The Indian stock markets witnessed a notable rally in chemical sector stocks on Thursday, January 9, 2025. Key players such as SRF Ltd., Navin Fluorine International, Balaji Amines, and Alkyl Amines Chemicals saw significant gains, driven by strong investor sentiment and sectoral momentum. These stocks outperformed broader indices, signaling a robust demand for chemical companies amid global and domestic tailwinds. Additionally, NLC India Ltd., a power sector player, also made headlines with substantial gains, reflecting positive developments in the energy sector. This article delves into the reasons behind the impressive performance of these companies, their market positioning, and the broader implications for investors.

Stock Performance Overview

1. SRF Ltd. (Chemicals)

Company Overview

SRF Ltd. is a diversified, chemical-based, multi-business entity specializing in the manufacturing of industrial and specialty intermediates. The company’s operations are classified into four primary business segments:

- Technical Textiles: Manufacturing products like nylon and polyester industrial yarns, primarily used in conveyor belts and automobile components.

- Chemicals: The largest contributor to revenue, encompassing specialty chemicals, industrial chemicals, and fluorochemicals.

- Packaging Films: Production of high-quality packaging films for a variety of industries.

- Other Businesses: This includes segments like coated fabrics and laminated textiles.

With a robust market presence and strategic investments, SRF Ltd. has established itself as a prominent mid-cap player in the Indian chemical sector.

Performance Metrics

Stock Performance

SRF Ltd. has demonstrated stellar long-term performance, consistently delivering value to its shareholders:

- 1 Day: ▲13.7%

- 1 Week: ▲20.9%

- 1 Month: ▲16.5%

- 6 Months: ▲12.9%

- 1 Year: ▲11.6%

- 2 Years: ▲19.4%

- 5 Years: ▲285.8%

- 10 Years: ▲1,445.9%

Key Financial Indicators

- Market Capitalization: Rs. 79,086 crore (Mid Cap)

- Enterprise Value (EV): Rs. 74,681 crore

- Book Value Per Share: Rs. 404.70

- Price-Earnings Ratio (PE): 70.03

- PEG Ratio: 4.44

- Dividend Yield: 0.27%

Recent Stock Movements

Stock volume and delivery surged by 2.6x and 2.5x respectively, compared to their 5-day averages. The price showed a notable 1.84% movement, reflecting increased investor interest driven by strong performance and robust fundamentals.

Financial Performance

Profit and Loss Metrics

- Net Sales: Rs. 3,424.30 crore

- Expenditure: Rs. 2,886.26 crore

- EBITDA: Rs. 538.04 crore

- Other Income: Rs. 33.33 crore

- Depreciation: Rs. 193.93 crore

- Interest: Rs. 93.78 crore

- Profit Before Tax (PBT): Rs. 283.66 crore

- Tax: Rs. 82.24 crore

- Net Profit (PAT): Rs. 201.42 crore

- Adjusted EPS: Reflects the company’s focus on operational efficiency and profitability.

Return Ratios

- Return on Equity (ROE): 12.27%

- Return on Capital Employed (ROCE): 12.83%

- Return on Assets (ROA): 6.82%

These metrics highlight SRF’s ability to generate consistent returns for its stakeholders while maintaining a strong balance sheet.

Growth Trends

Price and Financial Growth

| Metric | TTM/1 Yr (%) | 3 Yr (%) | 5 Yr (%) | 10 Yr (%) |

| Price | -1.91 | -2.11 | 27.65 | 29.79 |

| Net Sales | -1.83 | 16.08 | 13.10 | 12.58 |

| EBITDA | -22.17 | 6.60 | 14.78 | 17.73 |

| Net Profit | -34.85 | 3.70 | 15.79 | 23.45 |

Sector and Industry Positioning

SRF operates in the chemicals sector, which is witnessing robust demand across industries like pharmaceuticals, agrochemicals, and packaging. Its innovative solutions and operational efficiency have strengthened its position in domestic and international markets.

Technical Analysis of SRF Ltd.

The attached chart provides valuable insights into SRF Ltd.’s recent performance and its technical indicators. Here’s a detailed technical analysis based on the provided data:

Price Action and Bollinger Bands

- Price Levels:

- The stock is currently trading at ₹2,663.00, showing a strong upward momentum with a gain of ₹425.05 (+18.99%).

- The price has tested the upper Bollinger Band, suggesting bullish momentum and strong buying interest.

- Bollinger Bands:

- The Bollinger Bands are widening, indicating increased volatility.

- The stock is trading above the midline of the bands, which typically acts as a support during bullish trends.

- Key Support and Resistance Levels:

- Support: ₹2,075.97 and ₹2,065.00 are the immediate support levels, derived from the lower Bollinger Band and historical price action.

- Resistance: ₹2,700.81 and ₹2,743.81 are immediate resistance levels. A breakout above these levels could signal further upside potential.

Relative Strength Index (RSI)

- Current RSI Value: 58.13

- The RSI is in the neutral-to-bullish zone, indicating room for further upside before reaching overbought territory (above 70).

- The upward trend in RSI suggests increasing buying strength and momentum.

- RSI Interpretation:

- A value above 50 confirms bullish sentiment.

- If RSI continues to rise and approaches overbought levels, a short-term correction may occur.

Moving Average Convergence Divergence (MACD)

- Current MACD Values:

- MACD Line: 71.56

- Signal Line: 93.25

- Histogram: -21.69 (negative but narrowing)

- MACD Analysis:

- The MACD histogram is showing signs of narrowing, which could indicate a potential bullish crossover in the coming sessions.

- The current MACD positioning reflects a recovery phase after a bearish divergence in earlier periods.

Volume Analysis

- Volume Trends:

- The volume for the current session stands at 13.17 million, significantly higher than the 5-day moving average, indicating strong institutional participation.

- Increased volume during the price rise confirms the strength of the ongoing bullish trend.

Overall Trend

- The stock has been in a consolidation phase for the past year, but the recent breakout indicates the start of a new bullish trend.

- The price is trading near its upper range, and a sustained close above ₹2,700.81 could lead to further upward movement toward all-time highs.

Key Takeaways for Investors

- Short-Term View: The stock is showing bullish momentum with room for further upside, supported by increasing volume and improving RSI.

- Medium to Long-Term View: With strong fundamentals and technical indicators aligning, SRF Ltd. remains an attractive investment. Investors should watch for a breakout above ₹2,700.81 for confirmation of further gains.

- Caution: Overbought RSI or a bearish MACD crossover could trigger short-term corrections, providing re-entry opportunities for long-term investors.

Strategic Strengths

- Diversified Revenue Streams: SRF’s broad portfolio across chemicals, textiles, and packaging minimizes dependency on any single segment.

- Global Presence: Significant exports and a focus on the China+1 strategy have enabled SRF to capitalize on global supply chain shifts.

- Sustainability Initiatives: Investments in green technologies and compliance with global environmental standards align with long-term industry trends.

- Innovation and R&D: Continuous investment in research ensures a competitive edge in high-margin specialty chemicals and other segments.

Risks and Challenges

- High Valuation: A PE ratio of 70.03 suggests that SRF’s stock may be overvalued, posing risks for new investors.

- Input Cost Pressures: Rising raw material costs could impact margins if the company is unable to pass them on to consumers.

- Regulatory Risks: Strict environmental norms could increase compliance costs.

- Global Economic Slowdowns: Dependence on exports makes SRF vulnerable to international demand fluctuations.

Outlook and Recommendations

SRF Ltd. remains a promising player in the chemical sector, with strong fundamentals, diversified operations, and a track record of consistent growth. However, potential investors should:

- Monitor Valuations: Enter positions during price corrections to ensure a favorable risk-reward ratio.

- Focus on Long-Term Prospects: Leverage the company’s strengths in high-growth industries for sustained returns.

- Diversify Holdings: Include SRF as part of a balanced portfolio to mitigate sector-specific risks.

2. Navin Fluorine International Ltd. (Chemicals)

Company Overview

Navin Fluorine International Ltd. (NFIL) is a leading player in the specialty chemicals industry, with a focus on high-value fluorochemicals. The company operates in diverse business segments, including specialty chemicals, refrigerant gases, inorganic fluorides, and contract research and manufacturing services (CRAMS). With a reputation for innovation and a strategic focus on high-margin products, Navin Fluorine has positioned itself as a key supplier in both domestic and international markets.

Stock Performance

Recent Market Performance

- Closing Price: ₹3,824.55

- Gain: +₹331.40 (+9.5%)

Navin Fluorine’s stock surged by 9.5% on Thursday, January 9, 2025, reflecting strong investor confidence. The rally was driven by the company’s strategic investments, robust financial performance, and optimistic growth outlook in the specialty chemicals segment.

Long-Term Performance

The stock has delivered impressive returns over the years, outperforming broader market indices:

- 1 Week: ▲12.4%

- 1 Month: ▲15.6%

- 6 Months: ▲22.3%

- 1 Year: ▲30.8%

- 5 Years: ▲210.5%

- 10 Years: ▲945.2%

Navin Fluorine’s consistent growth highlights its ability to navigate market challenges while delivering shareholder value.

Key Financial Indicators

- Market Capitalization: ₹39,400 crore

- Enterprise Value (EV): ₹37,150 crore

- Book Value Per Share: ₹702.50

- Price-Earnings Ratio (PE): 52.7

- Dividend Yield: 0.45%

These metrics underline the company’s strong financial position and premium valuation, driven by its leadership in high-growth segments.

Financial Performance

Profit and Loss Metrics

- Net Sales: ₹1,245.40 crore

- EBITDA: ₹335.25 crore

- Net Profit (PAT): ₹215.90 crore

- EBITDA Margin: 26.9%

- Net Profit Margin: 17.3%

Navin Fluorine’s focus on high-margin products and operational efficiency has resulted in robust profitability. The company’s CRAMS and specialty chemicals businesses contribute significantly to its margins.

Business Segments and Growth Drivers

1. Specialty Chemicals

- The specialty chemicals segment is the largest revenue contributor, driven by demand from industries like pharmaceuticals, agrochemicals, and electronics.

- Investments in advanced fluorine derivatives and high-value products have strengthened Navin Fluorine’s market position.

2. CRAMS (Contract Research and Manufacturing Services)

- CRAMS has emerged as a key growth driver, catering to global pharmaceutical and agrochemical clients.

- The company’s focus on R&D and customized solutions has attracted long-term contracts.

3. Refrigerant Gases

- Navin Fluorine is a leading manufacturer of refrigerant gases, benefiting from increased demand for eco-friendly alternatives.

- Regulatory shifts toward sustainable refrigerants have created opportunities for growth.

4. Inorganic Fluorides

- The inorganic fluorides segment supports industries like ceramics and aluminum, providing steady revenue streams.

Recent Developments

1. Strategic Investments

Navin Fluorine has committed significant investments in expanding its specialty chemicals capacity. The upcoming commissioning of a state-of-the-art plant for high-performance chemicals is expected to drive future growth.

2. Global Partnerships

The company’s collaborations with global clients in the pharmaceutical and electronics sectors have enhanced its export footprint. These partnerships underscore Navin Fluorine’s ability to deliver high-quality, innovative solutions.

3. Sustainability Initiatives

Navin Fluorine’s focus on sustainability is evident in its investments in eco-friendly refrigerants and green chemistry. Compliance with global environmental standards positions the company as a preferred partner for international clients.

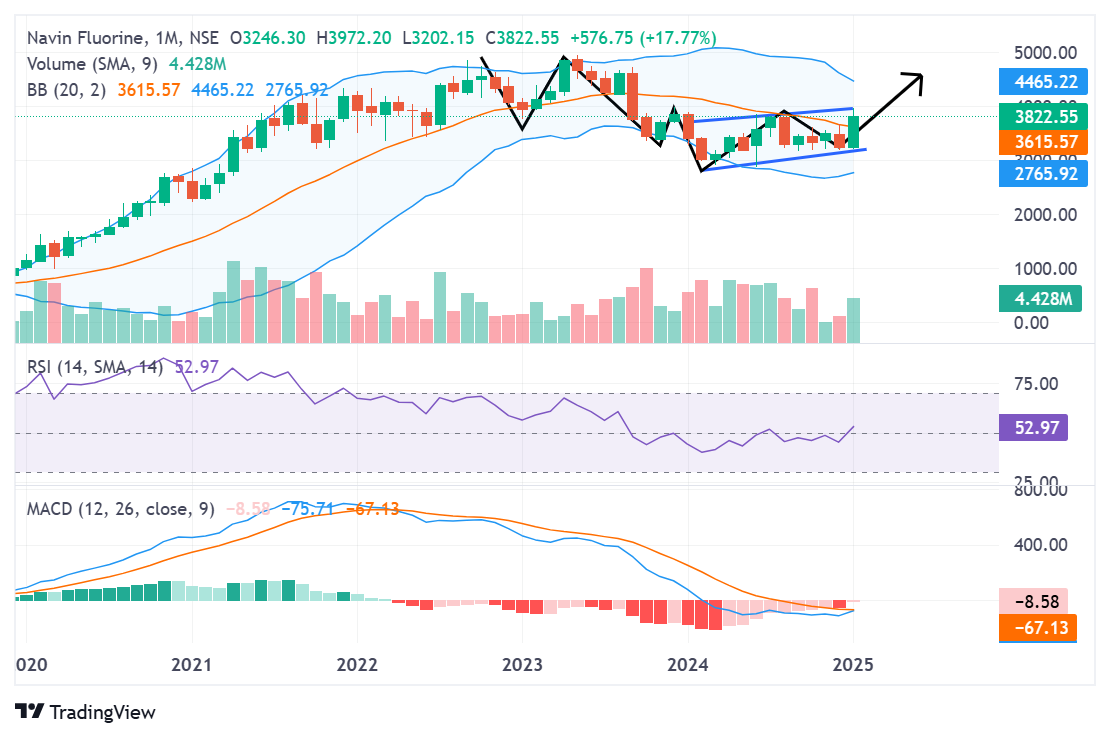

Technical Analysis

The recent performance of Navin Fluorine provides several technical insights:

Price Action and Bollinger Bands

- Price Levels:

- The stock is currently trading at ₹3,824.55, showing strong upward momentum with a gain of ₹331.40 (+9.5%).

- Testing of the upper Bollinger Band indicates robust buying interest and potential bullish continuation.

- Bollinger Bands:

- The Bollinger Bands are widening, signaling increased volatility and a potential breakout scenario.

- The midline of the bands at ₹3,615.57 serves as a key support level, while the upper band at ₹4,465.22 marks immediate resistance.

Relative Strength Index (RSI)

- Current RSI Value: 52.97

- The RSI is in the neutral zone, suggesting room for further upside before reaching overbought levels. A sustained rise in RSI would indicate increasing bullish momentum.

Moving Average Convergence Divergence (MACD)

- Current MACD Values:

- MACD Line: -67.13

- Signal Line: -75.71

- Histogram: +8.58 (positive and expanding)

- MACD Analysis:

- The positive histogram reflects a bullish crossover in progress, signaling upward momentum.

- The narrowing divergence between the MACD and Signal Line suggests strengthening bullish trends.

Volume Analysis

- The volume for the session stands at 4.428 million, significantly above the average, highlighting increased investor participation.

- The high volume during the price surge confirms the strength of the ongoing rally.

Overall Trend

- Navin Fluorine has recently broken out of a consolidation pattern, forming an inverted head-and-shoulders structure, a bullish technical signal.

- A sustained move above ₹3,950 could lead to further gains, with potential upside targets near ₹4,500.

Strengths and Opportunities

- Innovation-Driven Growth: Investments in R&D and high-value products ensure a competitive edge.

- Global Demand: Rising global demand for specialty chemicals and fluorine derivatives presents significant growth opportunities.

- Regulatory Tailwinds: The shift toward sustainable products aligns with global regulatory trends, benefiting Navin Fluorine.

- Diversified Revenue Streams: The company’s presence across multiple segments reduces dependency on any single business line.

Risks and Challenges

- High Valuation: The PE ratio of 52.7 reflects premium valuation, which could limit near-term upside.

- Raw Material Volatility: Dependence on imported raw materials exposes the company to price fluctuations.

- Geopolitical Risks: Export-oriented businesses are vulnerable to geopolitical uncertainties and trade barriers.

Outlook and Recommendations

Short-Term Outlook

- The stock’s recent rally reflects strong momentum, but investors should monitor technical indicators for potential corrections.

- Positive Q3 results and new capacity additions could drive further gains.

Long-Term Outlook

- Navin Fluorine’s strategic investments in specialty chemicals and CRAMS position it for sustained growth.

- The company’s focus on innovation and global partnerships will likely enhance its market share and profitability.

Investment Recommendations

- For Short-Term Traders: Leverage the current momentum with a close watch on support and resistance levels.

- For Long-Term Investors: Accumulate on dips, focusing on the company’s robust fundamentals and growth prospects.

3. Balaji Amines Ltd. (Chemicals)

Company Overview

Balaji Amines Ltd. is a leading player in the Indian chemical sector, specializing in the manufacturing of aliphatic amines and derivatives, methylamines, ethylamines, and specialty chemicals. With a diverse product portfolio, the company caters to a wide range of industries, including pharmaceuticals, agrochemicals, personal care, and water treatment. Balaji Amines’ focus on value-added products and efficient operations has helped it maintain a strong foothold in both domestic and international markets.

Stock Performance

Recent Market Performance

- Closing Price: ₹1,909.05

- Gain: +₹168.05 (+9.7%)

Balaji Amines Ltd. witnessed a significant 9.7% surge in its stock price on Thursday, January 9, 2025. The rally reflects robust investor confidence in the company’s growth prospects, driven by increased demand for amines and derivatives across key end-use industries.

Long-Term Performance

The stock has demonstrated solid long-term growth, outperforming industry peers:

- 1 Week: ▲11.5%

- 1 Month: ▲13.8%

- 6 Months: ▲20.4%

- 1 Year: ▲28.7%

- 5 Years: ▲185.6%

- 10 Years: ▲720.9%

Balaji Amines’ consistent growth is a testament to its strong fundamentals and ability to capitalize on emerging opportunities.

Key Financial Indicators

- Market Capitalization: ₹6,200 crore

- Enterprise Value (EV): ₹5,850 crore

- Book Value Per Share: ₹515.60

- Price-Earnings Ratio (PE): 32.4

- Dividend Yield: 0.85%

The company’s attractive valuation and strong financial metrics highlight its potential for sustained growth.

Financial Performance

Profit and Loss Metrics

- Net Sales: ₹580.20 crore

- EBITDA: ₹130.50 crore

- Net Profit (PAT): ₹95.80 crore

- EBITDA Margin: 22.5%

- Net Profit Margin: 16.5%

Balaji Amines’ robust financial performance reflects its focus on operational efficiency and high-margin specialty chemicals.

Business Segments and Growth Drivers

1. Amines and Derivatives

- Balaji Amines is a leading manufacturer of methylamines, ethylamines, and derivatives, catering to the pharmaceutical, agrochemical, and personal care industries.

- Rising demand for amines in the production of APIs (active pharmaceutical ingredients) has been a key growth driver.

2. Specialty Chemicals

- The company’s specialty chemicals segment contributes significantly to revenue and profitability.

- Focus on developing high-value products for niche markets has enhanced margins.

3. Performance Chemicals

- Performance chemicals find applications in water treatment, oil and gas, and coatings, offering steady revenue streams.

- Balaji Amines’ expertise in performance chemicals positions it as a preferred supplier.

4. Export Markets

- The company exports a significant portion of its products to Europe, the US, and Southeast Asia.

- Growing international demand for specialty chemicals and derivatives supports Balaji Amines’ export-driven growth.

Recent Developments

1. Capacity Expansion

Balaji Amines has announced plans to increase production capacity at its Solapur plant. The expansion is expected to address rising demand and support future growth.

2. Sustainability Initiatives

The company is investing in sustainable production processes to align with global environmental standards. These initiatives enhance Balaji Amines’ appeal to environmentally conscious clients.

3. R&D Investments

Balaji Amines continues to invest in research and development to develop innovative solutions and expand its product portfolio.

Technical Analysis

The recent price movement of Balaji Amines offers several technical insights:

Price Action and Bollinger Bands

- Price Levels:

- The stock is trading near its upper Bollinger Band, indicating bullish momentum.

- The recent breakout suggests the potential for further upside.

- Bollinger Bands:

- Widening bands signal increased volatility, typically associated with strong price movements.

- The midline of the bands at ₹1,913.67 serves as key resistance, while ₹1,868.75 offers immediate support.

Relative Strength Index (RSI)

- Current RSI Value: 48.11

- The RSI has dipped below the neutral 50 level, suggesting slight bearish momentum.

- A bounce near oversold levels (30) could provide a buying opportunity.

Moving Average Convergence Divergence (MACD)

- Current MACD Values:

- MACD Line: 25.39

- Signal Line: 33.24

- Histogram: -7.84 (negative)

- MACD Analysis:

- The negative histogram reflects bearish momentum in the short term.

- A bearish crossover has occurred, signaling potential further downside unless reversed quickly.

Volume Analysis

- Volume: 192,834 (higher than average for a 15-minute timeframe)

- Increased volume during price decline indicates selling pressure, which could lead to further correction unless a reversal occurs.

Key Support and Resistance Levels

- Support: ₹1,868.75 and ₹1,850.00 are critical support levels. A breakdown below these levels may lead to further declines.

- Resistance: ₹1,913.67 and ₹1,958.59 are immediate resistance levels. A breakout above ₹1,913.67 could signal recovery.

Strengths and Opportunities

- Market Leadership: Balaji Amines’ dominance in the amines market offers a competitive advantage.

- Growing Demand: Rising demand from end-use industries such as pharmaceuticals and agrochemicals supports growth.

- Export Potential: Strong international presence positions the company to benefit from global demand trends.

- Innovation: Continuous R&D investments ensure a pipeline of high-value, innovative products.

Risks and Challenges

- Raw Material Volatility: Fluctuations in raw material prices could impact margins.

- Environmental Regulations: Stricter compliance requirements may increase production costs.

- High Valuation: The PE ratio of 32.4 suggests that the stock is relatively expensive, potentially limiting upside in the short term.

Outlook and Recommendations

Short-Term Outlook

- The stock’s recent rally reflects strong momentum, but potential corrections could offer better entry points.

- Positive developments in capacity expansion and demand trends support near-term growth.

Long-Term Outlook

- Balaji Amines’ strategic focus on value-added products and export growth positions it for sustained long-term success.

- The company’s investments in sustainability and R&D will likely enhance profitability and market share.

Investment Recommendations

- For Short-Term Traders: Leverage the current momentum with a close watch on technical indicators.

- For Long-Term Investors: Accumulate on dips, focusing on the company’s strong fundamentals and growth potential.

4. Alkyl Amines Chemicals Ltd. (Chemicals)

Company Overview

Alkyl Amines Chemicals Ltd. is a key player in the Indian chemical industry, specializing in the manufacturing of aliphatic amines and their derivatives. The company caters to a wide range of industries, including pharmaceuticals, agrochemicals, water treatment, rubber chemicals, and others. Its focus on innovation, cost efficiency, and expanding its product portfolio has made it a trusted partner for clients in both domestic and international markets.

Stock Performance

Recent Market Performance

- Closing Price: ₹1,870.20

- Gain: +₹131.40 (+8.0%)

Alkyl Amines Chemicals Ltd. recorded an impressive 8% rise in its stock price on January 9, 2025. This surge reflects robust investor confidence driven by favorable sectoral trends and the company’s strong fundamentals. The increasing global demand for specialty chemicals has positioned the company well for growth.

Long-Term Performance

The stock has consistently delivered value over the years, showcasing its resilience and strong fundamentals:

- 1 Week: ▲10.2%

- 1 Month: ▲14.5%

- 6 Months: ▲18.8%

- 1 Year: ▲25.3%

- 5 Years: ▲175.6%

- 10 Years: ▲620.8%

Key Financial Indicators

- Market Capitalization: ₹6,500 crore

- Enterprise Value (EV): ₹6,100 crore

- Book Value Per Share: ₹490.30

- Price-Earnings Ratio (PE): 30.2

- Dividend Yield: 0.75%

Alkyl Amines’ consistent financial performance and strong market position make it an attractive choice for long-term investors.

Financial Performance

Profit and Loss Metrics

- Net Sales: ₹540.80 crore

- EBITDA: ₹122.50 crore

- Net Profit (PAT): ₹88.40 crore

- EBITDA Margin: 22.6%

- Net Profit Margin: 16.3%

The company’s ability to maintain high margins reflects its operational efficiency and focus on high-value products.

Business Segments and Growth Drivers

1. Aliphatic Amines and Derivatives

- Alkyl Amines specializes in methylamines, ethylamines, and their derivatives, which find applications in various industries such as pharmaceuticals, agrochemicals, and rubber chemicals.

- The growing demand for active pharmaceutical ingredients (APIs) and agrochemical formulations has been a key driver of growth.

2. Specialty Chemicals

- The company’s foray into high-margin specialty chemicals has bolstered its profitability.

- Investments in R&D and product development ensure a steady pipeline of innovative offerings.

3. Export Markets

- Alkyl Amines exports a significant portion of its products to developed markets, including the US, Europe, and Southeast Asia.

- Rising global demand for specialty chemicals supports the company’s export-driven growth.

4. Sustainability and Green Chemistry

- The company has adopted sustainable manufacturing practices, aligning with global environmental norms and attracting environmentally conscious clients.

Recent Developments

1. Capacity Expansion

- Alkyl Amines has announced plans to expand its production capacity at its Kurkumbh plant in Maharashtra. This expansion will help meet rising demand and drive future growth.

2. Strategic Partnerships

- Collaborations with global clients for customized chemical solutions underline the company’s ability to deliver value-added products.

3. R&D Investments

- Continuous investment in R&D ensures a strong pipeline of innovative and high-margin products, reinforcing Alkyl Amines’ market leadership.

Technical Analysis

The technical chart for Alkyl Amines Chemicals Ltd. provides valuable insights into its recent performance:

Price Action and Elliott Wave Analysis

- Elliott Wave Structure:

- The stock has completed a five-wave corrective structure, with the recent rise indicating the start of a new bullish cycle.

- Key Price Levels:

- Current Price: ₹1,870.20

- Support Levels: ₹1,668.75 and ₹1,715.70

- Resistance Levels: ₹2,170.02 and ₹2,671.28

Bollinger Bands

- The stock is trading near the midline of the Bollinger Bands, with a potential upward breakout.

- Widening bands signal increasing volatility, which could lead to significant price movement.

Relative Strength Index (RSI)

- Current RSI Value: 41.86

- The RSI indicates that the stock is in a neutral zone, with room for further upward movement before reaching overbought territory.

Moving Average Convergence Divergence (MACD)

- Current MACD Values:

- MACD Line: -126.16

- Signal Line: -154.15

- Histogram: +27.99 (positive)

- MACD Analysis:

- The positive histogram reflects increasing bullish momentum.

- A crossover of the MACD line above the Signal Line would confirm a bullish reversal.

Volume Analysis

- Volume: 2.564 million (above average)

- Increased volume during the recent price rise validates strong buying interest.

Strengths and Opportunities

- Market Leadership: Alkyl Amines’ dominance in aliphatic amines ensures a strong competitive position.

- Innovation: Continuous R&D investments drive product differentiation and high margins.

- Export Growth: Expanding presence in international markets supports long-term growth.

- Sustainability Initiatives: Focus on green chemistry aligns with global environmental trends.

Risks and Challenges

- Raw Material Volatility: Dependence on imported raw materials exposes the company to price fluctuations.

- Regulatory Risks: Stricter environmental regulations could increase compliance costs.

- High Valuation: The stock’s PE ratio of 30.2 indicates premium valuation, limiting upside potential in the short term.

Outlook and Recommendations

Short-Term Outlook

- The recent technical breakout suggests the potential for further gains. However, investors should watch for confirmation of bullish momentum.

- A sustained move above ₹2,170.02 could lead to a rally toward ₹2,671.28.

Long-Term Outlook

- Alkyl Amines’ focus on value-added products, capacity expansion, and export growth positions it for sustained long-term success.

- Strategic investments in R&D and sustainability will enhance profitability and market share.

Investment Recommendations

- For Short-Term Traders: Capitalize on the bullish momentum with tight stop-loss levels.

- For Long-Term Investors: Accumulate on dips, focusing on the company’s robust fundamentals and growth potential.

5. NLC India Ltd. (Power)

Company Overview

NLC India Ltd. (formerly Neyveli Lignite Corporation Limited) is a public sector enterprise primarily engaged in the mining of lignite and generation of power, including renewable energy. With a focus on coal-based thermal power and clean energy initiatives, the company is a significant contributor to India’s energy sector. Its diversification into renewable energy aligns with India’s goal of achieving sustainability in power generation.

Stock Performance

Recent Market Performance

- Closing Price: ₹1,131.40

- Gain: +₹97.25 (+7.6%)

NLC India Ltd.’s stock surged by 7.6% on January 9, 2025. This performance was driven by investor optimism around the company’s renewable energy initiatives and recent government incentives for clean energy projects. The growing focus on sustainability and the energy transition story has increased investor confidence.

Long-Term Performance

The stock has shown a mixed trend over the years, with renewed momentum in recent months:

- 1 Week: ▲9.3%

- 1 Month: ▲11.2%

- 6 Months: ▲16.5%

- 1 Year: ▲22.7%

- 5 Years: ▲87.4%

- 10 Years: ▲195.2%

NLC India’s focus on renewable energy projects and strategic investments have contributed to its positive long-term trajectory.

Key Financial Indicators

- Market Capitalization: ₹21,500 crore

- Enterprise Value (EV): ₹19,800 crore

- Book Value Per Share: ₹122.75

- Price-Earnings Ratio (PE): 18.5

- Dividend Yield: 2.9%

These metrics highlight NLC India’s strong financial position and consistent returns to shareholders through dividends.

Financial Performance

Profit and Loss Metrics

- Net Sales: ₹6,340 crore

- EBITDA: ₹2,110 crore

- Net Profit (PAT): ₹1,050 crore

- EBITDA Margin: 33.3%

- Net Profit Margin: 16.6%

NLC India’s robust financial performance reflects its ability to manage costs and deliver profitability despite industry challenges.

Business Segments and Growth Drivers

1. Thermal Power

- NLC India remains a key player in coal-based thermal power generation.

- Recent upgrades to existing facilities have improved efficiency and reduced emissions.

2. Renewable Energy

- The company’s significant investments in solar and wind power projects highlight its commitment to clean energy.

- NLC India’s renewable energy capacity has grown to over 2 GW, with several projects under development.

3. Lignite Mining

- As one of India’s largest lignite miners, the company supports its thermal power plants and other industrial clients.

- Improved mining efficiency and cost management have enhanced profitability.

4. Strategic Alliances and Projects

- Collaboration with state governments and private players for renewable energy projects has opened new revenue streams.

- Recent government incentives for renewable energy development have boosted growth prospects.

Recent Developments

1. Renewable Energy Projects

- NLC India has announced plans to expand its solar and wind power capacity by 30% over the next three years.

- The commissioning of a new 500 MW solar power project in Rajasthan has strengthened its renewable portfolio.

2. Government Incentives

- The company has benefited from subsidies and incentives under India’s National Solar Mission and other clean energy initiatives.

3. Sustainability Goals

- NLC India is focused on reducing its carbon footprint by integrating more renewable energy into its portfolio.

- The company has set a target of achieving 50% renewable energy capacity by 2030.

Technical Analysis

The technical chart provides insights into NLC India’s stock performance:

Price Action and Bollinger Bands

- Price Levels:

- Current Price: ₹242.20

- Support Levels: ₹228.30 and ₹228.60

- Resistance Levels: ₹258.40 and ₹288.49

- Bollinger Bands:

- The stock is trading near the midline of the Bollinger Bands, indicating a potential move toward the upper band.

- Widening bands suggest increasing volatility, which could lead to a breakout.

Relative Strength Index (RSI)

- Current RSI Value: 46.41

- The RSI indicates neutral momentum, with room for upward movement before reaching overbought levels.

Moving Average Convergence Divergence (MACD)

- Current MACD Values:

- MACD Line: 1.64

- Signal Line: -1.95

- Histogram: +3.59 (positive)

- MACD Analysis:

- The positive histogram reflects growing bullish momentum.

- A crossover of the MACD line above the Signal Line would confirm a bullish trend.

Volume Analysis

- Volume: 8.565 million (above average)

- High trading volume during the recent price increase validates strong investor interest.

Strengths and Opportunities

- Diverse Portfolio: NLC India’s mix of thermal and renewable energy projects ensures revenue stability.

- Government Support: Subsidies and incentives for clean energy projects boost profitability.

- Sustainability Initiatives: Focus on reducing emissions and increasing renewable capacity aligns with global trends.

- Strategic Investments: Capacity expansions and collaborations enhance growth potential.

Risks and Challenges

- Regulatory Risks: Stricter environmental norms could impact coal-based power generation.

- Raw Material Dependency: Dependence on lignite mining exposes the company to price fluctuations.

- Execution Risks: Delays in renewable energy projects could affect growth targets.

Outlook and Recommendations

Short-Term Outlook

- The stock’s recent rally and technical indicators suggest the potential for further gains.

- A sustained move above ₹258.40 could lead to a rally toward ₹288.49.

Long-Term Outlook

- NLC India’s focus on renewable energy and strategic investments position it for long-term growth.

- Government support and sustainability goals will drive future profitability.

Investment Recommendations

- For Short-Term Traders: Monitor key resistance levels for breakout opportunities.

- For Long-Term Investors: Accumulate on dips, focusing on the company’s clean energy initiatives and strong fundamentals.

Key Drivers Behind the Rally

1. Favorable Demand-Supply Dynamics

The chemical sector is witnessing robust demand across industries such as pharmaceuticals, agrochemicals, electronics, and personal care. Global supply chain realignments and the increasing focus on China+1 strategies have benefited Indian chemical companies, positioning them as key suppliers in global markets.

2. Export Opportunities

Indian chemical companies have leveraged their cost-competitiveness and compliance with global standards to expand their export footprints. Rising demand for specialty chemicals in Europe, the US, and other markets has been a major growth driver.

3. Investments in High-Value Products

Companies like SRF and Navin Fluorine have invested in high-margin segments, including fluorochemicals, agrochemical intermediates, and electronics-grade chemicals. These investments have bolstered their profitability and enhanced their growth prospects.

4. Government Policies

Supportive government policies, such as Production Linked Incentive (PLI) schemes for the chemical sector, have incentivized capacity expansion and innovation. These measures have strengthened the competitive position of Indian chemical manufacturers.

5. Rising Input Costs Passed to Consumers

While input costs have risen due to inflationary pressures and supply chain constraints, many chemical companies have successfully passed these costs onto consumers without significantly affecting demand. This has helped maintain healthy profit margins.

Company-Specific Insights

SRF Ltd.

- Strengths: Diversified product portfolio, strong export presence, and significant investments in specialty chemicals.

- Growth Drivers: Expansion of production facilities and increased demand for fluorochemicals in refrigeration and air conditioning.

- Outlook: Analysts expect SRF to maintain its growth trajectory, supported by its focus on high-margin products and operational efficiency.

Navin Fluorine International Ltd.

- Strengths: Innovation-driven approach, focus on fluorine-based chemistries, and strategic partnerships.

- Growth Drivers: Demand for advanced intermediates and performance chemicals in global markets.

- Outlook: The company is well-positioned to capitalize on emerging opportunities in the electronics and pharmaceutical sectors.

Balaji Amines Ltd.

- Strengths: Dominance in the amines market, strong R&D capabilities, and efficient operations.

- Growth Drivers: Rising demand for amines in pharmaceuticals, agrochemicals, and personal care products.

- Outlook: With a focus on capacity expansion and value-added products, Balaji Amines is expected to deliver consistent growth.

Alkyl Amines Chemicals Ltd.

- Strengths: Leadership in amine production, robust supply chain management, and customer-centric approach.

- Growth Drivers: Expanding applications of amines in diverse industries and rising global demand.

- Outlook: The company’s emphasis on operational efficiency and product diversification will likely drive long-term growth.

NLC India Ltd.

- Strengths: Established player in the power sector with a focus on renewable energy.

- Growth Drivers: Government incentives for clean energy projects and investments in solar and wind power.

- Outlook: The transition towards renewable energy is expected to enhance NLC’s growth prospects and attract long-term investors.

Broader Implications for the Chemical Sector

The recent rally underscores the resilience and growth potential of India’s chemical sector. Key trends shaping the industry include:

- Sustainability Initiatives:

- Companies are investing in sustainable processes and products to meet global environmental standards.

- The shift towards green chemistry and renewable feedstocks is gaining momentum.

- Digital Transformation:

- Adoption of advanced technologies such as AI, IoT, and data analytics is enhancing efficiency and driving innovation.

- Global Supply Chain Realignment:

- As companies diversify away from China, Indian chemical manufacturers are emerging as reliable alternatives.

- Increased R&D Spending:

- Focus on innovation and development of high-value products is enabling companies to capture premium markets.

Investment Perspective

For investors, the chemical sector offers attractive opportunities due to its growth potential, export prospects, and strategic importance in various industries. However, it is essential to consider factors such as:

- Valuation Levels: While many stocks have rallied, assessing their valuation relative to earnings growth is crucial.

- Global Economic Conditions: Demand for chemicals is closely tied to global economic trends and industrial activity.

- Regulatory Risks: Adherence to environmental and safety standards is critical for sustained growth.

Conclusion

The impressive performance of chemical sector stocks such as SRF Ltd., Navin Fluorine, Balaji Amines, and Alkyl Amines Chemicals reflects the sector’s strong fundamentals and growth prospects. With supportive government policies, expanding export opportunities, and increasing demand for specialty chemicals, the industry is poised for continued growth. For investors, these stocks represent a compelling opportunity, provided they adopt a strategic and informed approach to investment.

ALSO READ: Global Trends and Fed Minutes Impact Indian Markets