The cryptocurrency market began the final weekend of March with mixed movements. Bitcoin and Ethereum saw mild declines, while some altcoins surged amid a flurry of institutional interest and regulatory headlines. Traders and long-term holders closely monitored key levels and developments as they assessed the health of the market ahead of April. This article presents a detailed snapshot of crypto prices on March 30, 2025, along with the latest events shaping sentiment, trends, and investor behavior.

Market Snapshot

The global crypto market capitalization reached approximately $2.69 trillion today. The market declined by around 1.18% in the last 24 hours. Trading volumes also dipped slightly, reflecting cautious positioning from investors after a volatile week.

Despite the minor correction, Bitcoin continued to dominate the market with a 61.15% share, while Ethereum followed as the second-largest asset by market cap. Several small-cap and mid-cap tokens displayed strong momentum, which suggested ongoing activity in niche areas like DeFi, gaming, and green energy tokens.

Major Cryptocurrency Prices

Bitcoin (BTC)

Bitcoin traded at $83,023.49, falling 1.71% in the past 24 hours. The price dropped slightly after rallying earlier in the week, but Bitcoin remained well above key support levels. Long-term holders stayed confident, and institutional demand provided a strong foundation for price resilience.

Market analysts noted increased accumulation by whales and continued buying by institutions. Traders viewed the recent dip as a short-term correction rather than a trend reversal. The $80,000 level acted as a psychological support zone that many investors defended through buying pressure.

Ethereum (ETH)

Ethereum hovered at $1,839.57, recording a 2.68% decline over 24 hours. ETH underperformed Bitcoin slightly but continued to attract attention due to its upcoming upgrades and growing ecosystem of decentralized applications (dApps).

Developers and staking communities remained active on the Ethereum network. Though gas fees increased slightly during peak trading hours, ETH maintained its dominance as the top platform for smart contracts and DeFi innovation.

Core DAO (CORE)

Core DAO emerged as the top performer of the day, rising over 23%. Investors turned their focus toward projects offering cross-chain solutions and governance utility. Core DAO’s surge highlighted growing interest in Layer 1 alternatives and community-driven ecosystems.

Market watchers credited the price rally to new partnerships, increased DeFi integration, and speculative interest from retail buyers chasing momentum in altcoins.

Key Developments Influencing Prices

BlackRock’s Strategic Bitcoin Investment

BlackRock, one of the world’s largest asset managers, bought $172 million worth of Bitcoin this week. The firm purchased BTC at an average price of around $68,800, signaling strong institutional confidence in crypto as a long-term store of value.

After the announcement, Bitcoin’s price jumped by over 3.5%, reaching $71,200 within two hours. BlackRock’s move reaffirmed the trend of traditional finance players entering crypto through direct purchases and ETF-related strategies. The market reacted positively, with several other institutions reportedly planning similar allocations in April.

Presidential Pardons for BitMEX Executives

Former U.S. President Donald Trump granted pardons to the co-founders of BitMEX—Arthur Hayes, Benjamin Delo, and Samuel Reed—as well as former employee Gregory Dwyer. The crypto community received the news with mixed reactions. While some viewed the decision as controversial, others saw it as a step toward regulatory leniency and clarity.

Traders responded by increasing trading activity on older centralized platforms, though questions about regulatory enforcement continued to circulate. The development reminded investors of crypto’s complex legal backdrop, especially in the U.S. market.

Galaxy Digital’s $200 Million Settlement

Galaxy Digital, a prominent crypto investment firm, agreed to pay $200 million in settlement to New York regulators. The investigation centered around allegations of market manipulation involving the LUNA token.

The settlement renewed discussions around corporate accountability and compliance. Institutional investors demanded stronger audit and transparency measures from digital asset companies. Retail investors focused on the need for more education and better due diligence when investing in high-risk tokens.

Growing Security Threats in the Crypto World

In recent months, crypto millionaires have faced increasing security threats. Incidents involving home invasions, robberies, and kidnapping attempts have become more frequent. The high-profile case of influencer and streamer Amouranth brought the issue into public view after intruders broke into her residence and demanded access to her crypto holdings.

Wealthy crypto holders have now started enhancing personal security, keeping minimal funds on hot wallets, and relying more on cold storage solutions. Platforms also advised users to improve their digital hygiene through multi-factor authentication, secure passphrases, and reduced public exposure.

Stablecoin Development: USD1

World Liberty Financial, a crypto venture created by Donald Trump and his sons, announced the launch of USD1, a fully backed stablecoin. The new token will peg itself 1:1 to the U.S. dollar and hold reserves in treasuries and other safe assets.

The group aims to position USD1 as a trusted digital alternative for institutional settlements, sovereign transactions, and cross-border payments. This development could introduce fresh competition to established stablecoins like USDT and USDC, especially if USD1 gains regulatory approval and adoption from government-backed financial entities.

Market Sentiment: Accumulation and Risk Sensitivity

Market sentiment shifted toward cautious optimism today. Analysts highlighted increasing accumulation by long-term holders. On-chain data showed growing mean coin age, which suggested reduced coin movement and tighter supply.

The “Value Days Destroyed” indicator, which tracks the age of coins being sold, also remained low. This pattern indicated investor patience and confidence. Historically, such conditions paved the way for gradual rallies in the months ahead.

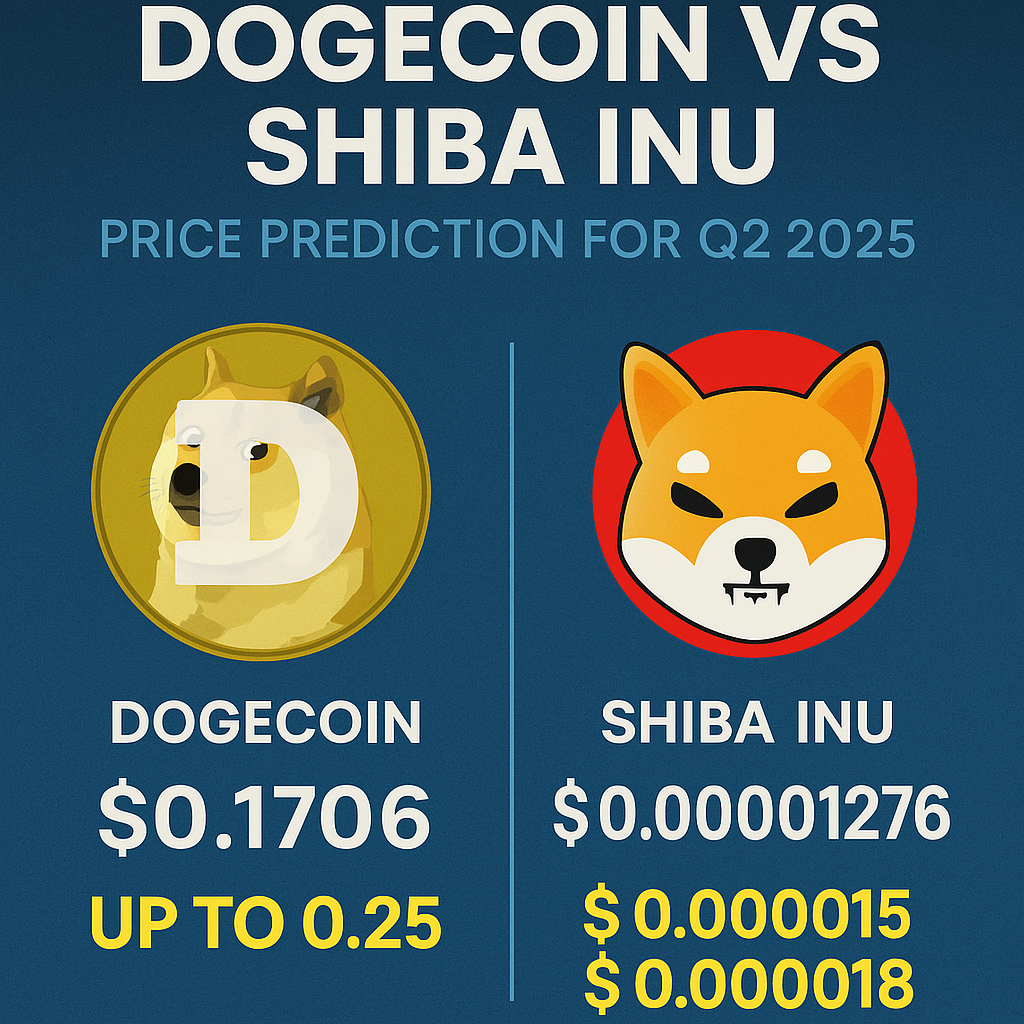

However, risks remained. Analysts warned that if Bitcoin dropped below $80,000, altcoins like Dogecoin, Chainlink, and Avalanche could see sharp corrections due to their strong correlation with BTC. Investors stayed alert to key levels and maintained protective stop-loss strategies.

Upcoming Economic Events

The market awaits macroeconomic signals next week, particularly on Friday, April 3, 2025, when the U.S. government will release unemployment and non-farm payrolls data. These figures will influence Federal Reserve policy and affect broader risk asset sentiment, including crypto.

If data reflects a strong labor market, traders may anticipate tighter monetary policy. On the other hand, weak data could support more dovish signals, possibly fueling another round of crypto buying.

Conclusion: Navigating a Dynamic Crypto Landscape

On March 30, 2025, the crypto market reflected a blend of correction, accumulation, and sector rotation. While Bitcoin and Ethereum cooled slightly after previous rallies, investors continued to rotate capital into altcoins like Core DAO. BlackRock’s investment, Galaxy Digital’s settlement, and stablecoin news kept the ecosystem buzzing with updates.

Security concerns and political headlines reminded investors to approach the market with awareness, discipline, and risk control. The next few days could bring renewed volatility, especially with macroeconomic announcements on the horizon.

As April approaches, market participants should monitor price levels closely, stay informed on regulatory shifts, and align their portfolios with long-term trends rather than short-term noise.