The cryptocurrency market remains highly dynamic, with Bitcoin (BTC), Ethereum (ETH), and XRP experiencing significant price movements, while altcoins like EOS, Raydium (RAY), and Maker (MKR) emerged as top gainers. At the same time, some tokens, including Four (FORM), PancakeSwap (CAKE), and Cronos (CRO), faced notable declines. Here’s an in-depth analysis of today’s crypto market trends.

Bitcoin Price Analysis

Bitcoin (BTC) is trading at approximately $83,007, reflecting a slight decrease of 0.001% from the previous close. In recent months, Bitcoin has experienced significant volatility. After reaching an all-time high of over $109,000 in January 2025, the cryptocurrency has seen a correction, declining by approximately 24.3% to its current levels. This correction aligns with historical patterns where Bitcoin undergoes substantial pullbacks following rapid ascents.

Market Dynamics and Whale Accumulation

Despite the recent downturn, on-chain data indicates a notable trend: high-net-worth investors, colloquially known as “whales,” have been accumulating Bitcoin aggressively. Since November 2024, these investors have added over 1 million BTC to their holdings, with more than 200,000 BTC accumulated in March alone. This accumulation suggests strong confidence in Bitcoin’s long-term value proposition and may provide a stabilizing effect on its price.

Technical Analysis

From a technical standpoint, Bitcoin is encountering resistance around its 200-day Exponential Moving Average (EMA), currently near $85,496. The Relative Strength Index (RSI) is hovering in neutral territory, indicating indecisiveness among traders. A sustained move above the 200-day EMA could signal a bullish reversal, while failure to do so might result in further consolidation or downside.

External Factors: FOMC Meeting

The Federal Open Market Committee (FOMC) meeting scheduled for March 19, 2025, is a critical event that could influence Bitcoin’s price. Monetary policy decisions, especially those related to interest rates, can impact investor sentiment across various asset classes, including cryptocurrencies. Traders should monitor the outcomes of this meeting closely, as they may introduce volatility in the short term.

Future Outlook

Analysts maintain a cautiously optimistic outlook for Bitcoin. Some forecasts suggest that, if historical trends persist, Bitcoin could reach a cycle top of approximately $150,000 in 2025. Factors contributing to this projection include increased institutional adoption, favorable regulatory developments, and the upcoming Bitcoin halving event, which historically has led to supply constraints and price appreciation.

Ethereum Price Analysis

Ethereum (ETH) is trading at approximately $1,934.18, reflecting a modest increase of 1.424% from the previous close. Over the past 30 days, Ethereum has experienced a significant decline of nearly 30%, with its price struggling to surpass the $2,000 resistance level. This downturn aligns with broader market trends, where Bitcoin’s dominance has surged, leading to an all-time high in the BTC/ETH ratio. Specifically, as of March 14, 2025, one Bitcoin could purchase over 44 ETH, up 30% from the 1:33 ratio observed on February 25.

Technical Analysis

Technical indicators present a mixed outlook for Ethereum. The Bollinger Band Trend (BBTrend) indicator has turned positive after six consecutive days in negative territory, suggesting a potential early sign of stabilization. However, the current BBTrend value remains modest at 0.22, indicating that bullish momentum is still tentative.

Additionally, Ethereum is retesting a five-year ascending trendline, which has historically acted as strong support during major market corrections, such as the March 2020 crash and the post-FTX collapse in 2022. This retest could signal a potential rebound if the support holds.

Market Dynamics and Whale Activity

On-chain data indicates a decline in the number of Ethereum whales—wallets holding at least 1,000 ETH—since February 22, 2025. The current count stands at 5,752, down from a peak of 5,828. This reduction suggests cautious behavior among large investors, potentially contributing to Ethereum’s recent price struggles.

Analyst Predictions and Future Outlook

Analysts present a range of predictions for Ethereum’s future price trajectory. Some forecasts suggest that Ethereum could reach a price range between $13,500 and $17,000, based on the completion of a Wave 4 correction and the initiation of Wave 5, as per Elliott Wave Theory. Conversely, other projections are more conservative, with price targets adjusted from $10,000 to $4,000 for 2025, reflecting a cautious stance amid current market conditions.

XRP Price Analysis

XRP is trading at approximately $2.29, reflecting a slight decline of 2.16% from the previous close. Over the past week, XRP has experienced modest fluctuations, with its price oscillating between $2.28 and $2.34. This stability is notable, especially considering the broader cryptocurrency market’s volatility during the same period. Year-to-date, XRP has demonstrated resilience, maintaining a gain of over 13%, even as other major cryptocurrencies have faced more significant downturns.

Technical Analysis

Technical indicators present a cautiously optimistic outlook for XRP. The 50-day moving average (MA50) is positioned at $2.30, while the 200-day moving average (MA200) is at $2.40, suggesting that XRP is currently trading slightly below its short-term average but remains above key support levels. The Relative Strength Index (RSI) is at 48, indicating neutral market momentum, neither overbought nor oversold. Bollinger Bands show the price hovering near the lower band at $2.25, which could signal potential oversold conditions and a possible bounce if buying pressure increases.

Market Dynamics and Whale Activity

On-chain data reveals significant activity among large investors, commonly referred to as “whales.” In the past week alone, XRP whales have accumulated approximately $464 million worth of the digital asset. This follows an earlier accumulation of over $700 million in March, indicating strong institutional confidence in XRP’s future prospects.

Regulatory Landscape and Legal Developments

The ongoing legal battle between Ripple and the U.S. Securities and Exchange Commission (SEC) continues to influence XRP’s price dynamics. The SEC’s silence on its appeal strategy has added a layer of uncertainty, potentially capping XRP’s price gains. Additionally, the Office of Inspector General’s (OIG) investigation into potential conflicts of interest within the SEC may impact the agency’s stance on the Ripple case. These regulatory uncertainties contribute to market caution, affecting XRP’s short-term price movements.

Analyst Predictions and Future Outlook

Analysts present a range of predictions for XRP’s future price trajectory. Some forecasts suggest that XRP could reach a price range between $5 and $7 in the first half of 2025, driven by strong post-election momentum and Ripple’s advancements in the crypto space. Conversely, other projections are more conservative, with price targets adjusted from $10 to $4, reflecting a cautious stance amid current market conditions.

Biggest Gainers

The cryptocurrency market saw a mix of strong upward movements, with EOS (EOS) leading the pack as the top gainer of the day. EOS surged by 27.20% to reach $0.6264, likely fueled by recent ecosystem developments and renewed investor interest.

Raydium (RAY) followed closely, posting a 14.08% gain, bringing its price to $1.90. The rise in RAY’s value may be attributed to an increase in decentralized finance (DeFi) activity on the Solana network, where Raydium plays a key role as an automated market maker (AMM).

Among other top gainers, Maker (MKR) saw a 9.90% increase, hitting $1,311.31. Maker’s price surge is likely tied to growing demand for decentralized stablecoin solutions and governance improvements within its ecosystem.

Hyperliquid (HYPE) gained 7.24%, trading at $13.96, while Polkadot (DOT) rose 6.54% to $4.54 as optimism around interoperability and cross-chain developments boosted its price.

Other notable gainers include:

- Neo (NEO) (+6.37%, $8.54)

- Kava (KAVA) (+6.09%, $0.5165)

- VeChain (VET) (+5.65%, $0.02587)

- DeXe (DEXE) (+5.64%, $18.59)

- TRON (TRX) (+5.45%, $0.2345)

Biggest Losers

On the flip side, some cryptocurrencies struggled to maintain their momentum, with Four (FORM) taking the biggest hit of the day. FORM declined by 13.18%, falling to $1.55, likely due to profit-taking and market corrections after recent gains.

PancakeSwap (CAKE), one of the leading DeFi projects, experienced a 5.12% drop, bringing its price to $2.40. The decline could be linked to shifting investor interest towards newer DeFi platforms and lower trading volumes on Binance Smart Chain-based projects.

Cronos (CRO), the native token of Crypto.com, also saw a 5.06% decrease, trading at $0.07797, as broader market uncertainty weighed on centralized exchange tokens.

Other notable losers included:

- Berachain (BERA) (-4.57%, $5.97)

- Celestia (TIA) (-4.29%, $3.27)

- Mantle (MNT) (-2.90%, $0.7988)

- BNB (BNB) (-2.18%, $617.97)

- Helium (HNT) (-1.63%, $3.06)

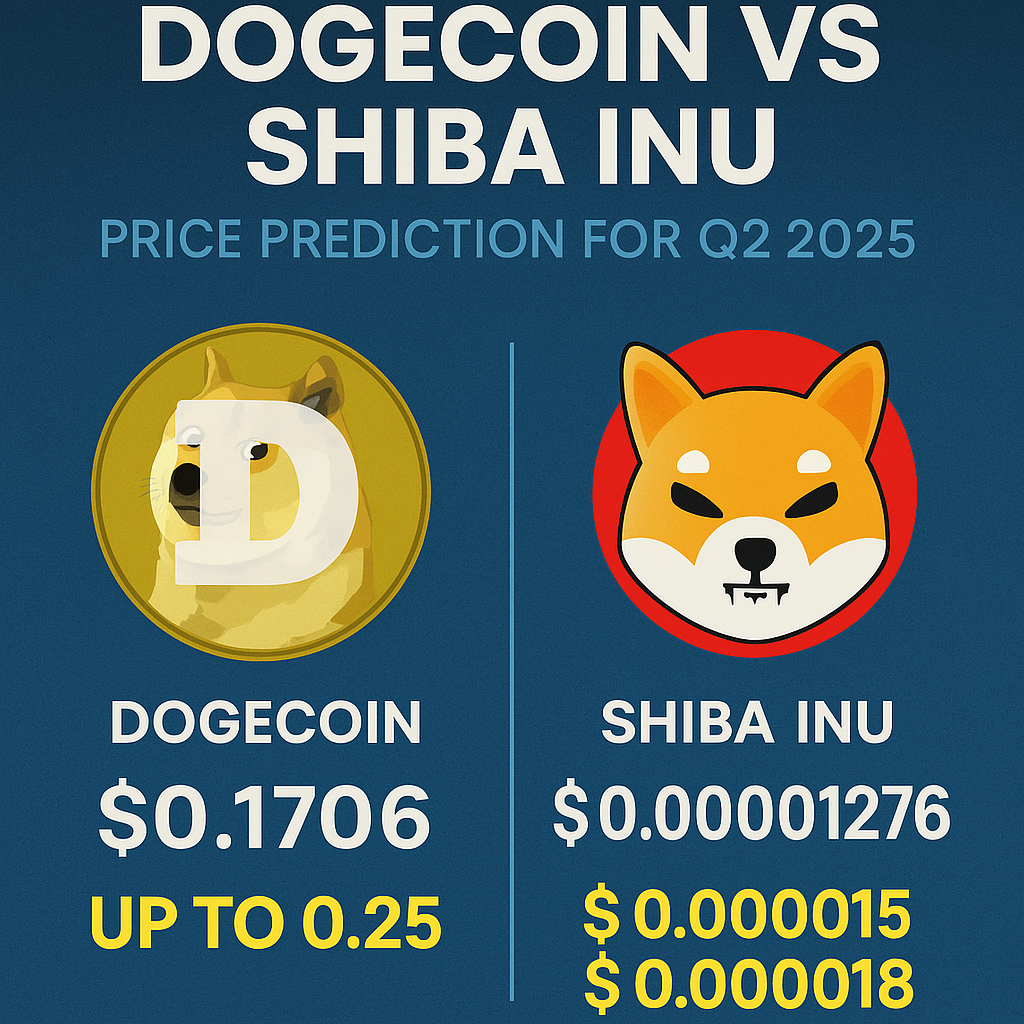

- Shiba Inu (SHIB) (-1.33%, $0.00001254)

- UNUS SED LEO (LEO) (-1.30%, $9.69)

Today’s crypto market presents a mix of stability and volatility. Bitcoin and Ethereum are testing key support and resistance levels, while XRP faces regulatory uncertainties. The FOMC meeting remains a critical event that could trigger market-wide price swings.

Investors should monitor technical indicators, whale activity, and external market forces to navigate the current landscape. While short-term volatility persists, long-term outlooks for major cryptos remain positive, especially ahead of major events like the Bitcoin halving in 2025.