An Initial Public Offering (IPO) marks a significant milestone for any company. It allows businesses to raise capital from the public by selling shares for the first time. IPOs also enable investors to become stakeholders in promising ventures. For companies, IPOs are a route to fund expansion, repay debts, or diversify ownership. For investors, IPOs offer an opportunity to invest early in growing enterprises. The Dam Capital Advisors IPO has attracted considerable attention due to its strong financial performance and the potential for impressive listing gains.

Overview of Dam Capital Advisors

Dam Capital Advisors Ltd. is a prominent financial services provider specializing in investment banking and institutional equities. With an employee base of over 121 professionals, the company caters to 263 active clients across major economies, including the USA, UK, Europe, Singapore, Australia, and South Africa. The company’s expertise spans private equity advisory, mergers and acquisitions, and institutional broking.

Established as a reliable financial solutions partner, Dam Capital Advisors has demonstrated robust growth. The company reported a 141% increase in revenue for the fiscal year ending March 2024. The market capitalization of Rs 2,000.41 crore underscores its prominence in the industry.

Dam Capital Advisors IPO Details

The Dam Capital Advisors IPO opened for subscription on 19th December 2024 and closed on 23rd December 2024. It is an entirely Offer for Sale (OFS) issue, wherein existing shareholders divested approximately 2.97 crore shares, aggregating to Rs 840.25 crore. Below are the key details:

- IPO Open Date: 19th December 2024

- IPO Close Date: 23rd December 2024

- Lot Size: 53 shares

- Shares Offered: 2,96,90,900 shares

- Price Band: Rs 269 to Rs 283

- Listing Platforms: BSE and NSE

- IPO Listing Date: 27th December 2024

Market Sentiment and Grey Market Premium (GMP)

The Grey Market Premium (GMP) serves as a barometer of market sentiment. As of 23rd December 2024, the GMP for Dam Capital Advisors IPO stood at Rs 160, translating to an estimated listing price of Rs 443. Investors anticipate a listing gain of approximately 56.54% based on these figures.

The GMP trends over the last 12 sessions revealed fluctuations, with the lowest GMP at Rs 0 and the highest at Rs 170. These variations reflect the evolving market dynamics and investor sentiment:

| Date | GMP (in Rs) | Estimated Listing Price (in Rs) |

|---|---|---|

| 23-12-2024 | 160 | 443 |

| 22-12-2024 | 160 | 443 |

| 21-12-2024 | 160 | 443 |

| 20-12-2024 | 160 | 443 |

| 19-12-2024 | 170 | 453 |

| 18-12-2024 | 148 | 431 |

| 17-12-2024 | 108 | 391 |

| 16-12-2024 | 108 | 391 |

| 15-12-2024 | 0 | 283 |

| 14-12-2024 | 0 | 283 |

| 13-12-2024 | 0 | 283 |

| 12-12-2024 | 0 | 283 |

Subscription Analysis

The IPO received an overwhelming response from investors, with an overall subscription of 10.26 times. The retail category was subscribed 10.42 times, indicating robust interest among individual investors. Non-Institutional Investors (NII) subscribed 16.06 times, while Qualified Institutional Buyers (QIB) subscribed 1.27 times.

The growing subscription rates signify strong confidence in the company’s future prospects. The following table summarizes the subscription status:

| Category | Subscription |

|---|---|

| Retail | 10.42x |

| NII | 16.06x |

| QIB | 1.27x |

Financial Performance Analysis

Dam Capital Advisors’ financial performance over the last three years highlights steady growth and improved profitability. Key financial metrics include:

| Year Ended | Assets (in Cr.) | Borrowings (in Cr.) | Revenue (in Cr.) | Profit After Tax (in Cr.) | Net Worth (in Cr.) |

|---|---|---|---|---|---|

| 31-Mar-2024 | 214.68 | 4.93 | 182 | 70.52 | 162.61 |

| 31-Mar-2023 | 1201.16 | 3.29 | 85.04 | 8.67 | 95.13 |

| 31-Mar-2022 | 166.72 | 1.41 | 94.51 | 21.9 | 87.97 |

The substantial revenue growth of 141% in FY 2024 is a testament to the company’s operational efficiency and strategic initiatives.

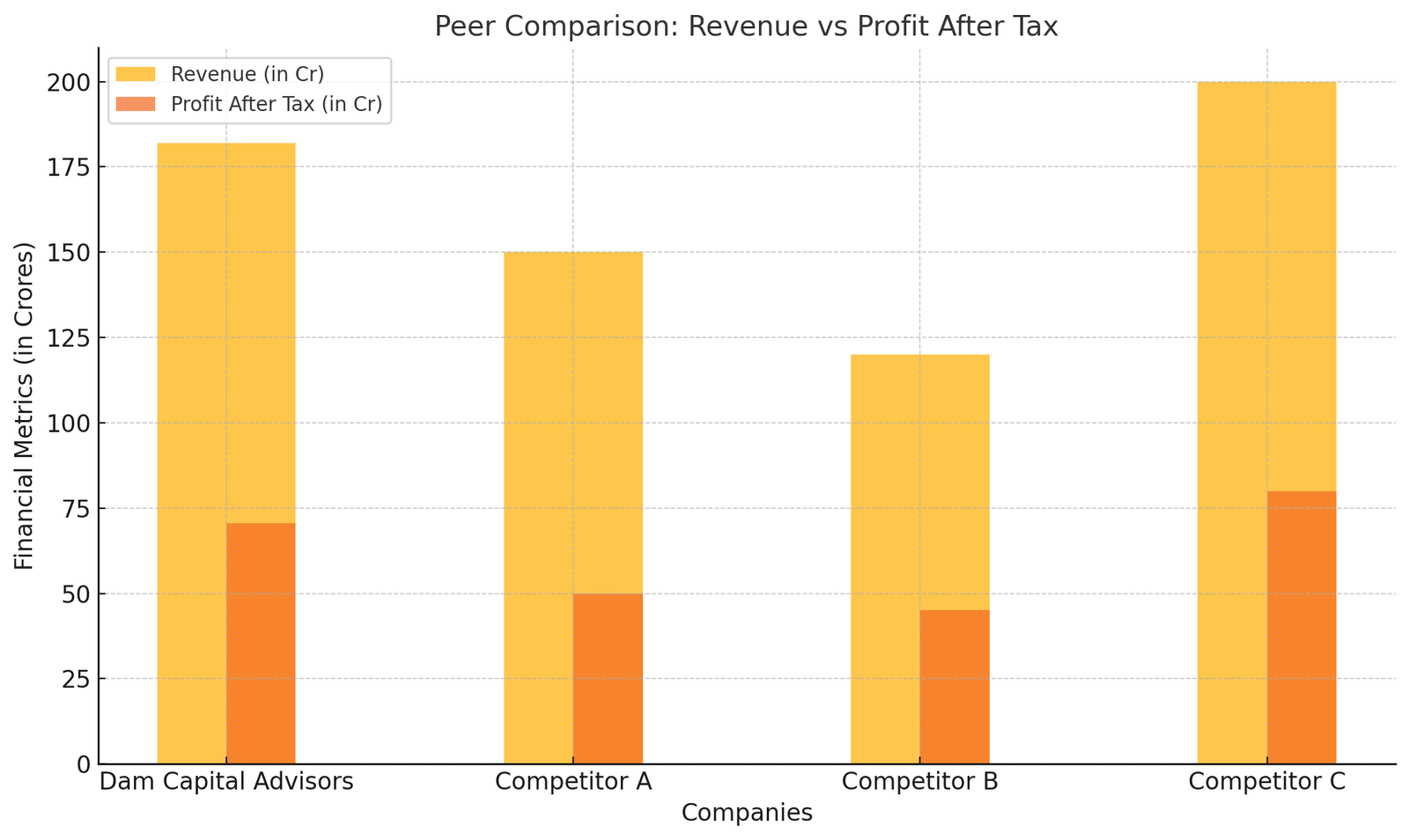

Peer Comparison

When compared to industry peers, Dam Capital Advisors stands out due to its robust revenue growth and international presence. Competitors in the financial advisory space often face challenges in maintaining profitability, but Dam Capital Advisors has managed to achieve consistent growth, making it an attractive investment option.

| Company | Revenue (in Cr.) | Profit After Tax (in Cr.) | Market Cap (in Cr.) |

|---|---|---|---|

| Dam Capital Advisors | 182 | 70.52 | 2000.41 |

| Competitor A | 150 | 50.00 | 1800.00 |

| Competitor B | 120 | 45.00 | 1600.00 |

| Competitor C | 200 | 80.00 | 2500.00 |

Global IPO Trends

Recent global IPO markets have exhibited varied trends across regions:

- Sectoral Dominance: High-growth sectors like technology, artificial intelligence, and fintech continue to dominate IPO activity. Investors show strong interest in innovative industries.

- Regional Performance: While U.S. and Asian IPOs have experienced significant traction, European markets have faced challenges, including regulatory hurdles and slower adoption.

- Mixed Returns: Not all IPOs have delivered robust returns. Factors such as market volatility and overvaluation have led to underwhelming performances for some companies.

- Increased Retail Participation: Technological advancements and ease of access through online platforms have driven retail investors to actively participate in IPOs, influencing subscription levels and aftermarket performance.

These trends highlight a dynamic landscape for IPOs, offering opportunities and risks depending on the sector and regional focus.

Offer for Sale (OFS) Mechanism

In an OFS, existing shareholders sell their stakes in the company. While the proceeds do not directly benefit the organization, they allow shareholders to monetize their holdings. Investors should note that the lack of fresh equity infusion means the IPO proceeds will not be used for expansion or operational improvements.

Risks and Challenges

Despite its strengths, investors should consider the following risks:

- Market Volatility: Fluctuations in stock markets can impact listing gains.

- Global Economic Conditions: Being a globally active company, Dam Capital Advisors is exposed to macroeconomic risks.

- Highly Competitive Industry: The financial advisory sector is intensely competitive, with pressure on margins.

Analytical Insights on Valuation

The IPO price band of Rs 269 to Rs 283 values the company attractively given its growth potential. The Price-to-Earnings (P/E) ratio is competitive when compared to peers. Considering its consistent profit growth, the valuation offers both listing gains and long-term investment appeal.

Expert Opinions

Market analysts have expressed optimism regarding the IPO. The strong subscription rates and robust financials indicate potential for impressive listing gains. Experts suggest that long-term investors could benefit from the company’s growth trajectory and global presence.

Future Prospects

Post-IPO, Dam Capital Advisors aims to strengthen its market position by expanding its service offerings and deepening client relationships. The company’s focus on private equity advisory and institutional broking aligns with high-growth areas in the financial services sector.

Long-Term Growth Drivers

- Increased Institutional Investments: The global trend of rising institutional investments positions Dam Capital Advisors for future growth.

- Digital Transformation: The company’s adoption of technology to enhance efficiency and client experience is a key driver.

- Global Expansion: Plans to enter untapped markets provide significant growth opportunities.

Conclusion

The Dam Capital Advisors IPO offers a compelling opportunity for investors seeking short-term listing gains and long-term growth potential. The strong financial performance, global presence, and robust market sentiment position the company as a promising player in the financial advisory space.

Investors should evaluate their risk appetite and investment goals before subscribing to the IPO. While the offer for sale limits direct benefits to the company, the robust fundamentals and market confidence make this IPO worth considering. For long-term investors, the company’s growth trajectory and strategic initiatives hold considerable promise.

ALSO READ: Transrail Lighting Limited IPO: A Comprehensive Analysis