a gradual increase in price, resembling the shape of a cup or a rounded bottom. Such formations are often interpreted as a signal of potential upward momentum in the stock’s price trajectory.

In the monthly time frame, the stock’s movement is characterized by a red candlestick pattern. During this period, key support levels range between ₹82.75 to ₹86.90, suggesting significant price levels where buying interest has historically emerged, potentially preventing further downside movements. Conversely, resistance levels are observed between ₹144.10 to ₹159.25, indicating price levels where selling pressure has historically been prominent, hindering further upward movements.

On the weekly timeframe, Tata Steel’s stock exhibits a green candlestick pattern. Here, support is noted within the range of ₹95.30 to ₹100.35, highlighting price levels where buying interest has been prominent on a weekly basis, potentially providing a floor for the stock’s price. Resistance levels are observed around ₹114 and ₹134 to ₹138, indicating price levels where selling pressure has historically been prevalent on a weekly basis, hindering further upward movements.

Further analysis reveals that Tata Steel stock price is displaying a trend of making higher highs, indicating a potential uptrend in its price trajectory. Additionally, the stock is observed to be taking support from a trend line, depicted by a blue line on the daily timeframe. This suggests that the stock’s upward movements are supported by a consistent trend line, further reinforcing the bullish sentiment in the stock.

In the daily timeframe, Tata Steel’s stock demonstrates a consistent pattern of finding support at the 20-day Simple Moving Average (SMA). The 20-day SMA is a widely used technical indicator that calculates the average closing price of the stock over the past 20 trading days. When the stock price approaches or dips below the 20-day SMA, it tends to find support, indicating increased buying interest at or around this level. This pattern suggests short-term bullish sentiment, with traders seeing the stock as potentially undervalued and viewing the support level as an opportunity to enter or add to their positions.

On the weekly timeframe, Tata Steel’s stock is observed to be near the 20-day SMA. This proximity indicates that the stock’s recent price movements are in line with its short-term trend as reflected by the 20-day SMA. While not directly touching the SMA, the stock’s proximity to this moving average suggests that it is still within the range of its recent price trends.

Investment Outlook

In conclusion, Tata Steel emerges as a fundamentally robust company with a solid market position and a track record of success. Despite historical volatility, the company exhibits strong growth potential, driven by factors such as sustained steel demand, cost optimization initiatives, and efficient operations. However, investors should remain mindful of inherent risks, including volatility in steel prices, fluctuations in raw material costs, and broader economic conditions, when considering an investment in Tata Steel.

Tata Steel’s journey in the steel industry reflects resilience, adaptability, and strategic prowess. With a rich history and a promising future, Tata Steel continues to stand as a beacon of strength in the global steel market. As investors navigate the complexities of the market, Tata Steel remains a compelling choice, offering potential growth opportunities amidst evolving industry dynamics.

Also Read: Bitcoin Price Analysis: Will it Cross $80K Before Halving Event?