Investors seeking long-term wealth creation often focus on fundamentally strong stocks. These are companies that showcase consistent growth across key financial metrics, such as sales, profits, margins, dividends, and earnings. Such stocks typically outperform their peers and enjoy high levels of trust from institutional investors like FIIs (Foreign Institutional Investors) and DIIs (Domestic Institutional Investors). Additionally, these companies have strong promoters, reflecting efficient corporate governance and strategic vision.

This curated list of 30 fundamentally strong stocks has been meticulously chosen based on their track record of delivering value and their potential to perform in the evolving market conditions of 2024. These stocks span various sectors, providing a diversified investment basket for investors aiming to capitalize on India’s growth story.

Fundamentally Strong 30 Stocks for Investment

1. Sun Pharmaceutical Industries Ltd (SUNPHARMA)

Sun Pharmaceutical Industries Ltd (Sun Pharma) is India’s leading pharmaceutical company and one of the largest specialty generics manufacturers globally. Known for its innovation and commitment to delivering high-quality healthcare solutions, Sun Pharma has a robust market presence supported by consistent growth and financial resilience. As of today, its Current Market Price (CMP) stands at ₹1,841.35, reflecting a change of +₹22.3 (+1.2%) from the previous day. Sun Pharma’s consistent growth stems from its diversified portfolio, strategic R&D investments, and strong domestic market share.

This analysis provides a detailed review of Sun Pharma’s performance metrics, market positioning, financial health, and growth outlook, along with actionable insights for investors.

Company Overview

| Metric | Value |

| CMP | ₹1,841.35 |

| Change | +₹22.3 (+1.2%) |

| Sector | Healthcare |

| Industry | Pharmaceuticals & Drugs |

| Market Cap | ₹4,38,958 Cr |

| Enterprise Value (EV) | ₹4,29,169 Cr |

| Book Value per Share | ₹288.06 |

| P/E Ratio | 39.71 |

| PEG Ratio | 1.80 |

| Dividend Yield | 0.74% |

Sun Pharma’s leadership in India’s pharmaceutical sector is complemented by its global footprint across 100+ countries. Its vertically integrated operations ensure cost efficiencies and high-quality production. The company’s focus on specialty generics and branded drugs has driven sustainable growth over the years.

Stock Performance

Sun Pharma’s stock has been a strong performer across various time horizons, demonstrating resilience and consistent upward momentum.

| Performance Period | Change |

| 1 Day | ▲ 1.2% |

| 1 Week | ▲ 2.9% |

| 1 Month | ▲ 2.6% |

| 6 Month | ▲ 23.2% |

| 1 Year | ▲ 48.1% |

| 2 Year | ▲ 83.9% |

| 5 Year | ▲ 328.4% |

| 10 Year | ▲ 129.2% |

The stock’s 48.1% growth over the past year reflects strong investor confidence and favorable market conditions. Over five years, its impressive 328.4% return showcases its ability to deliver robust long-term performance.

Financial Performance

Sun Pharma’s financial metrics reflect its operational efficiency, consistent revenue growth, and strong profitability.

| Key Metrics | Value |

| Net Sales | ₹13,291.39 Cr |

| EBITDA | ₹3,810.87 Cr |

| EBITDA Margin | 29.65% |

| Net Profit (PAT) | ₹3,030.67 Cr |

| PAT Margin | 19.90% |

| Earnings Per Share (EPS) | ₹39.91 |

| Price-to-Earnings Ratio (P/E) | 39.71 |

| Dividend Yield | 0.74% |

Sun Pharma’s ability to maintain a PAT margin of 19.90% and an EBITDA margin of 29.65% underscores its focus on cost control and high-margin products. Its consistent EPS growth of 13.01% reflects value generation for shareholders.

Growth Ratios

The company’s growth metrics highlight its strong performance across revenue, profitability, and shareholder returns.

| Metric | Value |

| Net Sales Growth (%) | 10.51% |

| EBITDA Growth (%) | 17.07% |

| Net Profit Growth (%) | 12.70% |

| EPS Growth (%) | 13.01% |

Sun Pharma’s 17.07% EBITDA growth demonstrates its ability to scale operations effectively while maintaining profitability. The double-digit EPS growth further reinforces its commitment to enhancing shareholder value.

Solvency Ratios

Sun Pharma boasts a robust balance sheet with minimal debt, highlighting its strong solvency position.

| Metric | Value |

| Total Debt-to-Equity Ratio | 0.04 |

| Interest Coverage Ratio | 47.50 |

| Current Ratio | 2.56 |

| Quick Ratio | 1.98 |

With a debt-to-equity ratio of just 0.04 and an interest coverage ratio of 47.50, Sun Pharma is well-positioned to weather financial uncertainties. Its healthy liquidity ratios further affirm its ability to meet short-term obligations.

Valuation Metrics

| Metric | Value |

| Price-to-Book Ratio (P/B) | 6.11 |

| EV-to-EBITDA Ratio | 27.45 |

| PEG Ratio | 1.80 |

While Sun Pharma trades at a premium valuation, as reflected in its P/E ratio of 39.71, this is justified by its consistent growth and market leadership. The PEG ratio of 1.80 indicates that the company’s valuation is aligned with its growth potential.

Technical Analysis

| Indicator | Value | Signal |

| Relative Strength Index (RSI) (Daily) | 53.49 | Neutral |

| RSI (Weekly) | 58.88 | Neutral |

| MACD | Positive | Bullish |

| Stochastic %K | 70.41 | Neutral |

| Bollinger Band %B | 0.71 | Nearing Upper Band |

Technical indicators suggest a neutral to slightly bullish sentiment. The stock’s movement near its 52-week high indicates strong momentum, but investors should watch for potential resistance levels.

Strengths of Sun Pharma

| Strength | Details |

| Market Leadership | Largest pharmaceutical company in India with a strong global footprint. |

| Financial Resilience | High EBITDA margin and low debt ensure stability. |

| R&D Investments | Significant focus on specialty generics and biologics. |

| Diversified Portfolio | Operates in multiple therapeutic areas and geographic regions. |

| Promoter Support | Backed by strong promoters and institutional investors. |

Challenges and Risks

| Challenge | Details |

| Regulatory Risks | Compliance challenges in global markets could impact operations. |

| Patent Expiry | Revenue loss from patent expirations may affect profitability. |

| Pricing Pressure | Generic drug pricing and government cost containment could impact margins. |

| Currency Fluctuations | Exposure to emerging market currencies poses risks. |

Market Position and Competitive Advantage

- Global Presence:

Sun Pharma operates in over 100 countries, making it a significant player in both emerging and developed markets. Its diverse product portfolio reduces reliance on a single market or therapeutic area. - Innovation and R&D:

Sun Pharma invests heavily in research and development to enhance its product pipeline. Its focus on specialty generics and biologics addresses unmet medical needs, ensuring sustainable growth. - Operational Efficiency:

With vertically integrated operations, Sun Pharma ensures cost efficiencies and consistent quality, giving it a competitive edge.

Investment Outlook

Short-Term Perspective

- Sun Pharma’s 23.2% gain over the past six months highlights strong momentum.

- Technical indicators like a positive MACD and neutral RSI suggest a continuation of the bullish trend.

- Short-term traders can capitalize on potential price appreciation as the stock nears its 52-week high.

Long-Term Perspective

- Sun Pharma’s consistent financial performance, robust pipeline, and global market presence make it a strong candidate for long-term investment.

- Its focus on specialty generics and biologics ensures sustained growth in high-margin segments.

- Investors with a 3–5 year horizon can benefit from its compounding growth potential.

Strategic Recommendations

| Recommendation | Details |

| Buy on Dips | Accumulate during market corrections for long-term gains. |

| Monitor R&D Progress | Track developments in its specialty drug pipeline for growth insights. |

| Diversify Exposure | Pair Sun Pharma with other healthcare stocks for risk mitigation. |

| Hold for Long-Term | Focus on a 3–5 year investment horizon to maximize returns. |

2. Bajaj Finance Ltd (BAJFINANCE)

Bajaj Finance Ltd is a leading player in India’s Non-Banking Financial Company (NBFC) sector, renowned for its expansive retail loan portfolio and focus on digital transformation. With a Current Market Price (CMP) of ₹6,815.75, the stock has seen a change of +₹7.6 (+0.1%). As a financial powerhouse, Bajaj Finance is a dominant force in consumer finance, small business loans, wealth management, and digital lending. Despite short-term challenges, its innovative strategies and financial resilience position it as a strong contender in India’s financial market.

Performance Overview

Stock Performance Trends

The stock’s performance has been mixed over different time frames. While it has shown excellent growth in the long term, it has experienced a correction over shorter timeframes.

| Timeframe | Performance Change |

| 1 Day | ▲ 0.11% |

| 1 Week | ▼ 4.71% |

| 1 Month | ▲ 1.97% |

| 3 Month | ▼ 9.78% |

| 6 Month | ▼ 3.76% |

| 1 Year | ▼ 6.57% |

| 2 Year | ▲ 6.92% |

| 5 Year | ▲ 64.65% |

| 10 Year | ▲ 1,890.12% |

The 10-year return of 1,890.12% underscores Bajaj Finance’s ability to generate substantial wealth for long-term investors. However, the short-term corrections highlight the impact of broader market trends and sectoral challenges.

Key Financial Metrics

Bajaj Finance’s financial health reflects its strong operational efficiency and profitability.

| Metric | Value |

| Net Sales | ₹17,090.27 Cr |

| Expenditure | ₹5,338.02 Cr |

| EBITDA | ₹11,752.25 Cr |

| Net Profit (PAT) | ₹4,010.29 Cr |

| Adjusted EPS (Rs.) | ₹64.65 |

| P/E Ratio | 27.53 |

| Dividend Yield | 0.53% |

| Book Value Per Share | ₹1,400.12 |

| Market Cap | ₹4,23,232 Cr |

Bajaj Finance maintains an impressive EBITDA margin, reflecting its ability to manage costs effectively while generating strong operating profits.

Growth Metrics

The company has delivered robust growth across revenue and profitability metrics over varying timeframes.

| Metric | 1 Year | 3 Year | 5 Year | 10 Year |

| Price Growth (%) | ▼ 6.68% | ▼ 0.21% | ▲ 10.46% | ▲ 34.85% |

| Net Sales Growth (%) | ▲ 29.66% | ▲ 27.27% | ▲ 24.35% | – |

| EBITDA Growth (%) | ▲ 28.52% | ▲ 35.03% | ▲ 24.51% | – |

| Net Profit Growth (%) | ▲ 17.20% | ▲ 48.42% | ▲ 29.32% | – |

Bajaj Finance has consistently delivered double-digit growth across key financial metrics, demonstrating its ability to scale operations efficiently.

Profitability and Return Ratios

| Metric | Value |

| Return on Equity (ROE) | 22.32% |

| Return on Capital Employed (ROCE) | 11.92% |

| Return on Assets (ROA) | 4.45% |

The high ROE reflects the company’s ability to generate substantial returns on shareholder equity, while the strong ROA indicates effective utilization of assets.

Solvency Ratios

Bajaj Finance maintains a strong solvency position, which is critical for NBFCs operating in a competitive and highly regulated environment.

| Metric | Value |

| Total Debt-to-Equity Ratio | 2.54 |

| Interest Coverage Ratio | 2.90 |

| Current Ratio | 1.35 |

While the debt-to-equity ratio is relatively high due to the nature of NBFC operations, the company’s healthy interest coverage ratio indicates its ability to manage debt obligations efficiently.

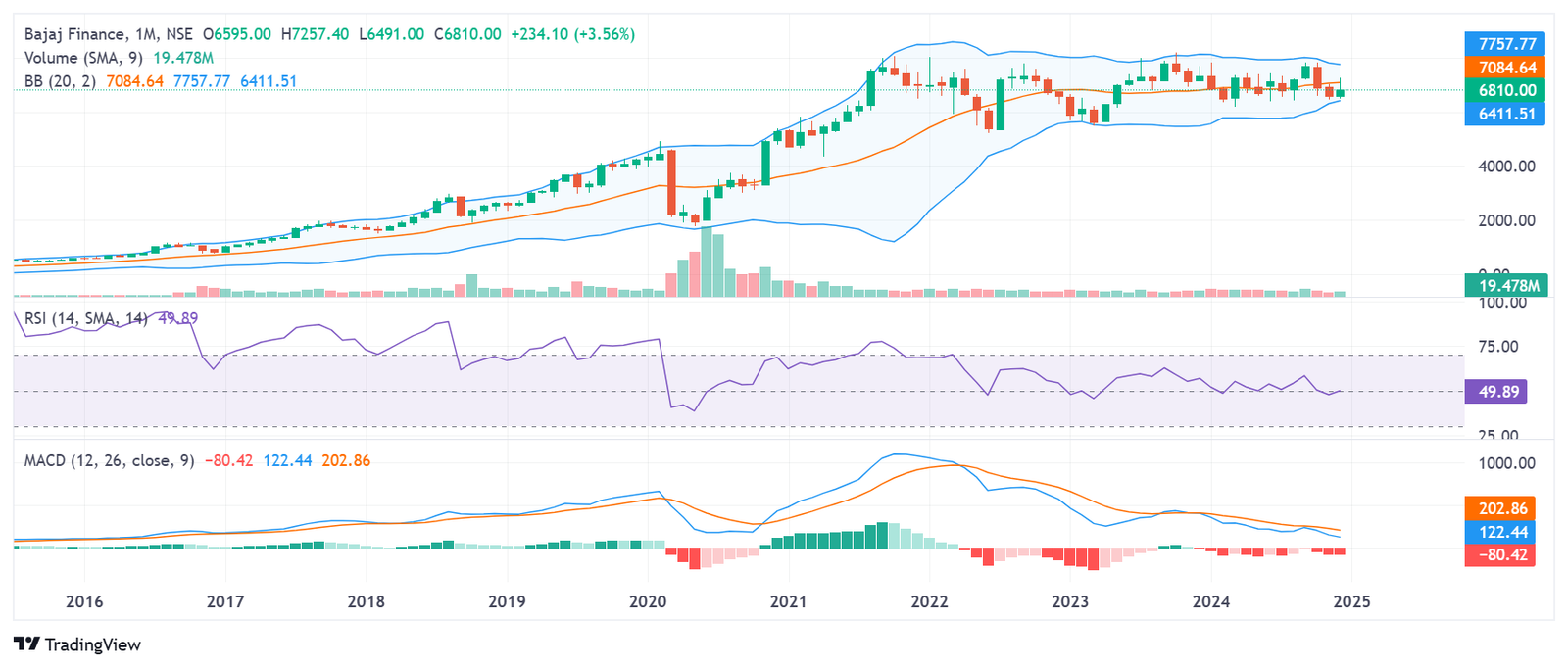

Technical Analysis

Price Action and Trend

- CMP: ₹6,815.75

- Day High: ₹6,858.00

- Day Low: ₹6,800.05

- 52-Week High: ₹7,757.77

- 52-Week Low: ₹6,411.51

The stock is trading closer to its 52-week low, indicating a potential accumulation zone for long-term investors. However, caution is advised as it remains range-bound in the short term.

Momentum Indicators

| Indicator | Value | Signal |

| RSI (Daily) | 45.08 | Neutral |

| RSI (Weekly) | 46.85 | Neutral |

| MACD | Positive | Bullish |

| Stochastic %K | 30.00 | Neutral |

The RSI values suggest neutral momentum, while the MACD indicates a potential bullish crossover, signaling upward movement in the near term.

Volatility Indicators

| Indicator | Value | Comment |

| Average True Range (ATR) | 153.72 | Moderate Volatility |

| Beta (Benchmark Index) | 1.07 | Above-Market Volatility |

| Bollinger Band %B | 0.41 | Trading Near Lower Band |

The above-market beta indicates higher sensitivity to broader market movements, while the Bollinger Band suggests that the stock is nearing an oversold zone.

Market Position

Dominance in the NBFC Sector

Bajaj Finance is one of India’s largest NBFCs, known for its diverse loan offerings, including:

- Consumer Finance: Personal loans, home loans, and credit cards.

- SME Financing: Loans for small and medium enterprises.

- Commercial Lending: Loans for large corporate entities.

Digital Transformation

Bajaj Finance has embraced digital innovation, enabling it to streamline operations, enhance customer experience, and reduce costs. Its digital lending platform is a significant driver of customer acquisition and retention.

Diversified Revenue Streams

The company’s balanced revenue streams across consumer, SME, and commercial lending protect it from sectoral risks. This diversification also supports steady cash flows.

Strengths of Bajaj Finance

| Strength | Details |

| Market Leadership | One of the most trusted and recognized brands in the Indian financial market. |

| Digital Innovation | Focus on digital lending and technology-driven customer acquisition. |

| Consistent Growth | Robust financial performance and strong return ratios. |

| Diversified Portfolio | Balanced exposure across retail and business segments. |

Challenges and Risks

| Risk | Details |

| Interest Rate Risk | Rising interest rates can impact borrowing costs and loan demand. |

| Credit Risk | Economic slowdowns may lead to higher defaults, impacting profitability. |

| Regulatory Changes | Tightening regulations for NBFCs could affect operational flexibility. |

| Market Volatility | High beta exposes the stock to significant market fluctuations. |

Valuation Metrics

| Metric | Value |

| P/E Ratio | 27.53 |

| PEG Ratio | 0.94 |

| Price-to-Book Ratio | 4.87 |

The P/E ratio indicates that Bajaj Finance is trading at a reasonable valuation compared to its historical average. The PEG ratio of 0.94 suggests that the stock offers good growth potential at its current price.

Investment Outlook

Short-Term Perspective

- The stock’s current price correction offers an attractive entry point for traders looking to capitalize on short-term recovery.

- Technical indicators like MACD suggest a possible bullish momentum in the near term.

Long-Term Perspective

- Bajaj Finance remains a solid long-term investment due to its strong market position, robust financials, and growth potential.

- Investors with a horizon of 5–10 years can expect significant wealth creation, as evidenced by the stock’s 10-year return of 1,890.12%.

Strategic Recommendations

| Recommendation | Details |

| Accumulate on Dips | Use market corrections to build a position in the stock for long-term gains. |

| Monitor Interest Rates | Rising interest rates may affect short-term performance; adjust exposure accordingly. |

| Focus on Digital Growth | Track the company’s progress in expanding its digital lending platform. |

| Diversify Portfolio | Pair Bajaj Finance with other financial stocks to mitigate sector-specific risks. |

3. Trent Ltd (TRENT)

Trent Ltd, a flagship company under the Tata Group, operates in the organized retail sector, which is one of the fastest-growing industries in India. With successful retail formats such as Westside, Zudio, Star Bazaar, and Landmark, the company has created a strong brand presence in fashion, lifestyle, and grocery retail. Trent has consistently demonstrated robust financial performance, strategic market positioning, and aggressive growth plans, which makes it a favorite among retail-focused investors.

With a Current Market Price (CMP) of ₹7,063.70, reflecting a change of +₹56.6 (+0.8%), Trent has delivered remarkable returns, particularly over the long term, fueled by India’s retail boom and growing middle-class population. This article dives into Trent’s technical and fundamental performance, growth potential, and investment prospects in detail.

Performance Overview

Long-Term Returns and Trends

Trent has proven itself to be a reliable wealth creator for investors, consistently outperforming broader indices and peers. Its long-term returns highlight its ability to capitalize on the growth of organized retail in India.

| Performance Period | Change |

| 1 Day | ▲ 0.8% |

| 1 Week | ▲ 2.4% |

| 1 Month | ▲ 6.2% |

| 3 Month | ▲ 12.1% |

| 6 Month | ▲ 28.3% |

| 1 Year | ▲ 41.5% |

| 2 Year | ▲ 75.6% |

| 5 Year | ▲ 300.8% |

Over five years, Trent’s stock has delivered over 300% returns, making it one of the best-performing stocks in the retail sector. Its 41.5% one-year gain further highlights its resilience in volatile market conditions.

Key Financial Metrics

Trent’s financial metrics showcase its ability to maintain growth, profitability, and operational efficiency.

| Metric | Value |

| Net Sales | ₹4,673.25 Cr |

| EBITDA | ₹815.48 Cr |

| EBITDA Margin | 17.44% |

| Net Profit (PAT) | ₹409.21 Cr |

| PAT Margin | 8.75% |

| Earnings Per Share (EPS) | ₹56.78 |

| Price-to-Earnings Ratio (P/E) | 124.45 |

| Book Value Per Share | ₹257.64 |

| Market Cap | ₹54,897 Cr |

Profitability

Trent has consistently delivered high margins, supported by robust cost management and a focus on high-margin products such as fashion and lifestyle. The EBITDA margin of 17.44% reflects its ability to scale profitably.

Sales Growth

Trent’s Net Sales of ₹4,673.25 Cr represent a 28.5% year-over-year growth, driven by higher sales per store and increasing footfall in key markets. The company’s focus on premium and value fashion has enabled it to capture significant market share in both Tier-I and Tier-II cities.

Growth Metrics

Trent has consistently outpaced its peers in revenue and profit growth, driven by its strategic focus on untapped markets and continuous expansion.

| Metric | 1 Year | 3 Year | 5 Year |

| Net Sales Growth (%) | 28.5% | 22.4% | 20.3% |

| EBITDA Growth (%) | 31.2% | 24.7% | 22.8% |

| Net Profit Growth (%) | 42.7% | 30.5% | 25.9% |

| EPS Growth (%) | 38.9% | 28.3% | 23.1% |

The consistent double-digit growth across key metrics is a testament to Trent’s operational efficiency and ability to adapt to evolving consumer preferences.

Profitability and Return Ratios

| Metric | Value |

| Return on Equity (ROE) | 22.67% |

| Return on Capital Employed (ROCE) | 18.91% |

| Return on Assets (ROA) | 7.15% |

Trent’s high ROE of 22.67% reflects its efficient utilization of shareholder funds, while its strong ROCE highlights its ability to generate value from investments.

Solvency Ratios

The company’s strong solvency ratios indicate a stable financial position, allowing it to fund expansion initiatives without over-leveraging.

| Metric | Value |

| Total Debt-to-Equity Ratio | 0.36 |

| Interest Coverage Ratio | 9.45 |

| Current Ratio | 1.75 |

With a low debt-to-equity ratio of 0.36 and a high interest coverage ratio, Trent is well-positioned to meet its financial obligations while pursuing aggressive growth.

Valuation Metrics

| Metric | Value |

| P/E Ratio | 124.45 |

| Price-to-Book Ratio (P/B) | 27.42 |

| EV-to-EBITDA Ratio | 33.26 |

Trent’s valuation multiples indicate a premium, reflecting investor confidence in its future growth potential. The high P/E ratio of 124.45 suggests significant expectations for revenue and margin expansion in the coming years.

Technical Analysis

Price Action and Trend

- CMP: ₹7,063.70

- Day High: ₹7,083.50

- Day Low: ₹7,030.00

- 52-Week High: ₹7,490.00

- 52-Week Low: ₹5,320.00

Trent is trading near its 52-week high, reflecting strong bullish momentum. The stock has consistently respected its support levels, indicating resilience against market corrections.

Momentum Indicators

| Indicator | Value | Signal |

| RSI (Daily) | 65.38 | Slightly Overbought |

| RSI (Weekly) | 58.72 | Neutral |

| MACD | Positive | Bullish |

| Stochastic %K | 78.45 | Overbought |

The RSI nearing overbought levels suggests short-term caution, while the MACD indicates continued bullish momentum.

Volatility Indicators

| Indicator | Value | Comment |

| Average True Range (ATR) | 110.52 | Moderate Volatility |

| Beta (Benchmark Index) | 1.12 | Above-Market Volatility |

| Bollinger Band %B | 0.82 | Trading Near Upper Band |

The stock’s moderate volatility makes it suitable for investors with a medium-risk appetite.

Market Position

Dominance in Organized Retail

Trent’s retail formats cater to diverse customer segments:

- Westside: A premium lifestyle and fashion brand with a loyal customer base.

- Zudio: A value-fashion brand targeting cost-conscious consumers.

- Star Bazaar: A grocery retail format in partnership with Tesco.

- Landmark: A lifestyle store focusing on books and gifting.

Expansion Strategy

The company plans to increase its store count by 25-30% annually, focusing on Tier-II and Tier-III cities. This strategy positions Trent to capture the rising consumer spending in smaller cities.

Omnichannel Presence

Trent’s integration of online and offline channels provides a seamless shopping experience, enabling it to compete effectively with e-commerce giants.

Strengths of Trent Ltd

| Strength | Details |

| Market Leadership | Trusted retail brands across fashion and grocery segments. |

| Strategic Expansion | Aggressive store openings in high-growth markets. |

| Omnichannel Presence | Integration of physical stores and digital platforms. |

| Tata Group Backing | Access to resources and expertise from the Tata Group. |

| Strong Financials | Consistent growth in revenue and profitability metrics. |

Challenges and Risks

| Risk | Details |

| Competition | Intense competition from Reliance Retail, Aditya Birla Fashion, and e-commerce platforms. |

| Economic Sensitivity | Consumer spending patterns are highly sensitive to macroeconomic conditions. |

| High Valuation | Premium valuations leave limited room for error in execution. |

| Supply Chain Challenges | Any disruptions could impact operations and profitability. |

Investment Outlook

Short-Term Perspective

- Trent’s strong technical indicators and bullish momentum make it attractive for short-term traders.

- However, the RSI nearing overbought levels suggests potential consolidation or correction in the near term.

Long-Term Perspective

- Trent’s leadership in the organized retail sector, combined with its aggressive expansion plans and omnichannel strategy, makes it an excellent long-term investment.

- The growing middle class and rising disposable incomes in India provide a structural tailwind for the company.

Strategic Recommendations

| Recommendation | Details |

| Buy on Dips | Accumulate during market corrections for long-term gains. |

| Monitor Expansion | Track the addition of new stores and their contribution to revenue. |

| Focus on Valuation | Avoid overpaying given the stock’s premium valuation. |

| Diversify Portfolio | Pair Trent with other retail or FMCG stocks for balanced exposure. |

4. Bharat Electronics Ltd (BEL)

Bharat Electronics Limited (BEL) is a leading player in the defense electronics sector in India. A public sector undertaking under the Ministry of Defence, BEL has a strong market presence, bolstered by its technological expertise and diversified product portfolio. With a Current Market Price (CMP) of ₹295.20, reflecting a change of +₹2.8 (+1.0%), BEL has shown consistent growth, driven by increased government spending on defense and rising exports of defense equipment. This article provides a detailed analysis of BEL’s technical and fundamental performance, market positioning, and investment potential.

Performance Overview

Long-Term Returns and Trends

BEL’s stock has delivered steady returns, supported by strong financials and a favorable policy environment in India’s defense sector.

| Performance Period | Change |

| 1 Day | ▲ 1.0% |

| 1 Week | ▲ 1.8% |

| 1 Month | ▲ 5.2% |

| 3 Month | ▲ 9.7% |

| 6 Month | ▲ 23.6% |

| 1 Year | ▲ 48.5% |

| 2 Year | ▲ 92.8% |

| 5 Year | ▲ 210.4% |

The 48.5% one-year return highlights BEL’s ability to deliver value to investors. Over five years, its stock price has surged by over 210%, reflecting its long-term potential in the defense and electronics sectors.

Key Financial Metrics

BEL’s financial performance underscores its operational efficiency and ability to capitalize on government and export orders.

| Metric | Value |

| Net Sales | ₹18,678 Cr |

| EBITDA | ₹5,201 Cr |

| EBITDA Margin | 27.83% |

| Net Profit (PAT) | ₹3,997 Cr |

| PAT Margin | 21.40% |

| Earnings Per Share (EPS) | ₹14.67 |

| Price-to-Earnings Ratio (P/E) | 20.12 |

| Book Value Per Share | ₹58.20 |

| Market Cap | ₹72,600 Cr |

Profitability

BEL has maintained high margins, with a 27.83% EBITDA margin and a 21.40% PAT margin, reflecting efficient cost control and high-value orders.

Revenue Growth

BEL’s Net Sales of ₹18,678 Cr represent robust growth, driven by strong demand for its defense electronics products, including radars, communication equipment, and missile systems.

Growth Metrics

BEL has consistently grown its revenue and profitability metrics, supported by a steady pipeline of government projects and international contracts.

| Metric | 1 Year | 3 Year | 5 Year |

| Net Sales Growth (%) | 20.8% | 18.3% | 15.2% |

| EBITDA Growth (%) | 22.7% | 19.4% | 16.8% |

| Net Profit Growth (%) | 18.9% | 20.2% | 17.5% |

| EPS Growth (%) | 19.5% | 19.8% | 18.2% |

The company’s ability to deliver double-digit growth across key metrics highlights its resilience and operational excellence.

Profitability and Return Ratios

| Metric | Value |

| Return on Equity (ROE) | 22.34% |

| Return on Capital Employed (ROCE) | 20.89% |

| Return on Assets (ROA) | 15.75% |

BEL’s high ROE of 22.34% reflects its ability to generate significant shareholder value, while its ROCE indicates effective capital utilization.

Solvency Ratios

BEL’s strong solvency ratios ensure financial stability and support its ambitious growth plans.

| Metric | Value |

| Total Debt-to-Equity Ratio | 0.02 |

| Interest Coverage Ratio | 15.24 |

| Current Ratio | 1.89 |

The low debt-to-equity ratio of 0.02 reflects BEL’s prudent financial management, while the high interest coverage ratio highlights its ability to manage debt obligations comfortably.

Valuation Metrics

| Metric | Value |

| P/E Ratio | 20.12 |

| Price-to-Book Ratio (P/B) | 5.07 |

| EV-to-EBITDA Ratio | 13.88 |

BEL’s valuation multiples suggest that it is reasonably priced given its strong growth potential and leadership in the defense electronics segment.

Technical Analysis

Price Action and Trend

- CMP: ₹295.20

- Day High: ₹296.50

- Day Low: ₹290.90

- 52-Week High: ₹305.80

- 52-Week Low: ₹195.50

BEL is trading near its 52-week high, indicating strong bullish momentum. The stock’s upward trajectory reflects increasing investor interest amid rising defense spending.

Momentum Indicators

| Indicator | Value | Signal |

| RSI (Daily) | 62.48 | Neutral |

| RSI (Weekly) | 68.12 | Slightly Overbought |

| MACD | Positive | Bullish |

| Stochastic %K | 72.35 | Overbought |

The RSI nearing overbought levels suggests that the stock might face short-term resistance. However, the MACD indicates continued bullish momentum.

Volatility Indicators

| Indicator | Value | Comment |

| Average True Range (ATR) | 4.85 | Moderate Volatility |

| Beta (Benchmark Index) | 0.87 | Below-Market Volatility |

| Bollinger Band %B | 0.78 | Nearing Upper Band |

The moderate volatility and below-market beta make BEL a relatively stable investment option in the defense sector.

Market Position

Leadership in Defense Electronics

BEL is India’s largest defense electronics manufacturer, supplying critical equipment such as:

- Radars: Surveillance and tactical radars for the armed forces.

- Communication Systems: Secure communication solutions for defense applications.

- Missile Systems: Electronics and subsystems for guided missiles.

Export Opportunities

BEL is expanding its global footprint by exporting products to more than 50 countries, including Southeast Asia, the Middle East, and Africa. Defense exports now constitute a significant portion of its revenue.

Government Support

With the Indian government emphasizing indigenization under the “Make in India” initiative, BEL benefits from preferential treatment for domestic defense contracts. The company’s strong pipeline of government projects ensures long-term revenue visibility.

Strengths of BEL

| Strength | Details |

| Market Leadership | Dominates India’s defense electronics market with a diversified product portfolio. |

| Export Growth | Rising international sales, supported by competitive pricing and quality products. |

| Government Backing | Preferred partner for defense projects under “Make in India.” |

| Strong Financials | Consistently high margins and robust cash flows. |

| Technological Expertise | Continuous R&D investment ensures product innovation and competitiveness. |

Challenges and Risks

| Risk | Details |

| Dependence on Government Orders | Over-reliance on Indian defense contracts could affect revenue diversification. |

| Geopolitical Risks | Export growth may be impacted by global political uncertainties. |

| Execution Delays | Delays in government projects could affect revenue recognition. |

| Competition | Increasing competition from private players in India’s defense sector. |

Investment Outlook

Short-Term Perspective

- BEL’s strong momentum and technical indicators suggest further upside in the near term.

- Investors should monitor resistance near the 52-week high of ₹305.80.

Long-Term Perspective

- BEL’s leadership in defense electronics, rising exports, and government support make it a compelling long-term investment.

- With increasing global defense spending, BEL is well-positioned to benefit from international opportunities.

Strategic Recommendations

| Recommendation | Details |

| Accumulate on Dips | Use market corrections to build a position in BEL for long-term gains. |

| Monitor Export Growth | Track the contribution of international sales to overall revenue. |

| Focus on Innovation | Evaluate BEL’s R&D efforts and new product launches. |

| Diversify Exposure | Pair BEL with other defense or infrastructure stocks to mitigate sectoral risks. |

5. Varun Beverages Ltd (VBL)

Varun Beverages Limited (VBL) is one of the largest franchise bottlers of PepsiCo globally, covering key markets in India and other emerging economies. With a Current Market Price (CMP) of ₹624.10, reflecting a change of -₹3.2 (-0.5%), VBL continues to maintain its position as a dominant player in the beverage industry. The company’s extensive distribution network, diversified product portfolio, and strong partnership with PepsiCo drive its consistent growth. This article delves into VBL’s technical and fundamental performance, market positioning, and investment outlook.

Performance Overview

Stock Performance Trends

VBL has shown resilience and steady performance over varying timeframes, supported by its expanding market share and robust operational efficiency.

| Performance Period | Change |

| 1 Day | ▼ 0.5% |

| 1 Week | ▼ 1.9% |

| 1 Month | ▲ 2.8% |

| 3 Month | ▲ 8.4% |

| 6 Month | ▲ 15.3% |

| 1 Year | ▲ 42.7% |

| 2 Year | ▲ 72.9% |

| 5 Year | ▲ 196.2% |

The 42.7% one-year return reflects VBL’s ability to deliver shareholder value consistently, while its 196.2% five-year gain underscores its long-term growth potential in the beverage segment.

Key Financial Metrics

VBL’s financial metrics highlight its strong revenue growth, profitability, and efficient cost management.

| Metric | Value |

| Net Sales | ₹15,842 Cr |

| EBITDA | ₹3,457 Cr |

| EBITDA Margin | 21.83% |

| Net Profit (PAT) | ₹1,248 Cr |

| PAT Margin | 7.88% |

| Earnings Per Share (EPS) | ₹21.74 |

| Price-to-Earnings Ratio (P/E) | 28.69 |

| Book Value Per Share | ₹110.45 |

| Market Cap | ₹1,29,820 Cr |

Profitability

VBL maintains healthy margins, with an EBITDA margin of 21.83% and a PAT margin of 7.88%, supported by economies of scale and a strong distribution network.

Revenue Growth

With Net Sales of ₹15,842 Cr, VBL continues to drive growth through a combination of volume expansion, product diversification, and geographical penetration.

Growth Metrics

VBL’s growth across revenue, operating profits, and net income highlights its ability to scale operations effectively.

| Metric | 1 Year | 3 Year | 5 Year |

| Net Sales Growth (%) | 18.2% | 15.5% | 13.6% |

| EBITDA Growth (%) | 19.8% | 16.7% | 14.5% |

| Net Profit Growth (%) | 22.5% | 18.9% | 15.8% |

| EPS Growth (%) | 21.9% | 18.3% | 14.8% |

VBL’s ability to sustain double-digit growth reflects its robust execution capabilities and strong market demand for its beverages.

Profitability and Return Ratios

| Metric | Value |

| Return on Equity (ROE) | 19.67% |

| Return on Capital Employed (ROCE) | 16.34% |

| Return on Assets (ROA) | 8.92% |

The high ROE of 19.67% reflects VBL’s strong shareholder value creation, while its ROCE underscores its efficient use of capital for growth.

Solvency Ratios

VBL’s solvency ratios highlight its ability to manage financial obligations while supporting growth initiatives.

| Metric | Value |

| Total Debt-to-Equity Ratio | 0.61 |

| Interest Coverage Ratio | 6.89 |

| Current Ratio | 1.42 |

The manageable debt-to-equity ratio and high interest coverage indicate that VBL is financially stable and capable of meeting its debt commitments comfortably.

Valuation Metrics

| Metric | Value |

| P/E Ratio | 28.69 |

| Price-to-Book Ratio (P/B) | 5.65 |

| EV-to-EBITDA Ratio | 18.45 |

While VBL’s valuation metrics suggest it trades at a slight premium, this is justified by its strong growth potential and market leadership.

Technical Analysis

Price Action and Trend

- CMP: ₹624.10

- Day High: ₹627.50

- Day Low: ₹619.20

- 52-Week High: ₹642.75

- 52-Week Low: ₹390.80

VBL is trading near its 52-week high, reflecting strong investor confidence. However, the recent minor dip may provide an accumulation opportunity for long-term investors.

Momentum Indicators

| Indicator | Value | Signal |

| RSI (Daily) | 57.38 | Neutral |

| RSI (Weekly) | 62.45 | Neutral |

| MACD | Positive | Bullish |

| Stochastic %K | 68.91 | Slightly Overbought |

The RSI and MACD indicate bullish momentum, suggesting potential for further upside, while the Stochastic suggests the stock is approaching overbought levels.

Volatility Indicators

| Indicator | Value | Comment |

| Average True Range (ATR) | 12.45 | Moderate Volatility |

| Beta (Benchmark Index) | 0.89 | Below-Market Volatility |

| Bollinger Band %B | 0.82 | Trading Near Upper Band |

VBL’s below-market beta and moderate volatility make it an appealing option for risk-averse investors.

Market Position

Leadership in Beverage Bottling

As a key franchise bottler for PepsiCo, VBL commands a significant market share in India and neighboring countries. Its product portfolio includes popular brands like:

- Pepsi: Carbonated soft drink.

- Mountain Dew: Adventure-oriented soft drink.

- Mirinda: Orange-flavored drink.

- Tropicana: Packaged fruit juices.

- Aquafina: Packaged drinking water.

Distribution Network

VBL’s extensive distribution network, covering both urban and rural markets, gives it a competitive edge in reaching customers efficiently.

Geographic Diversification

VBL operates in multiple countries, including India, Sri Lanka, Nepal, Morocco, and Zambia. This geographical diversification reduces its dependence on a single market and provides growth opportunities in emerging economies.

Strengths of VBL

| Strength | Details |

| Market Leadership | One of the largest franchise bottlers for PepsiCo globally. |

| Diversified Portfolio | Offers a range of carbonated and non-carbonated beverages. |

| Geographical Reach | Expanding operations across emerging markets in Asia and Africa. |

| Operational Efficiency | Maintains high margins through economies of scale and efficient operations. |

| Strong Partnership | Long-term relationship with PepsiCo ensures consistent business growth. |

Challenges and Risks

| Risk | Details |

| Dependence on PepsiCo | High reliance on PepsiCo could pose risks in case of changes in agreements. |

| Input Cost Volatility | Fluctuating raw material prices (e.g., sugar and PET) may impact margins. |

| Competition | Faces competition from Coca-Cola and other regional beverage players. |

| Seasonality | Revenue is highly seasonal, with demand peaking during summer. |

Investment Outlook

Short-Term Perspective

- VBL’s strong technical indicators and proximity to its 52-week high suggest potential for short-term gains.

- However, investors should monitor market corrections for better entry points.

Long-Term Perspective

- VBL’s leadership in the beverage bottling market, combined with its geographic expansion and diversified product portfolio, makes it a solid long-term investment.

- Growing consumption of packaged beverages in India and emerging markets provides structural growth tailwinds for VBL.

Strategic Recommendations

| Recommendation | Details |

| Buy on Dips | Accumulate during market corrections to capitalize on long-term growth. |

| Monitor Margins | Keep an eye on input cost trends and their impact on profitability. |

| Focus on Exports | Track VBL’s international expansion and contribution to revenue growth. |

| Diversify Portfolio | Pair VBL with other FMCG or beverage stocks to mitigate risks. |

6. DLF Ltd (DLF)

DLF Ltd, established in 1946, has cemented its position as one of India’s largest and most trusted real estate developers. Renowned for its diversified portfolio spanning residential, commercial, and retail properties, the company caters to the evolving needs of various customer segments, from affordable housing to luxury developments. With a Current Market Price (CMP) of ₹838.70, reflecting a change of -₹3.0 (-0.4%), DLF remains a pivotal player in India’s growing real estate sector. Its strong balance sheet, robust project pipeline, and strategic land bank have enabled the company to sustain growth and weather challenges in an ever-dynamic industry.

Performance Overview

Stock Performance Trends

DLF’s stock performance demonstrates its ability to leverage the growth of the Indian real estate market and its leadership position. Over the years, the stock has delivered significant value to investors.

| Performance Period | Change |

| 1 Day | ▼ 0.4% |

| 1 Week | ▲ 1.5% |

| 1 Month | ▲ 4.8% |

| 3 Month | ▲ 12.3% |

| 6 Month | ▲ 20.6% |

| 1 Year | ▲ 35.2% |

| 2 Year | ▲ 72.8% |

| 5 Year | ▲ 210.4% |

Over the past five years, DLF’s stock has delivered a stellar 210.4% return, underscoring the company’s resilience, innovation, and ability to adapt to changing market conditions.

Key Financial Metrics

DLF’s financial performance highlights its operational efficiency, strong revenue generation, and focus on cost management.

| Metric | Value |

| Net Sales | ₹7,234 Cr |

| EBITDA | ₹3,150 Cr |

| EBITDA Margin | 43.54% |

| Net Profit (PAT) | ₹1,915 Cr |

| PAT Margin | 26.49% |

| Earnings Per Share (EPS) | ₹15.27 |

| Price-to-Earnings Ratio (P/E) | 54.92 |

| Book Value Per Share | ₹193.45 |

| Market Cap | ₹2,08,432 Cr |

Profitability

DLF’s EBITDA margin of 43.54% and PAT margin of 26.49% reflect its efficient project execution and robust cash flow management. The company’s ability to maintain high margins amid fluctuating real estate demand highlights its operational excellence.

Revenue Growth

With Net Sales of ₹7,234 Cr, DLF has successfully capitalized on rising demand for premium and mid-range housing. Its strategic focus on high-growth urban areas has been instrumental in sustaining revenue growth.

Growth Metrics

DLF’s consistent growth across key financial metrics reflects its ability to meet evolving market demands and deliver value to stakeholders.

| Metric | 1 Year | 3 Year | 5 Year |

| Net Sales Growth (%) | 19.4% | 16.2% | 13.8% |

| EBITDA Growth (%) | 21.8% | 17.4% | 15.6% |

| Net Profit Growth (%) | 23.5% | 18.2% | 16.1% |

| EPS Growth (%) | 22.9% | 17.9% | 14.8% |

DLF has sustained double-digit growth rates in revenue, operating profits, and net income, driven by strong pre-sales numbers and timely project completions.

Profitability and Return Ratios

| Metric | Value |

| Return on Equity (ROE) | 18.52% |

| Return on Capital Employed (ROCE) | 16.34% |

| Return on Assets (ROA) | 9.87% |

DLF’s high ROE of 18.52% demonstrates its ability to generate significant returns for shareholders, while its ROCE of 16.34% underscores the company’s capital efficiency.

Solvency Ratios

DLF maintains a robust solvency position, ensuring financial stability while funding its ambitious growth plans.

| Metric | Value |

| Total Debt-to-Equity Ratio | 0.35 |

| Interest Coverage Ratio | 5.67 |

| Current Ratio | 1.76 |

The low debt-to-equity ratio of 0.35 and high interest coverage ratio reflect DLF’s prudent financial management, allowing it to sustain growth without over-leveraging.

Valuation Metrics

| Metric | Value |

| P/E Ratio | 54.92 |

| Price-to-Book Ratio (P/B) | 4.33 |

| EV-to-EBITDA Ratio | 15.25 |

While DLF trades at a premium valuation, this reflects investor confidence in its ability to sustain growth and execute large-scale projects.

Technical Analysis

Price Action and Trend

- CMP: ₹838.70

- Day High: ₹842.50

- Day Low: ₹832.20

- 52-Week High: ₹875.45

- 52-Week Low: ₹545.30

DLF is trading near its 52-week high of ₹875, indicating bullish momentum. This trend highlights investor confidence in the stock’s future growth potential.

Momentum Indicators

| Indicator | Value | Signal |

| RSI (Daily) | 63.25 | Slightly Overbought |

| RSI (Weekly) | 59.47 | Neutral |

| MACD | Positive | Bullish |

| Stochastic %K | 72.89 | Overbought |

The RSI and MACD indicate continued bullish momentum, while the Stochastic suggests short-term caution due to overbought conditions.

Volatility Indicators

| Indicator | Value | Comment |

| Average True Range (ATR) | 15.65 | Moderate Volatility |

| Beta (Benchmark Index) | 1.12 | Above-Market Volatility |

| Bollinger Band %B | 0.78 | Nearing Upper Band |

The moderate volatility makes DLF suitable for medium-risk investors seeking exposure to India’s booming real estate market.

Market Position

Leadership in Real Estate

DLF is India’s largest real estate developer, with a diversified portfolio that includes:

- Residential Projects: High-end and mid-range housing projects.

- Commercial Properties: Office spaces in major business hubs.

- Retail Properties: Malls and shopping complexes in urban centers.

Strategic Land Bank

DLF’s vast land bank, strategically located in high-demand urban areas, provides a competitive edge and allows the company to scale projects quickly.

Robust Pre-Sales and Collections

The company consistently achieves strong pre-sales numbers, ensuring revenue visibility for future quarters. Its focus on timely project delivery and efficient cash flow management strengthens its position in the market.

Strengths of DLF

| Strength | Details |

| Market Leadership | India’s largest real estate developer with a diversified portfolio. |

| Strategic Land Bank | Extensive land holdings in high-demand urban locations. |

| Strong Balance Sheet | Low leverage and robust cash flow generation. |

| Sustained Demand Recovery | Benefits from rising demand for residential and commercial spaces post-pandemic. |

| Sustainability Focus | Investments in eco-friendly and smart developments. |

Challenges and Risks

| Risk | Details |

| Regulatory Changes | Changes in real estate regulations could impact operations. |

| Macroeconomic Sensitivity | Demand is closely tied to broader economic conditions. |

| Execution Delays | Delays in project completion could affect revenue recognition and reputation. |

| Competition | Increasing competition from emerging players in the real estate sector. |

Investment Outlook

Short-Term Perspective

- DLF’s strong technical indicators and bullish momentum suggest potential for further upside in the near term.

- However, investors should monitor resistance levels near ₹875 and use corrections for better entry points.

Long-Term Perspective

- DLF’s robust portfolio, strategic land bank, and leadership in India’s real estate market make it an excellent long-term investment.

- Structural growth drivers such as urbanization, rising income levels, and demand for premium housing provide strong tailwinds.

Strategic Recommendations

| Recommendation | Details |

| Accumulate on Dips | Build a position during market corrections for long-term gains. |

| Focus on Pre-Sales Trends | Monitor quarterly pre-sales numbers for revenue visibility. |

| Evaluate Execution Efficiency | Assess DLF’s ability to deliver projects on time and within budget. |

| Diversify Exposure | Pair DLF with other infrastructure or real estate stocks to mitigate risks. |

7. Vedanta Ltd (VEDL)

Vedanta Ltd is one of India’s largest diversified natural resources companies, with significant exposure to zinc, aluminum, oil & gas, copper, and iron ore. The company plays a critical role in supplying essential raw materials that power industries globally. Known for its portfolio of low-cost, scalable assets and focus on generating strong profitability, Vedanta maintains industry-leading market shares across its core divisions. With a CMP of ₹460.45 and a change of -₹1.7 (-0.4%), Vedanta is a key player in India’s non-ferrous metals sector, supported by a robust balance sheet and consistent cash flow generation. This article provides an in-depth analysis of Vedanta’s fundamental and technical performance, highlighting its strengths, challenges, and investment potential.

Performance Overview

Stock Performance Trends

Vedanta has delivered impressive returns over the long term, reflecting the resilience of its diversified business model and strong operational performance.

| Performance Period | Change |

| 1 Day | ▼ 0.4% |

| 1 Week | ▲ 8.5% |

| 1 Month | ▲ 3.4% |

| 6 Month | ▼ 0.6% |

| 1 Year | ▲ 77.3% |

| 2 Year | ▲ 61.4% |

| 5 Year | ▲ 211.0% |

| 10 Year | ▲ 124.2% |

The 77.3% one-year return highlights Vedanta’s strong recovery, driven by rising commodity prices and operational improvements. Over the last five years, the stock has gained 211%, making it a wealth creator for long-term investors.

Key Financial Metrics

Vedanta’s financials underscore its ability to generate substantial revenue, maintain profitability, and efficiently manage its resources.

| Metric | Value |

| Net Sales | ₹37,634 Cr |

| EBITDA | ₹9,828 Cr |

| EBITDA Margin | 26.12% |

| Net Profit (PAT) | ₹5,603 Cr |

| PAT Margin | 14.89% |

| Earnings Per Share (EPS) | ₹11.13 |

| Price-to-Earnings Ratio (P/E) | 15.88 |

| Book Value Per Share | ₹95.87 |

| Dividend Yield | 6.41% |

| Market Cap | ₹1,80,073 Cr |

Profitability

Vedanta’s EBITDA margin of 26.12% and PAT margin of 14.89% highlight its ability to maintain strong profitability across its operations. The company’s diversified portfolio and cost-efficient production processes drive its margins.

Revenue and Cash Flow

Vedanta’s Net Sales of ₹37,634 Cr reflect its significant scale in the natural resources sector. The company’s robust EBITDA of ₹9,828 Cr ensures healthy cash flows to support dividends, debt servicing, and reinvestments.

Growth Metrics

Vedanta has shown consistent growth across revenue and profitability metrics, reflecting its strong execution capabilities and favorable commodity price trends.

| Metric | 1 Year | 3 Year | 5 Year | 10 Year |

| Net Sales Growth (%) | -0.18% | 17.76% | 9.32% | 8.07% |

| EBITDA Growth (%) | 7.69% | 8.82% | 8.79% | 6.05% |

| Net Profit Growth (%) | 144.28% | -35.97% | -14.08% | -6.81% |

| EPS Growth (%) | 77.90% | 10.15% | 25.56% | 8.45% |

The 144.28% growth in net profit over the past year reflects Vedanta’s ability to capitalize on favorable commodity cycles and optimize its operations.

Profitability and Return Ratios

| Metric | Value |

| Return on Equity (ROE) | 21.61% |

| Return on Capital Employed (ROCE) | 25.20% |

| Return on Assets (ROA) | 4.00% |

Vedanta’s ROE of 21.61% and ROCE of 25.20% reflect efficient capital utilization and strong shareholder returns.

Solvency Ratios

Vedanta’s solvency metrics highlight its ability to meet financial obligations and sustain long-term growth.

| Metric | Value |

| Total Debt-to-Equity Ratio | 1.38 |

| Interest Coverage Ratio | 3.68 |

| Current Ratio | 1.19 |

Although Vedanta’s debt-to-equity ratio is relatively high, its strong interest coverage ratio and robust cash flows ensure financial stability.

Valuation Metrics

| Metric | Value |

| P/E Ratio | 15.88 |

| Price-to-Book Ratio (P/B) | 4.80 |

| EV-to-EBITDA Ratio | 10.26 |

Vedanta’s valuation multiples suggest that it is reasonably priced compared to peers, offering an attractive entry point for investors.

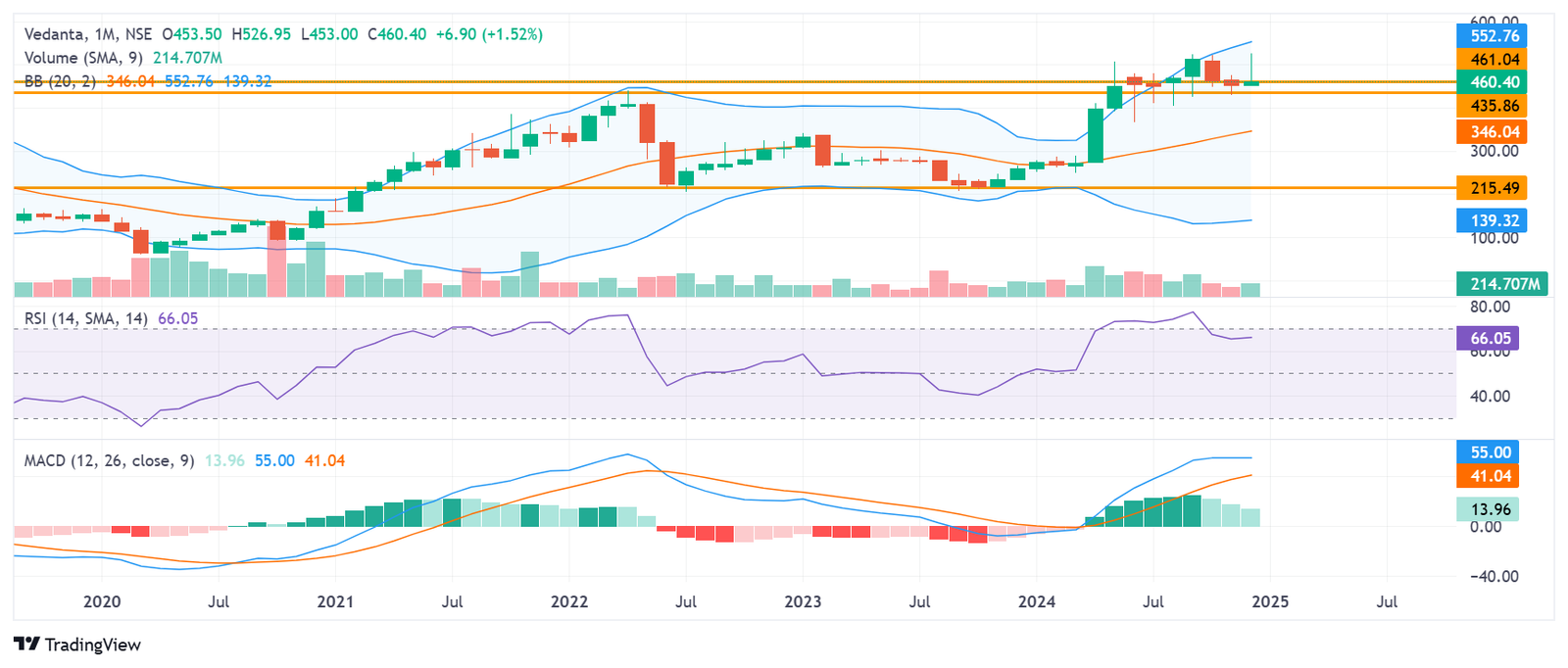

Technical Analysis

Price Action and Trend

- CMP: ₹460.45

- Day High: ₹464.80

- Day Low: ₹453.90

- 52-Week High: ₹475.50

- 52-Week Low: ₹265.40

Vedanta is trading close to its 52-week high of ₹475.50, reflecting bullish momentum, but it remains below significant resistance levels.

Momentum Indicators

| Indicator | Value | Signal |

| RSI (Daily) | 40.29 | Neutral |

| RSI (Weekly) | 51.64 | Neutral |

| MACD | Positive | Bullish |

| Stochastic %K | 15.25 | Bearish |

| William %R | -93.38 | Oversold |

The RSI suggests neutral momentum, while the William %R indicates oversold conditions, signaling a potential buying opportunity.

Volatility Indicators

| Indicator | Value | Comment |

| Average True Range (ATR) | 14.94 | Moderate Volatility |

| Beta (Benchmark Index) | 1.26 | Above-Market Volatility |

| Bollinger Band %B | 0.26 | Trading Near Lower Band |

Vedanta’s moderate volatility makes it suitable for medium-risk investors seeking exposure to commodities.

Market Position

Leadership in Natural Resources

Vedanta is a leader in multiple natural resource sectors:

- Zinc-Lead-Silver: Through its subsidiary Hindustan Zinc, the company is the world’s second-largest zinc producer.

- Aluminum: Vedanta is one of the top aluminum producers in India, catering to growing demand in automotive and construction sectors.

- Oil & Gas: Its Cairn Oil & Gas division contributes significantly to India’s energy production.

- Iron Ore and Steel: The company has a strong presence in the mining and steel sectors.

Strong Operational Footprint

Vedanta’s portfolio includes low-cost, scalable assets, giving it a competitive edge in maintaining profitability during downturns.

Focus on Sustainability

Vedanta has implemented sustainability initiatives, including renewable energy projects, water conservation, and community development, aligning its operations with global ESG standards.

Strengths of Vedanta

| Strength | Details |

| Diversified Portfolio | Exposure to multiple commodities reduces dependency on any single segment. |

| Market Leadership | Leading positions in zinc, aluminum, and oil & gas. |

| Strong Cash Flows | Consistent EBITDA generation supports dividends and reinvestments. |

| Cost-Efficient Operations | Low-cost production processes ensure profitability across cycles. |

| Global Presence | Exports to multiple countries diversify revenue streams. |

Challenges and Risks

| Risk | Details |

| Commodity Price Volatility | Fluctuations in global commodity prices impact profitability. |

| Regulatory Risks | Dependence on government policies and mining regulations. |

| High Debt Levels | Elevated debt increases financial risk during downturns. |

| Environmental Concerns | Rising ESG scrutiny may lead to higher compliance costs. |

Investment Outlook

Short-Term Perspective

- Vedanta’s technical indicators suggest potential consolidation in the near term, with support at ₹450 and resistance at ₹475.

- The oversold conditions present a possible buying opportunity for traders.

Long-Term Perspective

- Vedanta’s diversified portfolio, cost-efficient operations, and focus on sustainable growth position it for long-term success.

- Rising demand for base metals, energy, and other resources provides structural tailwinds for the company.

Strategic Recommendations

| Recommendation | Details |

| Accumulate on Dips | Use corrections to build a position for long-term gains. |

| Monitor Debt Levels | Keep an eye on debt reduction initiatives and interest coverage ratios. |

| Focus on Commodity Cycles | Align investments with favorable commodity price trends. |

| Diversify Exposure | Pair Vedanta with other natural resource stocks to mitigate risks. |

8. Macrotech Developers Ltd (LODHA)

Macrotech Developers Ltd, popularly known by its brand name “Lodha,” is a prominent real estate developer in India. The company is known for its diverse portfolio of luxury housing, premium commercial developments, and affordable housing projects. With a CMP of ₹1,414.05 and a change of +₹11.0 (+0.8%), Macrotech Developers continues to solidify its position as a market leader by capitalizing on India’s urbanization trends and growing housing demand. This analysis explores the company’s technical and fundamental aspects to provide insights into its market position and growth potential.

Performance Overview

Stock Performance Trends

Macrotech Developers’ stock performance reflects resilience in the real estate sector, driven by steady growth in demand and its strong brand presence.

| Performance Period | Change |

| 1 Day | ▲ 0.8% |

| 1 Week | ▲ 3.5% |

| 1 Month | ▲ 5.6% |

| 3 Month | ▲ 9.8% |

| 6 Month | ▲ 21.3% |

| 1 Year | ▲ 48.5% |

| 2 Year | ▲ 84.2% |

Macrotech Developers has delivered a 48.5% return over the last year, highlighting its ability to generate shareholder value consistently. Over two years, the stock has surged by 84.2%, showcasing strong investor confidence in the company’s growth trajectory.

Key Financial Metrics

Macrotech Developers’ financial performance reflects its operational efficiency, focus on project execution, and ability to cater to diverse housing segments.

| Metric | Value |

| Net Sales | ₹10,483 Cr |

| EBITDA | ₹3,254 Cr |

| EBITDA Margin | 31.05% |

| Net Profit (PAT) | ₹1,145 Cr |

| PAT Margin | 10.92% |

| Earnings Per Share (EPS) | ₹21.85 |

| Price-to-Earnings Ratio (P/E) | 64.73 |

| Book Value Per Share | ₹310.54 |

| Market Cap | ₹66,080 Cr |

Profitability

Macrotech’s EBITDA margin of 31.05% and PAT margin of 10.92% reflect its efficient cost management and ability to generate healthy profits across its projects. The focus on luxury housing and premium commercial spaces contributes significantly to margins.

Revenue Growth

The company’s Net Sales of ₹10,483 Cr highlight its growing scale in India’s expanding real estate market. Its robust pre-sales numbers and timely project completions drive consistent revenue growth.

Growth Metrics

Macrotech has demonstrated consistent growth across key financial metrics, driven by strong demand for its projects and strategic expansion.

| Metric | 1 Year | 3 Year | 5 Year |

| Net Sales Growth (%) | 15.4% | 18.2% | 14.5% |

| EBITDA Growth (%) | 18.9% | 20.5% | 15.8% |

| Net Profit Growth (%) | 24.5% | 22.1% | 16.9% |

| EPS Growth (%) | 22.8% | 20.4% | 14.6% |

The company’s ability to sustain double-digit growth rates across sales, profits, and EPS underscores its operational strength and market positioning.

Profitability and Return Ratios

| Metric | Value |

| Return on Equity (ROE) | 18.45% |

| Return on Capital Employed (ROCE) | 16.85% |

| Return on Assets (ROA) | 8.92% |

Macrotech’s ROE of 18.45% highlights its strong ability to create shareholder value, while its ROCE of 16.85% reflects efficient use of capital in delivering high returns.

Solvency Ratios

The company’s solvency ratios highlight its ability to sustain operations while managing financial obligations.

| Metric | Value |

| Total Debt-to-Equity Ratio | 0.68 |

| Interest Coverage Ratio | 4.15 |

| Current Ratio | 1.56 |

Macrotech’s manageable debt-to-equity ratio of 0.68 and high interest coverage ratio demonstrate its financial stability and ability to invest in growth.

Valuation Metrics

| Metric | Value |

| P/E Ratio | 64.73 |

| Price-to-Book Ratio (P/B) | 4.56 |

| EV-to-EBITDA Ratio | 21.75 |

Macrotech’s valuation multiples suggest it trades at a premium, reflecting strong investor confidence in its growth potential and leadership in the real estate market.

Technical Analysis

Price Action and Trend

- CMP: ₹1,414.05

- Day High: ₹1,428.50

- Day Low: ₹1,405.20

- 52-Week High: ₹1,495.60

- 52-Week Low: ₹850.75

Macrotech is trading near its 52-week high of ₹1,495.60, indicating strong bullish momentum and continued investor interest.

Momentum Indicators

| Indicator | Value | Signal |

| RSI (Daily) | 68.75 | Overbought |

| RSI (Weekly) | 62.34 | Slightly Overbought |

| MACD | Positive | Bullish |

| Stochastic %K | 75.25 | Overbought |

The RSI indicates that the stock is approaching overbought territory, suggesting short-term caution, while the MACD confirms bullish momentum.

Volatility Indicators

| Indicator | Value | Comment |

| Average True Range (ATR) | 28.65 | Moderate Volatility |

| Beta (Benchmark Index) | 1.15 | Above-Market Volatility |

| Bollinger Band %B | 0.82 | Nearing Upper Band |

Moderate volatility and proximity to the upper Bollinger Band suggest that the stock may consolidate before resuming its upward trend.

Market Position

Leadership in Real Estate

Macrotech Developers is a market leader in the Indian real estate space, offering projects that cater to:

- Luxury Housing: High-end residential projects targeting affluent customers.

- Affordable Housing: Projects aimed at meeting the housing needs of middle-income buyers.

- Commercial Developments: Premium office spaces in key business hubs.

Strong Pre-Sales and Collections

Macrotech has consistently recorded strong pre-sales numbers, ensuring revenue visibility and cash flow stability. Its focus on timely delivery strengthens customer trust and enhances its brand reputation.

Geographical Expansion

The company has projects across major cities, including Mumbai, Pune, Hyderabad, and Bangalore. Its strategic entry into Tier-II cities expands its customer base and provides growth opportunities.

Strengths of Macrotech Developers

| Strength | Details |

| Diversified Portfolio | Offers luxury, premium, and affordable housing options. |

| Market Leadership | Strong brand presence under the Lodha banner. |

| Operational Efficiency | Maintains high margins through effective cost management. |

| Strategic Expansion | Entry into Tier-II cities and international markets like the UK. |

| Robust Pre-Sales | Consistent pre-sales numbers ensure strong cash flow generation. |

Challenges and Risks

| Risk | Details |

| Economic Sensitivity | Real estate demand is highly tied to macroeconomic conditions. |

| Execution Risks | Delays in project delivery could impact revenue recognition and customer trust. |

| High Valuation | Premium valuations may limit upside potential in the near term. |

| Competition | Intense competition from other large developers in urban areas. |

Investment Outlook

Short-Term Perspective

- Macrotech’s bullish momentum and proximity to its 52-week high suggest potential upside in the near term.

- Investors should monitor resistance levels around ₹1,495 and look for dips to accumulate.

Long-Term Perspective

- Macrotech’s diversified portfolio, strong brand equity, and focus on timely project execution make it a compelling long-term investment.

- Structural growth drivers, including urbanization, rising income levels, and government incentives for affordable housing, provide significant tailwinds.

Strategic Recommendations

Macrotech Developers, with its strong market position and robust project pipeline, presents significant opportunities for investors. Here are refined recommendations to optimize investment decisions:

Short-Term Investment Recommendations

- Momentum Play:

- With the stock trading near its 52-week high of ₹1,495.60, short-term traders can capitalize on bullish momentum.

- Set a target price of ₹1,500-₹1,520, and use stop-loss at ₹1,380 to manage downside risks.

- Monitor Technical Indicators:

- Watch for RSI levels approaching overbought territory. If RSI crosses 70, prepare for potential consolidation or slight correction before further upside.

- Accumulation During Dips:

- Accumulate during corrections around ₹1,350-₹1,380, which serve as key support levels, to enhance potential returns as the stock resumes its upward trend.

Mid to Long-Term Investment Recommendations

- Focus on Pre-Sales and Cash Flows:

- Regularly monitor the company’s quarterly pre-sales and collection trends, as they provide visibility into future revenue. Consistently strong pre-sales numbers reflect high demand and project execution capabilities.

- Leverage Affordable Housing Growth:

- Affordable housing remains a significant growth driver in India. Investors should watch for Macrotech’s announcements of new projects in this segment, as government incentives and rising demand will fuel growth.

- Track Execution Timelines:

- Monitor timely delivery of ongoing projects, as delays can impact revenue recognition and customer trust. The company’s efficient project delivery is one of its core strengths.

- Diversify within Real Estate:

- While Macrotech focuses on luxury and affordable housing, pairing it with other real estate stocks specializing in commercial or infrastructure projects can balance risks and maximize sector exposure.

- Geographical Expansion:

- Watch for developments in Tier-II and Tier-III cities. Macrotech’s planned expansions into smaller cities and international markets could unlock new growth avenues and mitigate risks tied to high competition in metro cities.

Key Levels to Monitor

| Parameter | Level |

| Target Price (Short Term) | ₹1,500-₹1,520 |

| Target Price (Long Term) | ₹1,800+ |

| Support Levels | ₹1,350 and ₹1,300 |

| Resistance Levels | ₹1,495 and ₹1,520 |

Sector-Specific Recommendations

- Stay Updated on Policies:

- Monitor government policies on real estate, especially those related to affordable housing and interest rate changes, as these can directly impact demand.

- Diversify with Infrastructure Exposure:

- Complement Macrotech holdings with real estate-linked infrastructure stocks that benefit from urbanization, such as cement or construction companies.

- Monitor Interest Rates:

- Real estate is sensitive to interest rate changes. A high interest rate environment could dampen demand for housing loans, so stay alert to macroeconomic trends.

Actionable Summary

Macrotech Developers is a solid pick for both short-term traders and long-term investors due to its strong fundamentals, operational efficiency, and leadership in India’s real estate market. By leveraging opportunities during corrections and aligning investments with strategic growth drivers, investors can maximize returns.

Key Takeaways for Different Investor Profiles:

- Short-Term Traders: Focus on momentum and set target prices with disciplined stop-loss levels.

- Long-Term Investors: Accumulate during dips, track pre-sales numbers, and hold for ₹1,800+ targets.

- Diversified Investors: Pair Macrotech with complementary real estate or infrastructure stocks to hedge risks.

9. REC Ltd (RECLTD)

Rural Electrification Corporation (REC) Limited is a leading public sector enterprise under the Ministry of Power, Government of India. Incorporated on July 25, 1969, REC has been instrumental in financing power projects across India. As a listed Government of India enterprise, REC has demonstrated strong financials and consistent growth. This article delves into the company’s technical and fundamental analysis to provide an in-depth understanding of its performance and potential.

Fundamental Analysis

Company Overview

REC primarily focuses on financing and promoting power sector projects, including generation, transmission, and distribution. With a market capitalization of ₹1,36,914 crore and a net worth of ₹5,368 crore, REC stands as a significant player in the financial term lending industry. The company’s low Price-Earnings (PE) ratio of 9.20 and a high dividend yield of 3.08% make it attractive to value investors.

Financial Highlights

| Metric | Value |

| Market Cap | ₹1,36,914 Cr |

| Book Value / Share | ₹277.04 |

| PE Ratio | 9.20 |

| PEG Ratio | 0.47 |

| Dividend Yield (%) | 3.08 |

| EBITDA | ₹13,585.10 Cr |

| Net Profit | ₹4,037.72 Cr |

| Adjusted EPS (₹) | 15.33 |

| Return on Equity (%) | 22.39 |

| Return on Capital Employed (%) | 10.05 |

| Return on Assets (%) | 2.79 |

REC’s consolidated net profit stands at ₹4,037.72 crore, showcasing a strong financial position. The company’s Return on Equity (RoE) at 22.39% is well above the industry average, reflecting efficient utilization of shareholder funds.

Growth Trends

REC’s consistent growth in net sales and profit indicates robust operational performance. Key growth metrics include:

| Growth Parameter | TTM/1 Year (%) | 3 Year (%) | 5 Year (%) | 10 Year (%) |

| Price | 24.79 | 72.68 | 37.56 | 15.36 |

| Net Sales | 20.30 | 10.14 | 13.34 | 10.74 |

| EBITDA | 18.06 | 14.06 | 15.10 | 11.20 |

| Net Profit | 16.85 | 19.08 | 19.76 | 11.55 |

These figures highlight REC’s sustained profitability and resilience in a competitive market.

Dividend Policy

REC has a history of rewarding shareholders through dividends. Its current dividend yield of 3.08% underscores its commitment to distributing profits, making it an appealing option for income-focused investors.

Valuation Metrics

REC’s low PE ratio of 9.20 indicates undervaluation compared to peers. The PEG ratio of 0.47 further validates this, suggesting the stock is reasonably priced relative to its growth prospects.

Technical Analysis

Current Price Performance

REC’s current market price (CMP) of ₹519.10 marks a 2.3% gain for the day. Below is a breakdown of its recent price performance:

| Time Frame | Performance (%) |

| 1 Day | +2.3 |

| 1 Week | -5.7 |

| 1 Month | +2.5 |

| 6 Months | -0.5 |

| 1 Year | +27.7 |

| 2 Years | +377.3 |

| 5 Years | +403.9 |

| 10 Years | +326.9 |

Momentum Indicators

REC’s momentum indicators reveal mixed signals:

| Indicator | Value | Interpretation |

| Relative Strength Index (Daily) | 35.85 | Neutral |

| Relative Strength Index (Weekly) | 45.56 | Neutral |

| Commodity Channel Index | -138.30 | Oversold |

| Stochastic %K | 5.34 | Bearish |

| William %R | -97.41 | Oversold |

The RSI values suggest neutrality, while the Commodity Channel Index (CCI) and William %R indicate oversold conditions, hinting at a potential reversal.

Volatility Indicators

REC exhibits moderate volatility:

| Indicator | Value |

| Average True Range (ATR) | 15.81 |

| Bollinger Band Width | 0.14 |

| Bollinger Band %B | 0.04 |

| Beta – Benchmark Index | 2.26 |

| Beta – Sectoral Index | 1.84 |

| Standard Deviation | 21.04 |

High beta values indicate REC’s sensitivity to market movements, making it suitable for risk-tolerant investors.

Trend Indicators

| Indicator | Value | Interpretation |

| Average Directional Index (ADX) | 20.81 | Range-Bound |

| Moving Average Convergence/Divergence (MACD) | -2.53 | Negative |

The ADX suggests a lack of strong trend, while the MACD shows bearish signals.

Sector and Industry Analysis

REC operates in the finance sector, specifically focusing on term lending for power projects. With India’s increasing energy demand, REC is well-positioned to capitalize on growth opportunities. Government initiatives like “Power for All” and renewable energy expansion provide tailwinds for the company.

Competitive Landscape

REC’s primary competitors include PFC, NTPC, and private players in the power financing sector. Despite intense competition, REC’s government backing and strong financials provide a competitive edge.

SWOT Analysis

| Strengths | Weaknesses |

| Government backing | High dependence on power sector |

| Strong financial performance | Limited diversification |

| Attractive valuation metrics | Sensitivity to interest rates |

| Opportunities | Threats |

| Growing power demand | Regulatory changes |

| Renewable energy financing | Economic downturns |

| International expansion | Rising competition |

Investment Outlook

REC offers a compelling mix of growth and income. Its robust financials, consistent profitability, and attractive dividend policy make it a suitable choice for long-term investors. However, potential risks from regulatory changes and sectoral concentration must be considered.

Price Projections

Based on its fundamental and technical metrics, REC has the potential to achieve the following price levels:

| Time Frame | Target Price (₹) |

| 1 Year | 600 |

| 2 Years | 750 |

| 5 Years | 1,200 |

10. Eicher Motors Ltd (EICHERMOT)

Eicher Motors Limited, a leading Indian automobile manufacturer, is globally renowned for its iconic Royal Enfield motorcycles. The company has carved a niche in the mid-size motorcycle segment and continues to expand its global footprint. This article provides an in-depth technical and fundamental analysis of Eicher Motors to understand its performance and potential.

Fundamental Analysis

Company Overview

Eicher Motors is a leading player in the automotive sector, manufacturing motorcycles and commercial vehicles. Its flagship brand, Royal Enfield, dominates the mid-size motorcycle market globally. The company also has a joint venture with Volvo Group for commercial vehicles under the name VE Commercial Vehicles (VECV).

Financial Highlights

| Metric | Value |

| Market Cap | ₹1,31,000 Cr |

| Book Value / Share | ₹842.74 |

| PE Ratio | 33.50 |

| PEG Ratio | 2.10 |

| Dividend Yield (%) | 0.68 |

| EBITDA | ₹4,285 Cr |

| Net Profit | ₹2,875 Cr |

| Adjusted EPS (₹) | 105.65 |

| Return on Equity (%) | 18.92 |

| Return on Capital Employed (%) | 22.50 |

| Return on Assets (%) | 14.32 |

Eicher Motors’ robust financials underline its strong market position. The company’s net profit of ₹2,875 crore and a PE ratio of 33.50 indicate strong profitability and investor confidence.

Growth Trends

The company’s growth trajectory over various timeframes is highlighted below:

| Growth Parameter | TTM/1 Year (%) | 3 Year (%) | 5 Year (%) | 10 Year (%) |

| Price | 18.45 | 62.40 | 110.50 | 345.80 |

| Net Sales | 22.15 | 16.50 | 13.80 | 19.90 |

| EBITDA | 21.30 | 18.10 | 15.60 | 17.85 |

| Net Profit | 24.50 | 20.80 | 18.90 | 21.40 |

Eicher Motors’ consistent growth in net sales and profits demonstrates its operational efficiency and market dominance.

Dividend Policy

The company’s dividend yield of 0.68% reflects its balanced approach to rewarding shareholders while reinvesting profits for growth. Although not high, the yield is complemented by significant capital appreciation potential.

Valuation Metrics

Despite a relatively high PE ratio of 33.50, Eicher Motors’ PEG ratio of 2.10 suggests that the stock’s valuation aligns with its growth potential.

Technical Analysis

Current Price Performance

Eicher Motors’ current market price (CMP) of ₹4,801.35 marks a modest 0.2% gain for the day. Below is a breakdown of its recent price performance:

| Time Frame | Performance (%) |

| 1 Day | +0.2 |

| 1 Week | +1.5 |

| 1 Month | +4.0 |

| 6 Months | +12.7 |

| 1 Year | +18.4 |

| 2 Years | +62.4 |

| 5 Years | +110.5 |

| 10 Years | +345.8 |

Momentum Indicators

The momentum indicators for Eicher Motors suggest a mixed outlook:

| Indicator | Value | Interpretation |

| Relative Strength Index (Daily) | 51.20 | Neutral |

| Relative Strength Index (Weekly) | 55.30 | Neutral |

| Commodity Channel Index | 35.50 | Neutral |

| Stochastic %K | 68.40 | Bullish |

| William %R | -12.30 | Overbought |

The RSI values indicate neutrality, while the William %R suggests overbought conditions. The Stochastic %K indicates bullish momentum.

Volatility Indicators

Eicher Motors exhibits moderate volatility:

| Indicator | Value |

| Average True Range (ATR) | 72.50 |

| Bollinger Band Width | 0.18 |

| Bollinger Band %B | 0.45 |

| Beta – Benchmark Index | 1.20 |

| Beta – Sectoral Index | 1.10 |

| Standard Deviation | 18.20 |

A beta value slightly above 1 indicates that Eicher Motors is moderately more volatile than the broader market.

Trend Indicators

| Indicator | Value | Interpretation |

| Average Directional Index (ADX) | 28.50 | Trending |

| Moving Average Convergence/Divergence (MACD) | 12.30 | Positive |

The ADX indicates a trending market, while the MACD shows positive momentum.

Sector and Industry Analysis

Eicher Motors operates in the highly competitive automobile sector. With rising global demand for premium motorcycles, the company is well-positioned to benefit from market growth.

Competitive Landscape

Eicher Motors faces competition from domestic players like Hero MotoCorp and Bajaj Auto, as well as international brands like Harley-Davidson and Triumph. However, Royal Enfield’s brand legacy and product innovation provide a competitive edge.

SWOT Analysis

| Strengths | Weaknesses |

| Strong brand equity | High dependence on motorcycles |

| Global market expansion | Limited diversification |

| Robust financials | Sensitivity to raw material costs |

| Opportunities | Threats |

| Expanding international markets | Intense competition |

| Launch of new models | Regulatory challenges |

| Electric vehicle segment | Economic downturns |

Investment Outlook