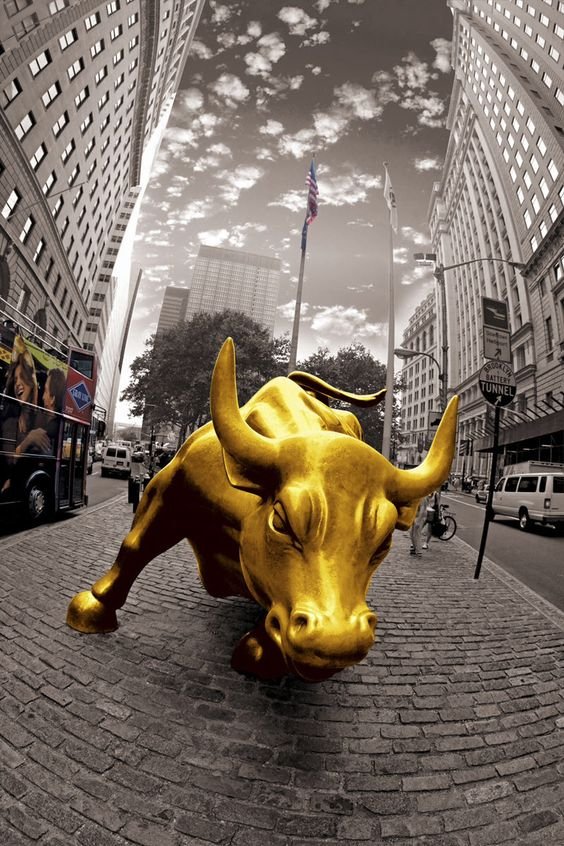

Investing in the stock market requires a keen eye for companies that not only show strong current performance but also have the potential for future growth. As of June 2024, several Indian stocks stand out as excellent investment opportunities. Here’s a detailed look at the top 10 stocks to consider:

1. Bharat Electronics Limited (BEL)

Bharat Electronics Limited is a key player in the defense electronics sector. The company benefits significantly from increased government spending on defense and technology.

With a strong order book and continuous innovation in defense systems, BEL is positioned for long-term growth. The company’s focus on modernization and strategic partnerships further strengthens its market position.

2. NTPC Limited

NTPC Limited is India’s largest energy conglomerate, primarily engaged in power generation. The company is heavily investing in renewable energy projects, aligning with the global shift towards sustainable energy sources.

NTPC’s stable revenue streams and expansion into green energy make it a reliable long-term investment. The company’s strategic initiatives to reduce carbon footprint also bolster its growth prospects.

3. NHPC Limited

NHPC Limited specializes in the construction and operation of hydroelectric power plants. As India pushes towards increasing its renewable energy capacity, NHPC stands to benefit from this trend.

The company’s robust project pipeline and government support for renewable energy initiatives provide a solid foundation for future growth.

4. State Bank of India (SBI)

State Bank of India is the largest public sector bank in India, known for its extensive reach and strong financial performance.

With a vast network of branches and a diversified portfolio of financial services, SBI is a cornerstone of India’s banking sector.

The bank’s ability to adapt to technological changes and its strategic focus on digital banking enhance its competitive edge.

5. ICICI Bank

ICICI Bank is a leading private sector bank with strong fundamentals. The bank has shown consistent growth in its retail and corporate banking segments.

Its proactive approach to adopting new technologies and expanding its digital footprint positions it well for future growth.

ICICI Bank’s focus on asset quality and risk management further enhances its investment appeal.

6. Larsen & Toubro (L&T)

Larsen & Toubro is a major player in the infrastructure and construction sector.

With a diverse portfolio of projects and a strong presence in both domestic and international markets, L&T is set to benefit from increased infrastructure spending by the government.

The company’s strategic initiatives in smart cities and urban infrastructure projects make it a compelling investment.

7. Mahindra & Mahindra (M&M)

Mahindra & Mahindra is a leading player in the automotive and agricultural sectors.

Known for its strong product portfolio and market presence, M&M is well-positioned to capitalize on the growing demand for vehicles and agricultural equipment.

The company’s focus on electric vehicles and sustainable mobility solutions further strengthens its growth prospects.

8. Hindustan Aeronautics Limited (HAL)

Hindustan Aeronautics Limited is a premier aerospace and defense company. The company benefits from increased defense spending and strategic partnerships with global defense firms.

HAL’s focus on indigenous production and technological advancements in aerospace systems positions it well for long-term growth.

9. Maruti Suzuki India Ltd (MSIL)

Maruti Suzuki is the leading car manufacturer in India with a strong market share.

The company’s continuous product innovation and focus on expanding its portfolio of electric and hybrid vehicles align with the evolving automotive market.

Maruti Suzuki’s robust distribution network and customer-centric approach further enhance its market position.

10. Oil and Natural Gas Corporation (ONGC)

Oil and Natural Gas Corporation is a major player in the oil and gas sector. ONGC is poised to benefit from energy sector reforms and increased exploration activities.

The company’s strategic initiatives in enhancing oil recovery and expanding its natural gas production capabilities provide strong growth prospects.

Investing in these top 10 Indian stocks offers a diversified portfolio spanning various sectors, including banking, defense, energy, infrastructure, and automotive.

Each of these companies has strong fundamentals and strategic initiatives that position them well for future growth. As always, it is advisable to conduct thorough research and consult with a financial advisor to ensure these investments align with your risk tolerance and financial goals.

By carefully selecting stocks from these recommended companies, investors can potentially achieve significant returns and secure a robust investment portfolio for the future.

ALSO READ: NIFTY 50 Top Stock Gainers and Losers (Intra-day)