In the fast-paced world of stock market trading, investors are constantly seeking strategies to capitalize on market movements and maximize profits. One such strategy involves trading Nifty options, offering opportunities for substantial gains but also carrying inherent risks. In this article, we delve into a specific Nifty options trade setup, analyzing its components, risks, and potential rewards.

Understanding the Trade Setup:

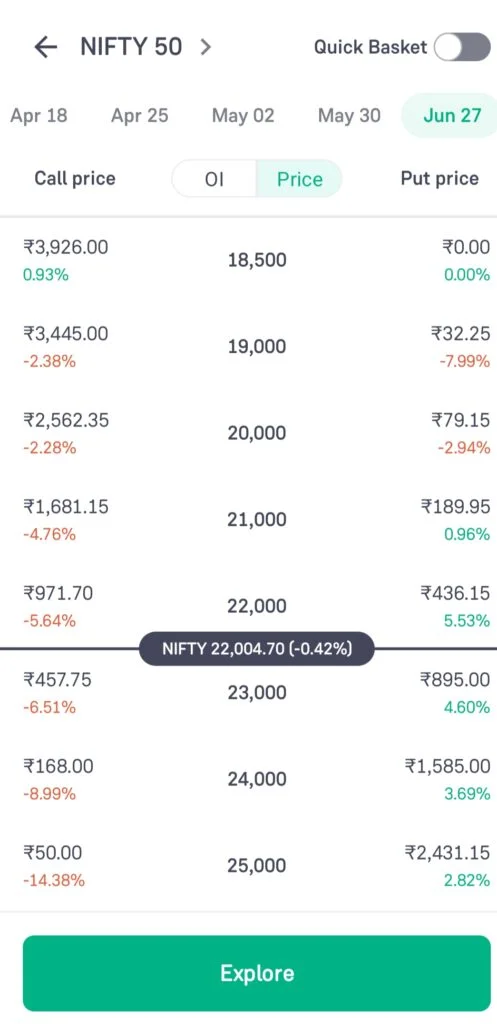

The trade setup involves a combination of buying and selling Nifty call options, specifically targeting different expiry dates. Here’s a breakdown of the key components:

Buy 23000CE 10 Lot June Last Week Expiry: This part of the trade involves purchasing 10 lots of Nifty call options with a strike price of 23000, expiring in the last week of June. Buying call options gives the investor the right, but not the obligation, to buy the Nifty index at the specified strike price on or before the expiry date.

Sell 22000CE 5 Lot May Last Week Expiry: Simultaneously, the investor sells 5 lots of Nifty call options with a strike price of 22000, expiring in the last week of May. Selling call options creates an obligation to sell the Nifty index at the strike price if the options are exercised by the buyer.

SOURCE: Grow

Risk and Reward Analysis:

Like any trading strategy, this Nifty options trade setup carries its own set of risks and potential rewards:

Risks:

Market Risk: The trade’s success depends on the movement of the Nifty index. If the market moves against the investor’s position, it could result in losses.

Time Decay: Options have a limited lifespan, and their value erodes as the expiry date approaches. Holding options until expiry without realizing profits could lead to losses due to time decay.

Leverage Risk: Options trading involves leveraging capital to control a larger position. While this amplifies potential profits, it also increases the magnitude of losses if the trade goes wrong.

Rewards:

Profit Potential: The trade aims to profit from the price difference between the two call options. If the Nifty index rises significantly, the purchased call options could appreciate in value, while the sold call options may expire worthless, resulting in a net profit.

Limited Losses: The predefined stop-loss level at 21400 spot helps mitigate potential losses by automatically exiting the trade if the market moves unfavorably.

In conclusion, the Nifty options trade setup outlined above presents an intriguing opportunity for traders willing to take on higher levels of risk in exchange for potentially higher rewards. However, it’s essential to approach such trades with caution, conducting thorough analysis and risk management to protect capital. As with any trading strategy, investors should consult with a financial advisor and practice prudent risk management techniques to navigate the complexities of the options market effectively.

ALSO READ: Optimize Investments: Art of NIFTY 50 Options Spread Trading