Founded in 1905, Phoenix Mills Ltd. started as a textile manufacturing company in Lower Parel, Mumbai, with a primary focus on producing cotton textiles. However, the company transformed over the years, becoming one of India’s leading real estate developers. In 1987, Phoenix Mills shifted its focus to real estate development, which led to the creation of one of Mumbai’s most iconic shopping destinations, High Street Phoenix. Today, the company’s portfolio spans across retail, hospitality, commercial, and residential sectors, making it a powerhouse in India’s mixed-use development space.

About the Company: Strategic Growth and Diversification

Phoenix Mills Ltd., along with its subsidiaries and group companies, collectively known as the PML Group, boasts an impressive portfolio of over 19 million square feet spread across major Indian cities like Mumbai, Bengaluru, Chennai, Pune, and Kolkata. This real estate giant has built a strong reputation for itself, focusing on retail-led mixed-use developments that balance commercial, residential, and hospitality offerings.

The company’s successful strategy stems from its well-rounded approach to real estate development. From land acquisition to planning, leasing, and management, Phoenix Mills handles every aspect of real estate operations. This meticulous attention to detail has helped the company grow exponentially in a highly competitive market.

Additionally, Phoenix Mills has formed strategic alliances with global financial giants such as the Canada Pension Plan Investment Board (CPPIB) and the Government of Singapore Investment Corporation (GIC), providing the company with the capital needed to fuel its aggressive expansion plans.

Financial Performance: Robust Growth Across All Segments

In FY24, Phoenix Mills Ltd. posted consolidated revenue of ₹3,978 crore, a significant jump of 79.1% YoY, driven primarily by strong growth in its retail rental income. The company’s ability to achieve such outstanding growth can be attributed to its diversified portfolio, which spans across four major revenue segments:

- Property & Related Services (58% of total revenue)

- Residential Business (22%)

- Commercial Assets (15%)

- Hospitality & Others (5%)

This balanced revenue mix allows Phoenix Mills to hedge against sector-specific risks and ensure steady growth even in volatile market conditions. The company’s diversified revenue streams also provide a strong foundation for future expansion into new areas.

Retail Portfolio: A Powerhouse of Indian Malls

Phoenix Mills’ retail portfolio is a cornerstone of its business, contributing significantly to its overall revenue. With over 11 million square feet of operational retail space spread across 8 major cities and 12 malls, Phoenix Mills has solidified its position as a market leader in India’s retail real estate sector.

The company’s malls, such as Phoenix Marketcity in Mumbai, Pune, Bangalore, and Chennai, are household names, drawing millions of shoppers each year. Phoenix Palladium in Ahmedabad and Phoenix United in Lucknow are other key assets in the company’s portfolio, offering both retail and commercial space to tenants.

In addition to its existing assets, Phoenix Mills is aggressively expanding its retail footprint. By FY27, the company expects to add an additional 1.98 million square feet of retail space and 2.8 million square feet of office space to its portfolio. The Phoenix Mall of Asia, set to open in Bangalore by October 2023, and Phoenix Grand Victoria in Kolkata, set for launch by FY27, are two major projects under development that will significantly enhance the company’s retail presence in key markets.

Residential and Hospitality Portfolio

Phoenix Mills is not just a retail powerhouse; it also has a growing presence in the residential and hospitality sectors. The company’s 3.5 million square feet of saleable residential area, spread across cities like Bengaluru and Kolkata, adds a valuable diversification layer to its portfolio.

Key residential projects include:

- One Bangalore West, a premier project in Bengaluru, with a total saleable area of 2.41 million square feet. As of FY24, 1.70 million square feet of this space had already been sold, generating ₹1,895 crore in cumulative revenue.

- Kessaku, Bengaluru, with a total saleable area of 1.03 million square feet, has seen 0.70 million square feet sold, contributing ₹1,184 crore in cumulative sales.

Phoenix Mills’ foray into the hospitality segment has also yielded impressive results. The company currently operates 395 keys at St. Regis Mumbai and 193 keys at Courtyard by Marriott, Agra. The upcoming 488-key Grand Hyatt in Bengaluru is expected to further boost the company’s revenue from the hospitality segment.

Sales Growth: Steady Performance Over the Years

Phoenix Mills has consistently demonstrated strong sales growth, driven primarily by its retail rental income. In FY24, the company recorded ₹3,978 crore in consolidated revenue, up 79.1% YoY. This growth was fueled by a 23% YoY increase in sales at the company’s retail malls, with total consumption across its properties reaching ₹11,344 crore.

Additionally, rental income surged by 27% YoY to ₹1,660 crore, driven by rising footfall at Phoenix Mills’ malls and increased demand for retail space. The jewellery segment saw the highest YoY growth at 23%, followed by gourmet and hypermarkets at 33%, and fashion and accessories at 6%.

EBITDA Growth: Consistent Profitability

EBITDA, or Earnings Before Interest, Taxes, Depreciation, and Amortization, is a key measure of a company’s operating profitability. Phoenix Mills achieved ₹2,177 crore in EBITDA for FY24, up from ₹1,519 crore in FY23. This growth reflects the company’s strong operational performance across its portfolio of retail, residential, and commercial assets.

Key contributors to EBITDA growth include:

- Cost of material consumption at ₹187 crore.

- Operating expenses, including electricity costs, at ₹592 crore.

- Increased revenue from commercial offices, which contributed ₹50 crore in Q1 FY25.

The company’s EBITDA margin, although slightly down from 58% in FY23 to 55% in FY24, remains strong. The margin decline was largely due to increased operational expenses linked to marketing efforts to drive footfall at Phoenix Mills’ properties.

PAT Growth: Impressive Earnings Performance

Phoenix Mills’ Profit After Tax (PAT) for FY24 stood at ₹1,334 crore, a slight decrease from ₹1,473 crore in FY23. The decline was due to a one-time exceptional item gain of ₹605 crore in FY23. However, the company’s PAT growth has been strong over the years, with a 5-year CAGR of 23.6%, reflecting its ability to generate consistent earnings.

In Q1 FY25, the company posted PAT of ₹313 crore, up from ₹290 crore in Q1 FY24, driven by rising rental income and operational efficiencies.

Profitability Metrics: EBITDA Margin, PAT Margin, ROE

Phoenix Mills Ltd. continues to demonstrate strong profitability across various metrics, highlighting the company’s operational efficiency and financial health.

- EBITDA Margin: Phoenix Mills’ EBITDA margin declined slightly to 55% in FY24, down from 58% in FY23. However, Q1 FY25 saw a rebound in the margin to 59%, indicating improving operational performance.

- PAT Margin: The PAT margin for FY24 was 33.1%, down from 55.81% in FY23, which had included the exceptional item gain. In Q1 FY25, the PAT margin improved to 34.7%.

- Return on Equity (ROE): Phoenix Mills’ ROE for FY24 was 15%, down from 19.7% in FY23. Despite the decline, the company continues to generate strong returns for its shareholders.

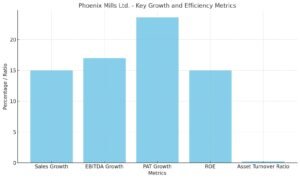

Chart: Phoenix Mills Ltd. Key Growth and Efficiency Metrics

The chart below provides a visual representation of Phoenix Mills’ key financial and operational metrics, allowing for an easier understanding of the company’s growth trajectory.

In this chart, the following metrics are highlighted:

- Sales Growth (CAGR): 15.0%

- EBITDA Growth (CAGR): 17.0%

- PAT Growth (CAGR): 23.6%

- ROE: 15.0%

- Asset Turnover Ratio: 0.22x

These figures demonstrate Phoenix Mills’ robust growth across multiple areas, from revenue and earnings to asset utilization and shareholder returns.

Efficiency Metrics: Cash Flow, Working Capital, and Asset Turnover

Cash Flows

Phoenix Mills generated ₹2,161.7 crore in CFO (Cash Flow from Operations) in FY24, driven by efficient working capital management. Cash outflows for capital expenditures amounted to ₹1,859.1 crore, primarily due to investments in properties.

Working Capital Cycle

The company maintained a negative working capital cycle of approximately 12 days in FY24, showcasing its efficiency in managing inventory and receivables. Phoenix Mills has implemented strong supply chain management practices, maintaining 127 days of payables and 91 days of inventory, which ensures liquidity and operational efficiency.

Asset Turnover Ratio

Phoenix Mills’ asset turnover ratio stood at 0.22x in FY24, reflecting the company’s ability to generate revenue from its assets. Total assets for the year increased by 10% YoY to ₹19,147 crore, driven by ongoing investments in properties under development, plant and equipment, and other assets. This increase in total assets highlights the company’s commitment to expanding its portfolio and driving future revenue growth.

Solvency Metrics: Debt, Coverage, and Liquidity

Maintaining a healthy balance between debt and equity is crucial for long-term financial stability. Phoenix Mills Ltd. has demonstrated prudence in managing its capital structure, ensuring that it leverages debt effectively without compromising solvency.

Debt to Equity Ratio

As of March 31, 2024, Phoenix Mills reported total debt of ₹4,259 crore, comprising ₹3,310 crore in long-term borrowings and ₹949 crore in short-term borrowings. The company’s net debt-to-equity ratio was a comfortable 0.51x, indicating a well-balanced capital structure that allows for continued expansion while minimizing financial risk.

Additionally, the group-level gross debt was ₹4,366 crore at the end of March 2024, with net debt at ₹2,654 crore. The company’s debt management reflects a disciplined approach to leveraging external capital for growth, while maintaining a conservative debt position.

Interest Coverage Ratio

Phoenix Mills has a robust interest coverage ratio of 5.15x for FY24, demonstrating its ability to comfortably meet its interest obligations. With EBIT at ₹2,039 crore and finance costs at ₹396 crore, the company’s strong operating income ensures that its debt servicing capabilities remain well within safe limits.

Current Ratio

The current ratio for FY24 stood at 1.5x, reflecting Phoenix Mills’ ability to cover its short-term liabilities with its current assets. With current assets of ₹3,387 crore and current liabilities of ₹2,245 crore, the company maintains sufficient liquidity to fund ongoing operations and future projects.

The cash and bank balance at the end of FY24 was ₹710 crore, up from ₹630 crore in FY23, ensuring ample liquidity to manage short-term obligations and invest in growth opportunities.

Efficiency in Expansion and Partnerships: A Look Ahead

Phoenix Mills Ltd. is not only focused on consolidating its current operations but is also aggressively expanding its presence across India. The company’s retail, office, and residential portfolios are set to grow significantly in the coming years, with new projects under development in key cities like Bengaluru and Kolkata.

Expansion Plans in Retail and Office Portfolios

The company’s retail footprint is expected to grow from 11 million square feet to 14 million square feet by FY27, driven by projects like Phoenix Mall of Asia in Bangalore and Phoenix Grand Victoria in Kolkata. These projects will not only increase the company’s retail space but will also enhance its presence in high-growth urban centers, ensuring continued revenue growth from the retail segment.

Similarly, Phoenix Mills’ office portfolio is set to expand by 5 million square feet by FY27, further diversifying its revenue streams and offering stable, long-term cash flows from commercial tenants.

Residential and Hospitality Growth

In the residential space, Phoenix Mills has secured land parcels in Alipore Kolkata and Bangalore that will add an additional 1 million square feet to its portfolio, expanding its presence in the high-demand residential market. The company’s strategic focus on high-value, luxury residential projects ensures that it continues to cater to affluent buyers, further boosting its revenue potential.

Phoenix Mills’ expansion in the hospitality sector also signals a shift towards more diversified income streams. The upcoming Grand Hyatt Bengaluru, with 488 keys, will add to the company’s already impressive hospitality portfolio, generating additional revenue from the growing tourism and business travel sectors.

Strategic Partnerships and Equity Financing

Phoenix Mills has successfully partnered with leading institutional investors to fund its growth initiatives. The company raised ₹4,533 crore in equity capital over the last 24 months, strengthening its balance sheet and providing the financial flexibility needed to execute its ambitious expansion plans.

Key partnerships include:

- A strategic alliance with CPP Investments, which committed ₹384 crore for a 49% stake in the company’s Alipore, Kolkata project.

- A joint venture with GIC, which acquired a 33% equity stake in Phoenix Mills’ new retail-led, mixed-use development platform.

These partnerships not only provide Phoenix Mills with capital but also underscore the confidence that global institutional investors have in the company’s growth potential and management capabilities.

Conclusion: A Vision for the Future

Phoenix Mills Ltd. has successfully transformed itself from a textile manufacturer into one of India’s leading real estate developers, with a diversified portfolio that spans retail, commercial, residential, and hospitality assets. The company’s financial performance in FY24, characterized by strong sales growth, robust EBITDA margins, and impressive PAT growth, reflects its ability to execute on its strategic initiatives and drive long-term shareholder value.

Looking ahead, Phoenix Mills is well-positioned to continue its growth trajectory, fueled by ongoing expansion projects, strategic partnerships, and a disciplined approach to financial management. The company’s strong cash flow generation, prudent use of debt, and commitment to operational efficiency ensure that it will remain a dominant player in India’s real estate market for years to come.

As Phoenix Mills continues to expand its retail and office portfolios, develop high-end residential projects, and grow its hospitality assets, it is poised to capitalize on the growing demand for high-quality real estate in India’s urban centers. With a strong balance sheet, a proven track record, and a clear vision for the future, Phoenix Mills Ltd. is a company that investors and stakeholders alike can trust to deliver sustainable, long-term growth.

ALSO READ: TTK Prestige: Leading Innovation in Kitchen Appliances