Hindustan Zinc, a leading integrated zinc-lead-silver producer in India, presents a compelling positional trade opportunity with an entry point above 540. This detailed analysis aims to provide insights into Hindustan Zinc’s current market position, assess recent developments, and outline a strategic trade setup with associated risks and potential rewards.

Hindustan Zinc is renowned as one of the world’s largest and India’s only integrated zinc-lead-silver producer. The company is primarily engaged in the mining and smelting of zinc, lead, and silver medals in India. With a strong presence in the non-ferrous metals sector, Hindustan Zinc is a key player in India’s industrial landscape.

Technical Analysis:

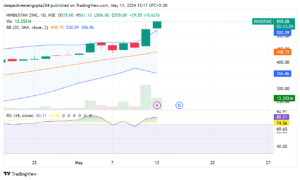

1. Breakout Signal: Hindustan Zinc is displaying signs of a potential breakout above the 540 level, which serves as a key resistance barrier. The stock recently closed at Rs. 525.50, crossing its Upper Bollinger Band by 5.9%, indicating the potential onset of an uptrend. Additionally, the stock closed at 7.91% higher than its previous All-Time High of Rs. 487.00, signaling bullish momentum.

2. Overbought Zone: The Relative Strength Index (RSI) crossed above 70, entering the overbought zone. While an overbought condition may suggest a potential pullback, it also reflects strong buying momentum, supporting the bullish thesis. The stock’s RSI entering the overbought zone underscores the strength of the uptrend.

3. High Volume and Delivery: Recent market analysis indicates a surge in both stock volume and delivery, with volumes increasing by 4.4 times and delivery by 1.9 times compared to their 5-day averages. This surge, coupled with a 15.2% price movement, suggests strong buying interest and validates the bullish sentiment.

Trade Setup:

1. Entry Point: Traders are advised to enter the trade above the 540 level, anticipating a breakout confirmation. This entry point ensures participation in the potential upward movement while minimizing the risk of entering prematurely.

2. Stop Loss (SL): To manage risk, a stop loss is set at 510. This level is below the entry point and acts as a safeguard against potential downside risks. Implementing a stop loss helps protect capital and ensures disciplined risk management.

3. Target Levels: Multiple target levels are identified to capture potential gains as the trade progresses. The targets are set at incremental levels of 5, 10, 15, 20, 25, 30, and 40 points from the entry, reflecting the anticipated upward movement in Hindustan Zinc. Traders can consider scaling out of their positions or adjusting their stop losses as the stock price approaches each target level.

4. Hold Period: The suggested hold period for the trade is a few days, allowing sufficient time for the anticipated breakout to unfold and for the stock price to reach the target levels. Traders should monitor the trade regularly and adjust their strategy based on evolving market conditions and price dynamics.

Market Overview:

Hindustan Zinc operates in the non-ferrous metals sector, specifically in the metal-nonferrous industry. With a market capitalization of 2,19,822.22 Cr. and a categorization as a large-cap company, Hindustan Zinc holds a significant position in India’s industrial sector. The company’s enterprise value stands at 2,31,208.83 Cr., reflecting its overall market valuation.

In conclusion, Hindustan Zinc presents a compelling positional trade opportunity for traders seeking to capitalize on potential breakout momentum. With favorable technical indicators, recent market developments, and a strong fundamental backdrop, Hindustan Zinc is well-positioned to experience further price appreciation in the coming days. However, traders should exercise caution, conduct thorough research, and implement proper risk management strategies to mitigate downside risks. As always, it is recommended to consult with a financial advisor before making any investment decisions.

ALSO READ: Kirloskar Oil Engines Positional Trade Analysis for May 13