Comprehensive Swing and Positional Trading Research: A Detailed Analysis

Swing trading and positional trading strategies are highly effective for investors looking to capture potential price movements over a few days to several weeks. The following analysis dives into four selected stocks for swing trades and one stock for positional trading, based on market research, financial performance, and price movement patterns. We will discuss each stock in detail, including potential entry points, stop losses, and target prices, as well as the reasoning behind these choices.

Swing Trading Explained

Swing trading is a strategy where traders aim to capture short- to medium-term gains over a period of days or weeks. Traders typically look for stocks that are consolidating, where the price fluctuates within a specific range, or trending, where the price moves consistently upward or downward. Swing traders aim to enter positions at optimal moments, when a breakout from consolidation or continuation of a trend is expected.

The main factors considered in swing trading are:

- Consolidation: This occurs when a stock’s price fluctuates in a relatively tight range without any significant upward or downward movement. Consolidation often precedes a breakout, where the stock may experience a significant price movement.

- Technical Indicators: These include moving averages, support and resistance levels, and price channels, which help predict future price movements.

- Financial Health: Improving financial performance of a company increases investor confidence and can drive stock prices higher over time.

Stock 1: ELICON Engineering

- Entry Point: Looks good above 655

- Stop Loss (SL): 600

- Potential Target: 5, 10, 15, 20, 25, 30, 35, 40+ points from entry

- Holding Period: Few weeks

Analysis: ELICON Engineering has shown strong consolidation over the last few weeks, with the stock forming a price channel where it oscillates between support and resistance levels. The current price action suggests an upward momentum, as the stock is nearing a breakout from its channel. Additionally, the financial performance of the company is gradually improving, making it an attractive option for swing traders.

The entry point of 655 indicates that the stock is moving towards the upper end of the price channel. A breakout above this level can potentially lead to a strong upward movement, with the first target being 660 (5 points), and subsequent targets extending up to 695 (40 points). The stop loss is set at 600, which ensures risk management in case the stock fails to maintain upward momentum.

The holding period for this swing trade is expected to last a few weeks, depending on how quickly the price moves through the target levels.

Stock 2: CHOLA Finance

- Entry Point: Looks good above 1650

- Stop Loss (SL): 1635

- Potential Target: 5, 10, 15, 20, 25, 30, 35, 40+ points from entry

- Holding Period: Few weeks

Analysis: CHOLA Finance is another strong candidate for swing trading. The stock has been consolidating in a narrow range, with strong support around 1635 and resistance near 1650. A breakout above 1650 indicates potential upward movement, which can lead to a rally in the stock price. CHOLA Finance has also shown consistent financial growth, further supporting the case for a bullish swing trade.

The first target is 1655, with further targets spaced at 5-point intervals up to 1690. The stop loss is set conservatively at 1635, allowing traders to exit with minimal loss in case the breakout fails. Traders should keep a close eye on the price action after entering the trade, as the stock may move quickly through the target levels.

This swing trade is suitable for a holding period of a few weeks, giving enough time for the price to develop through multiple targets.

Stock 3: BHEL (Bharat Heavy Electricals Limited)

- Entry Point: Looks good above 274

- Stop Loss (SL): 270

- Potential Target: 2, 4, 6, 7, 10 points from entry

- Holding Period: Few weeks

Analysis: BHEL has exhibited a strong consolidation phase, with a clear price range between 270 and 274. The stock has been hovering near its resistance level, and a breakout above 274 could signal a potential rally. While the stock’s price movements are relatively small compared to others, the targets are achievable in a shorter time frame, making it an ideal candidate for a quick swing trade.

The initial target is 276 (2 points), and the final target is 284 (10 points). A tight stop loss of 270 ensures that risk is well-managed, and traders can exit the position if the stock fails to gain upward momentum. BHEL’s financial performance is improving gradually, which adds further confidence to this swing trade.

This trade is expected to last for a few weeks, but it could reach its targets faster due to the relatively small price movements.

Stock 4: Bajaj Auto

- Entry Point: Looks good above 12,200

- Stop Loss (SL): 12,100

- Potential Target: 30, 60, 90, 100, 120, 150, 200 points from entry

- Holding Period: Few weeks

Analysis: Bajaj Auto has shown a consistent upward movement, with the stock consolidating around 12,100-12,200. The financial health of Bajaj Auto has been improving steadily, and the stock is poised for further growth. A breakout above 12,200 would confirm the continuation of the bullish trend, and traders can aim for targets ranging from 12,230 to 12,400.

The first target of 12,230 provides an immediate 30-point gain, while further targets extend up to 12,400. The stop loss of 12,100 provides a buffer in case the stock reverses direction. With Bajaj Auto’s solid financials and potential for long-term growth, this swing trade could turn out to be very profitable.

The holding period for Bajaj Auto is expected to last a few weeks, but given the potential for rapid price movement, traders should be ready to adjust their targets or exit early based on market conditions.

Positional Trading Explained

Positional trading is a strategy where traders hold a position for a longer duration, typically several weeks to months. Positional traders are less concerned with short-term price fluctuations and focus more on the overall trend of a stock. This strategy requires a deep understanding of the company’s financial health, industry trends, and macroeconomic factors.

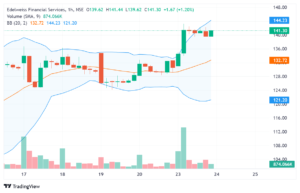

Stock 5: Edelweiss Financial Services

- Entry Point: Looks good above 140

- Stop Loss (SL): 130

- Potential Target: 145, 150, 155, 160

- Holding Period: Few weeks to a few months

Analysis: Edelweiss Financial Services has been in a consolidation phase, with the stock price hovering between 130 and 140. The company’s financial performance has been improving, and there is potential for further upside as the market sentiment shifts in favor of financial services companies. A breakout above 140 is a positive signal that the stock is ready for an upward trend.

The first target for this trade is 145, followed by 150, 155, and 160. These targets are spaced out to allow traders to capture profits at multiple levels. The stop loss is set at 130, providing a 10-point buffer in case of any market corrections.

Since this is a positional trade, the holding period could last several weeks or even months, depending on how the stock performs. The long-term potential of Edelweiss Financial Services is solid, making it a good option for traders who prefer a more passive trading strategy.

Conclusion: Importance of Risk Management

While the above stocks present attractive opportunities for swing and positional trading, it’s essential to emphasize the importance of risk management. Setting stop losses and adhering to them is critical to prevent significant losses. Traders should also avoid over-leveraging and ensure that they have a well-diversified portfolio to spread risk across different sectors.

Additionally, traders should stay updated with any financial news or events related to these companies, as changes in market conditions or company performance can impact stock prices significantly. Monitoring the price action regularly and being ready to exit or adjust positions based on new information is crucial for successful swing and positional trading.

Finally, always consult with a financial advisor before making any investment decisions. The stock market can be volatile, and it’s important to have a solid understanding of your risk tolerance and financial goals before entering any trade.

Disclaimer

All the research and analysis provided in this article is for educational purposes only. Please consult your financial advisor before making any investment decisions. Trading and investing in the stock market involve risk, and past performance is not indicative of future results.

This detailed breakdown of ELICON Engineering, CHOLA Finance, BHEL, Bajaj Auto, and Edelweiss Financial Services offers insights into potential trading opportunities based on market research. Swing and positional trading can be highly rewarding, but only when proper analysis and risk management strategies are applied.