In the latest trading session, the stock market exhibited a blend of gains and losses across various indices and sectors. While some segments experienced notable increases, others faced declines, reflecting the diverse sentiment among investors. This report provides a comprehensive analysis of the major indices’ performances, identifies the top gaining and losing sectors, and highlights the significant stock movements on the National Stock Exchange (NSE). Here’s a detailed look at the day’s market activities.

Market Closing Report: A Mixed Bag of Gains and Losses

Major Indices Performance

– NIFTY: Closed at 24,316, down by 9 points.

– SENSEX: Closed at 79,897, down by 27 points.

The slight declines in both NIFTY and SENSEX indicate a day of cautious trading with minor losses. The overall market sentiment appeared to be mixed, reflecting varied investor responses to sector-specific developments.

Losing Sectors

- Nifty Realty

– Performance: -1.5%

– The Nifty Realty index was the biggest loser of the day, falling by 1.5%. The decline in this sector could be attributed to concerns over rising interest rates or regulatory challenges affecting real estate companies.

- Nifty Pharma

– Performance: -0.6%

– The Nifty Pharma index also saw a decline, dropping by 0.6%. This could be due to various factors including regulatory scrutiny, pricing pressures, or profit-taking after previous gains.

Gaining Sectors

- Nifty Media

– Performance: +1.0%

– The Nifty Media index was the top gainer, rising by 1.0%. Strong earnings reports, optimistic forecasts, and increased investor interest in media companies likely drove the sector’s performance.

- Nifty FMCG

– Performance: +0.3%

– The Nifty FMCG index also saw gains, albeit modest, with a 0.3% increase. The consumer goods sector generally benefits from stable demand and defensive qualities, making it attractive to investors.

Top Indices Gainers: A Detailed Overview

Nifty PSE (Public Sector Enterprises)

Time: 03:51:59 PM

Index Level: 11,409.30

Change: +123.60

Percentage Change: 1.1%

The Nifty PSE index, which tracks the performance of public sector enterprises, witnessed a significant uptick. The index climbed by 123.60 points, marking a 1.1% increase. This rise can be attributed to strong performances from major public sector companies, reflecting investor confidence in government-owned enterprises.

Nifty CPSE (Central Public Sector Enterprises)

Time: 03:51:59 PM

Index Level: 7,293.30

Change: +77.75

Percentage Change: 1.1%

The Nifty CPSE index, comprising central public sector enterprises, also saw a substantial gain. It increased by 77.75 points, a 1.1% rise. This growth indicates positive market sentiment towards centrally administered public sector companies, potentially driven by policy support and favorable government announcements.

Nifty Media

Time: 03:51:59 PM

Index Level: 2,031.90

Change: +20.75

Percentage Change: 1.0%

The Nifty Media index, which includes leading media companies, recorded a gain of 20.75 points, reflecting a 1.0% increase. The media sector’s growth is likely driven by strong earnings reports and optimistic forecasts, which have boosted investor confidence in media stocks.

Nifty Microcap 250

Time: 03:51:59 PM

Index Level: 24,067.90

Change: +241.35

Percentage Change: 1.0%

The Nifty Microcap 250 index, which tracks the performance of 250 microcap stocks, saw a healthy rise of 241.35 points, translating to a 1.0% gain. This increase suggests robust investor interest in smaller companies, likely driven by their growth potential and attractive valuations.

Nifty Midcap 150

Time: 03:51:59 PM

Index Level: 65,486.15

Change: +529.00

Percentage Change: 0.8%

The Nifty Midcap 150 index, representing mid-sized companies, rose by 529.00 points, marking a 0.8% increase. The midcap segment’s performance indicates sustained investor interest in mid-sized companies, which often balance growth prospects and stability.

Nifty Alpha 50

Time: 03:51:59 PM

Index Level: 59,485.95

Change: +478.20

Percentage Change: 0.8%

The Nifty Alpha 50 index, which focuses on stocks with high alpha, or excess returns relative to the market, gained 478.20 points, a 0.8% rise. This suggests strong investor appetite for high-performing stocks that offer superior returns.

NIFTY200 Alpha 30

Time: 03:51:59 PM

Index Level: 28,787.10

Change: +208.30

Percentage Change: 0.7%

The NIFTY200 Alpha 30 index, comprising 30 high alpha stocks from the NIFTY 200, rose by 208.30 points, translating to a 0.7% increase. This reflects continued interest in top-performing stocks within the broader NIFTY 200 universe.

NIFTY Smallcap 100

Time: 03:51:59 PM

Index Level: 18,919.65

Change: +129.90

Percentage Change: 0.7%

The NIFTY Smallcap 100 index, which includes 100 small-cap stocks, saw a gain of 129.90 points, or 0.7%. This performance highlights growing investor confidence in small-cap companies, often seen as high-risk but high-reward investments.

Nifty Consumer Durables

Time: 03:51:59 PM

Index Level: 38,797.75

Change: +229.50

Percentage Change: 0.6%

The Nifty Consumer Durables index, tracking companies in the consumer durables sector, increased by 229.50 points, a 0.6% rise. The sector’s performance may be buoyed by strong consumer demand and favorable economic conditions.

Nifty Smallcap 250

Time: 03:51:59 PM

Index Level: 17,692.15

Change: +106.45

Percentage Change: 0.6%

The Nifty Smallcap 250 index, representing 250 small-cap stocks, rose by 106.45 points, or 0.6%. This gain underscores positive investor sentiment towards smaller companies with potential for significant growth.

Nifty Smallcap 50

Time: 03:51:59 PM

Index Level: 8,735.75

Change: +47.20

Percentage Change: 0.5%

The Nifty Smallcap 50 index, including 50 small-cap stocks, increased by 47.20 points, a 0.5% rise. This reflects steady interest in small-cap stocks, which can offer substantial returns.

Nifty India Corporate Group Index – Tata

Time: 03:51:59 PM

Index Level: 16,811.25

Change: +90.45

Percentage Change: 0.5%

The Nifty India Corporate Group Index – Tata, tracking companies under the Tata Group, rose by 90.45 points, or 0.5%. The performance of Tata Group companies indicates strong market confidence in one of India’s largest conglomerates.

Nifty Dividend Opportunities 50

Time: 03:51:59 PM

Index Level: 6,474.20

Change: +34.90

Percentage Change: 0.5%

The Nifty Dividend Opportunities 50 index, focusing on companies with high dividend yields, increased by 34.90 points, or 0.5%. This suggests investor preference for stocks offering stable dividend income.

Top Indices Decliners: A Detailed Overview

India VIX

Time: 03:55:59 PM

Index Level: 14.00

Change: -0.43

Percentage Change: ▼ 3.0%

The India VIX, which measures the market’s volatility, decreased by 0.43 points, marking a 3.0% drop. This decline suggests reduced market volatility and potentially lower investor anxiety.

Nifty Realty

Time: 03:55:59 PM

Index Level: 1,109.90

Change: -16.75

Percentage Change: ▼ 1.5%

The Nifty Realty index, tracking the performance of real estate companies, fell by 16.75 points, a 1.5% decrease. The real estate sector faced pressure, possibly due to concerns over rising interest rates or regulatory challenges.

Nifty Healthcare Index

Time: 03:55:59 PM

Index Level: 13,043.25

Change: -84.85

Percentage Change: ▼ 0.7%

The Nifty Healthcare Index, which includes leading healthcare companies, dropped by 84.85 points, reflecting a 0.7% decline. This suggests some weakness in the healthcare sector, possibly due to profit-taking or sector-specific challenges.

Nifty Pharma

Time: 03:55:59 PM

Index Level: 20,601.70

Change: -124.25

Percentage Change: ▼ 0.6%

The Nifty Pharma index, comprising major pharmaceutical companies, decreased by 124.25 points, a 0.6% drop. The pharma sector’s decline might be attributed to concerns over drug pricing or regulatory issues.

Nifty MNC

Time: 03:55:59 PM

Index Level: 30,967.45

Change: -122.20

Percentage Change: ▼ 0.4%

The Nifty MNC index, which tracks multinational companies, fell by 122.20 points, a 0.4% decline. This indicates a slight dip in the performance of multinational corporations, possibly due to global economic uncertainties.

Nifty MidSmall Healthcare

Time: 03:55:59 PM

Index Level: 36,826.45

Change: -124.25

Percentage Change: ▼ 0.3%

The Nifty MidSmall Healthcare index, covering mid and small-cap healthcare companies, decreased by 124.25 points, marking a 0.3% drop. This suggests a mild downturn in the healthcare segment among smaller companies.

NIFTY Midcap150 Quality 50

Time: 03:55:59 PM

Index Level: 24,847.55

Change: -68.10

Percentage Change: ▼ 0.3%

The NIFTY Midcap150 Quality 50 index, focusing on high-quality midcap companies, dropped by 68.10 points, a 0.3% decline. This indicates some investor caution towards midcap quality stocks.

NIFTY Alpha Low-Volatility 30

Time: 03:55:59 PM

Index Level: 28,936.00

Change: -51.30

Percentage Change: ▼ 0.2%

The NIFTY Alpha Low-Volatility 30 index, which tracks stocks with high alpha and low volatility, fell by 51.30 points, a 0.2% drop. This suggests slight investor caution towards lower volatility stocks.

Nifty Auto

Time: 03:55:59 PM

Index Level: 25,257.25

Change: -45.55

Percentage Change: ▼ 0.2%

The Nifty Auto index, covering automobile companies, decreased by 45.55 points, marking a 0.2% drop. The auto sector’s decline may reflect concerns over supply chain issues or demand fluctuations.

Nifty Infrastructure

Time: 03:55:59 PM

Index Level: 9,263.85

Change: -14.20

Percentage Change: ▼ 0.2%

The Nifty Infrastructure index, tracking infrastructure companies, fell by 14.20 points, a 0.2% decline. This indicates a slight pullback in the infrastructure sector, possibly due to policy concerns or project delays.

Nifty100 ESG Sector Leaders

Time: 03:55:59 PM

Index Level: 4,048.10

Change: -5.55

Percentage Change: ▼ 0.1%

The Nifty100 ESG Sector Leaders index, focusing on environmental, social, and governance (ESG) leaders, decreased by 5.55 points, a 0.1% drop. This suggests a marginal decline in ESG-focused investments.

Nifty500 Multicap Infrastructure 50:30:20

Time: 03:55:59 PM

Index Level: 14,708.80

Change: -20.35

Percentage Change: ▼ 0.1%

The Nifty500 Multicap Infrastructure 50:30:20 index, covering multicap infrastructure companies, fell by 20.35 points, a 0.1% decline. This indicates a minor pullback in the multicap infrastructure segment.

Nifty 100 Low Volatility 30

Time: 03:55:59 PM

Index Level: 19,541.40

Change: -23.05

Percentage Change: ▼ 0.1%

The Nifty 100 Low Volatility 30 index, tracking low volatility stocks, decreased by 23.05 points, a 0.1% drop. This suggests a slight decline in investor interest in low volatility stocks.

NIFTY India Manufacturing

Time: 03:55:59 PM

Index Level: 14,896.75

Change: -15.65

Percentage Change: ▼ 0.1%

The NIFTY India Manufacturing index, which tracks manufacturing companies, fell by 15.65 points, a 0.1% decline. This indicates a marginal downturn in the manufacturing sector.

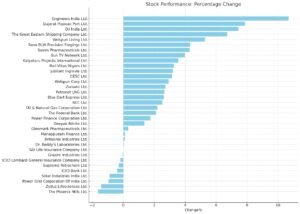

Top Market Gainers

Engineers India Ltd. (ENGINERSIN)

Exchange: NSE

Sector: Capital Goods

Industry: Engineering

Market Cap Category: Small Cap

Last Traded Price (LTP): ₹290.25

Change: ₹28

Change (%): 10.68%

Symbol for External Upload: ENGINERSIN,

Engineers India Ltd. operates in the engineering sector and is categorized as a small-cap company. Recently, the stock saw a significant increase of 10.68%, reflecting strong investor interest and positive market sentiment.

Gujarat Pipavav Port Ltd. (GPPL)

Exchange: NSE

Sector: Logistics

Industry: Port

Market Cap Category: Small Cap

Last Traded Price (LTP): ₹236.63

Change: ₹17.26

Change (%): 7.87%

Symbol for External Upload: GPPL,

Gujarat Pipavav Port Ltd. is involved in the logistics sector, specifically in port operations. As a small-cap company, it recently experienced a 7.87% increase in its stock price, indicating a favorable market outlook.

Oil India Ltd. (OIL)

Exchange: NSE

Sector: Crude Oil

Industry: Oil Exploration

Market Cap Category: Mid Cap

Last Traded Price (LTP): ₹551

Change: ₹38.15

Change (%): 7.44%

Symbol for External Upload: OIL,

Oil India Ltd. operates in the crude oil sector, focusing on oil exploration. This mid-cap company recently saw its stock price rise by 7.44%, reflecting positive developments or investor confidence in its operations.

Mazagon Dock Shipbuilders Ltd. (MAZDOCK)

Exchange: NSE

Sector: Ship Building

Industry: Ship Building

Market Cap Category: Mid Cap

Last Traded Price (LTP): ₹5744.45

Change: ₹386.3

Change (%): 7.21%

Symbol for External Upload: MAZDOCK,

Mazagon Dock Shipbuilders Ltd. is a mid-cap company in the shipbuilding industry. The stock increased by 7.21%, suggesting strong performance or positive news impacting investor sentiment.

The Great Eastern Shipping Company Ltd. (GESHIP)

Exchange: NSE

Sector: Logistics

Industry: Shipping

Market Cap Category: Small Cap

Last Traded Price (LTP): ₹1454.05

Change: ₹91.5

Change (%): 6.72%

Symbol for External Upload: GESHIP,

The Great Eastern Shipping Company Ltd. operates in the logistics sector, specifically shipping. As a small-cap company, its stock rose by 6.72%, indicating a positive market response.

Central Depository Services (India) Ltd. (CDSL)

Exchange: NSE

Sector: Finance

Industry: Depository Services

Market Cap Category: Small Cap

Last Traded Price (LTP): ₹2442.4

Change: ₹145.35

Change (%): 6.33%

Symbol for External Upload: CDSL,

Central Depository Services (India) Ltd. provides depository services in the finance sector. The small-cap company saw its stock price increase by 6.33%, reflecting favorable investor sentiment.

Data Patterns (India) Ltd. (DATAPATTNS)

Exchange: NSE

Sector: Other

Industry: Defence

Market Cap Category: Small Cap

Last Traded Price (LTP): ₹3395.2

Change: ₹190.4

Change (%): 5.94%

Symbol for External Upload: DATAPATTNS,

Data Patterns (India) Ltd. operates in the defense sector. The company, categorized as small-cap, experienced a 5.94% increase in its stock price, indicating positive market reactions.

Mangalore Refinery And Petrochemicals Ltd. (MRPL)

Exchange: NSE

Sector: Crude Oil

Industry: Refineries

Market Cap Category: Mid Cap

Last Traded Price (LTP): ₹241.91

Change: ₹12.13

Change (%): 5.28%

Symbol for External Upload: MRPL,

Mangalore Refinery And Petrochemicals Ltd. operates in the crude oil sector, focusing on refineries. As a mid-cap company, its stock price rose by 5.28%, indicating positive developments or investor confidence.

Welspun Living Ltd. (WELSPUNLIV)

Exchange: NSE

Sector: Textile

Industry: Textile

Market Cap Category: Small Cap

Last Traded Price (LTP): ₹174.26

Change: ₹8.74

Change (%): 5.28%

Symbol for External Upload: WELSPUNLIV,

Welspun Living Ltd. operates in the textile sector. The small-cap company saw a 5.28% increase in its stock price, reflecting favorable market conditions.

Cochin Shipyard Ltd. (COCHINSHIP)

Exchange: NSE

Sector: Ship Building

Industry: Ship Building

Market Cap Category: Mid Cap

Last Traded Price (LTP): ₹2863.6

Change: ₹136.35

Change (%): 5%

Symbol for External Upload: COCHINSHIP,

Cochin Shipyard Ltd. operates in the shipbuilding sector and is categorized as a mid-cap company. Its stock increased by 5%, indicating positive market sentiment.

Recent Performance of Selected Companies on NSE

In this article, we explore a selection of companies across various sectors listed on the National Stock Exchange (NSE) and their recent stock performance. Each company’s market capitalization, industry, and recent changes in stock prices are analyzed to provide insights into their current standing and potential growth.

Top declining stocks

Raymond Ltd. (RAYMOND)

Exchange: NSE

Sector: Textile

Industry: Textile – Weaving

Market Cap Category: Small Cap

Last Traded Price (LTP): ₹2001.3

Change: -₹1154.8

Change (%): -36.59%

Symbol for External Upload: RAYMOND,

Raymond Ltd. operates in the textile weaving industry and is categorized as a small-cap company. Recently, the stock saw a significant decrease of 36.59%, reflecting a sharp decline in investor confidence or negative market sentiment.

Shoppers Stop Ltd. (SHOPERSTOP)

Exchange: NSE

Sector: Retailing

Industry: Retailing

Market Cap Category: Small Cap

Last Traded Price (LTP): ₹837.2

Change: -₹58.75

Change (%): -6.56%

Symbol for External Upload: SHOPERSTOP,

Shoppers Stop Ltd. is involved in the retailing sector. As a small-cap company, it recently experienced a 6.56% decrease in its stock price, indicating challenges or negative news impacting investor sentiment.

Tube Investments of India Ltd. (TIINDIA)

Exchange: NSE

Sector: Automobile & Ancillaries

Industry: Cycles

Market Cap Category: Mid Cap

Last Traded Price (LTP): ₹4248.7

Change: -₹279.95

Change (%): -6.18%

Symbol for External Upload: TIINDIA,

Tube Investments of India Ltd. operates in the automobile and ancillaries sector, focusing on cycles. This mid-cap company recently saw its stock price fall by 6.18%, suggesting potential operational or market challenges.

360 One Wam Ltd. (360ONE)

Exchange: NSE

Sector: Finance

Industry: Finance – Others

Market Cap Category: Small Cap

Last Traded Price (LTP): ₹968.7

Change: -₹39.5

Change (%): -3.92%

Symbol for External Upload: 360ONE,

360 One Wam Ltd. operates in the finance sector. The company, categorized as small-cap, experienced a 3.92% decrease in its stock price, reflecting negative investor sentiment or market conditions.

Glenmark Life Sciences Ltd. (GLS)

Exchange: NSE

Sector: Healthcare

Industry: Pharmaceuticals & Drugs

Market Cap Category: Small Cap

Last Traded Price (LTP): ₹842.15

Change: -₹33.7

Change (%): -3.85%

Symbol for External Upload: GLS,

Glenmark Life Sciences Ltd. operates in the healthcare sector, specifically in pharmaceuticals and drugs. The small-cap company saw a 3.85% decrease in its stock price, indicating challenges or negative news in the market.

Brigade Enterprises Ltd. (BRIGADE)

Exchange: NSE

Sector: Realty

Industry: Construction – Real Estate

Market Cap Category: Small Cap

Last Traded Price (LTP): ₹1300.6

Change: -₹47.75

Change (%): -3.54%

Symbol for External Upload: BRIGADE,

Brigade Enterprises Ltd. is involved in the real estate construction sector. The small-cap company experienced a 3.54% decrease in its stock price, suggesting potential challenges or negative market sentiment.

Macrotech Developers Ltd. (LODHA)

Exchange: NSE

Sector: Realty

Industry: Construction – Real Estate

Market Cap Category: Large Cap

Last Traded Price (LTP): ₹1472.3

Change: -₹52.85

Change (%): -3.47%

Symbol for External Upload: LODHA,

Macrotech Developers Ltd. operates in the real estate construction sector. As a large-cap company, it recently saw a 3.47% decrease in its stock price, indicating some level of market or operational challenges.

Aegis Logistics Ltd. (AEGISLOG)

Exchange: NSE

Sector: Logistics

Industry: Logistics

Market Cap Category: Small Cap

Last Traded Price (LTP): ₹880.65

Change: -₹28.65

Change (%): -3.15%

Symbol for External Upload: AEGISLOG,

Aegis Logistics Ltd. operates in the logistics sector. The small-cap company saw a 3.15% decrease in its stock price, reflecting potential market challenges or negative sentiment.

Timken India Ltd. (TIMKEN)

Exchange: NSE

Sector: Automobile & Ancillaries

Industry: Bearings

Market Cap Category: Small Cap

Last Traded Price (LTP): ₹4081.35

Change: -₹122.1

Change (%): -2.9%

Symbol for External Upload: TIMKEN,

Timken India Ltd. operates in the automobile and ancillaries sector, focusing on bearings. The small-cap company experienced a 2.9% decrease in its stock price, suggesting potential challenges or negative market sentiment.

Delhivery Ltd. (DELHIVERY)

Exchange: NSE

Sector: Logistics

Industry: Courier Services

Market Cap Category: Mid Cap

Last Traded Price (LTP): ₹377

Change: -₹10.85

Change (%): -2.8%

Symbol for External Upload: DELHIVERY,

Delhivery Ltd. operates in the logistics sector, specifically courier services. The mid-cap company saw a 2.8% decrease in its stock price, indicating potential challenges or negative market sentiment.

Top Volume stocks

Bayer CropScience Ltd. (BAYERCROP)

Exchange: NSE

Sector: Chemicals

Industry: Pesticides & Agrochemicals

Market Cap Category: Small Cap

Today’s Volume: 194,766

Avg. Volume: 21,850.8

Times (x): 8.91

Last Traded Price (LTP): ₹6,588.75

Change: -₹0.6

Change (%): -0.01%

Symbol for External Upload: BAYERCROP,

Bayer CropScience Ltd. operates in the chemicals sector, specifically in pesticides and agrochemicals. The stock’s volume today was 8.91 times the average volume, indicating significant trading activity. Despite this, the stock price remained relatively stable with a minor decrease of 0.01%.

Sona BLW Precision Forgings Ltd. (SONACOMS)

Exchange: NSE

Sector: Automobile & Ancillaries

Industry: Auto Ancillary

Market Cap Category: Mid Cap

Today’s Volume: 11,049,927

Avg. Volume: 1,391,041.2

Times (x): 7.94

Last Traded Price (LTP): ₹719.9

Change: ₹29.95

Change (%): 4.34%

Symbol for External Upload: SONACOMS,

Sona BLW Precision Forgings Ltd. is involved in the auto ancillary industry. The stock saw a trading volume 7.94 times its average, reflecting high investor interest. The stock price increased by 4.34%, indicating positive sentiment and potential growth prospects.

Tube Investments of India Ltd. (TIINDIA)

Exchange: NSE

Sector: Automobile & Ancillaries

Industry: Cycles

Market Cap Category: Mid Cap

Today’s Volume: 1,852,352

Avg. Volume: 258,726

Times (x): 7.16

Last Traded Price (LTP): ₹4,248.7

Change: -₹279.95

Change (%): -6.18%

Symbol for External Upload: TIINDIA,

Tube Investments of India Ltd. operates in the cycles industry within the automobile and ancillaries sector. The stock’s volume was 7.16 times the average, but it experienced a significant decrease of 6.18%, suggesting negative market sentiment.

Glenmark Life Sciences Ltd. (GLS)

Exchange: NSE

Sector: Healthcare

Industry: Pharmaceuticals & Drugs

Market Cap Category: Small Cap

Today’s Volume: 439,548

Avg. Volume: 63,811

Times (x): 6.89

Last Traded Price (LTP): ₹842.15

Change: -₹33.7

Change (%): -3.85%

Symbol for External Upload: GLS,

Glenmark Life Sciences Ltd. is in the healthcare sector, focusing on pharmaceuticals and drugs. The stock saw trading volume 6.89 times its average but fell by 3.85%, reflecting potential challenges or negative investor sentiment.

Sapphire Foods India Ltd. (SAPPHIRE)

Exchange: NSE

Sector: Fast Moving Consumer Goods

Industry: Consumer Food

Market Cap Category: Small Cap

Today’s Volume: 404,669

Avg. Volume: 58,859.8

Times (x): 6.88

Last Traded Price (LTP): ₹1,554.15

Change: -₹1.2

Change (%): -0.08%

Symbol for External Upload: SAPPHIRE,

Sapphire Foods India Ltd. operates in the consumer food industry within the fast-moving consumer goods sector. The stock’s volume was 6.88 times the average, with a minor decrease of 0.08%, indicating stable performance despite high trading activity.

Hatsun Agro Product Ltd. (HATSUN)

Exchange: NSE

Sector: Fast Moving Consumer Goods

Industry: Consumer Food

Market Cap Category: Small Cap

Today’s Volume: 202,598

Avg. Volume: 31,592

Times (x): 6.41

Last Traded Price (LTP): ₹1,153.5

Change: ₹42.25

Change (%): 3.8%

Symbol for External Upload: HATSUN,

Hatsun Agro Product Ltd. is in the consumer food industry within the fast-moving consumer goods sector. The stock saw volume 6.41 times its average and increased by 3.8%, reflecting positive market sentiment and potential growth.

The Great Eastern Shipping Company Ltd. (GESHIP)

Exchange: NSE

Sector: Logistics

Industry: Shipping

Market Cap Category: Small Cap

Today’s Volume: 18,066,808

Avg. Volume: 2,842,230.6

Times (x): 6.36

Last Traded Price (LTP): ₹1,454.05

Change: ₹91.5

Change (%): 6.72%

Symbol for External Upload: GESHIP,

The Great Eastern Shipping Company Ltd. operates in the logistics sector, focusing on shipping. The stock’s volume was 6.36 times the average, with a significant increase of 6.72%, indicating strong positive sentiment.

NMDC Steel Ltd. (NSLNISP)

Exchange: NSE

Sector: Iron & Steel

Industry: Steel & Iron Products

Market Cap Category: Small Cap

Today’s Volume: 43,674,506

Avg. Volume: 7,002,461.8

Times (x): 6.24

Last Traded Price (LTP): ₹60.24

Change: ₹2.6

Change (%): 4.51%

Symbol for External Upload: NSLNISP,

NMDC Steel Ltd. operates in the iron and steel sector. The stock’s volume was 6.24 times the average, with a 4.51% increase, reflecting positive market sentiment and potential growth.

Engineers India Ltd. (ENGINERSIN)

Exchange: NSE

Sector: Capital Goods

Industry: Engineering

Market Cap Category: Small Cap

Today’s Volume: 58,790,312

Avg. Volume: 10,397,998.6

Times (x): 5.65

Last Traded Price (LTP): ₹290.25

Change: ₹28

Change (%): 10.68%

Symbol for External Upload: ENGINERSIN,

Engineers India Ltd. operates in the capital goods sector, focusing on engineering. The stock saw volume 5.65 times its average and increased by 10.68%, reflecting strong investor interest and positive sentiment.

Central Depository Services (India) Ltd. (CDSL)

Exchange: NSE

Sector: Finance

Industry: Depository Services

Market Cap Category: Small Cap

Today’s Volume: 6,135,158

Avg. Volume: 1,089,543.8

Times (x): 5.63

Last Traded Price (LTP): ₹2,442.4

Change: ₹145.35

Change (%): 6.33%

Symbol for External Upload: CDSL,

Central Depository Services (India) Ltd. operates in the finance sector, providing depository services. The stock’s volume was 5.63 times the average, with a 6.33% increase, indicating positive market sentiment and strong performance.

STOCKS WITH 52 WEEKS HIGHS

Conclusion

The trading session ended with a mixed bag of results, reflecting the diverse sentiments across different sectors. While the NIFTY and SENSEX indices recorded minor losses, certain sectors like media and FMCG managed to post gains, indicating investor confidence in these areas. Conversely, the real estate and pharmaceutical sectors faced pressures, highlighting the varying challenges and opportunities within the market. As always, investors should stay informed about sector-specific developments and adjust their strategies accordingly. This dynamic market environment underscores the importance of diversification and staying attuned to both macroeconomic and industry-specific factors to navigate the complexities of the market effectively.

ALSO READ: Corporate Updates: July 11, 2024 Highlights