Generating passive income from stocks can be a lucrative strategy for investors looking to supplement their regular income or build long-term wealth. Passive income refers to income that is earned with minimal effort or active involvement. While investing in stocks always carries some level of risk, there are several strategies that investors can use to generate passive income from stocks. Here are 20 strategies for generating passive income from stocks:

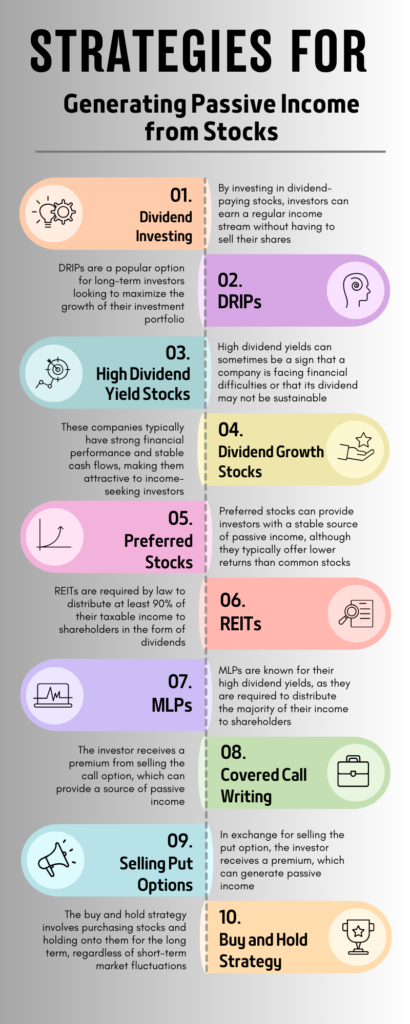

Dividend Investing: Dividend investing is a strategy where investors focus on purchasing stocks from companies that pay regular dividends to their shareholders. Dividends are typically paid out of the company’s profits, and the amount can vary based on the company’s performance and dividend policy. By investing in dividend-paying stocks, investors can earn a regular income stream without having to sell their shares.

Dividend Reinvestment Plans (DRIPs): DRIPs allow investors to reinvest their dividends back into the same stock, purchasing additional shares. This can help to compound returns over time, as the investor’s ownership stake in the company grows. DRIPs are a popular option for long-term investors looking to maximize the growth of their investment portfolio.

High Dividend Yield Stocks: High dividend yield stocks are stocks that offer a high dividend payout relative to their stock price. These stocks can provide investors with a significant income stream, but they can also be riskier than stocks with lower dividend yields. High dividend yields can sometimes be a sign that a company is facing financial difficulties or that its dividend may not be sustainable.

Dividend Growth Stocks: Dividend growth stocks are stocks of companies that have a history of consistently increasing their dividends over time. These companies typically have strong financial performance and stable cash flows, making them attractive to income-seeking investors. By investing in dividend growth stocks, investors can benefit from a growing stream of passive income from stocks.

Preferred Stocks: Preferred stocks are a type of stock that pays a fixed dividend, similar to a bond. They can provide investors with a stable source of passive income. Preferred stockholders have a higher claim on assets and earnings than common stockholders. However, they typically do not have voting rights. Preferred stocks often offer lower returns than common stocks.

Real Estate Investment Trusts (REITs) operate as companies that own, operate, or finance income-producing real estate across a range of property sectors. Investing in REITs allows individuals to gain exposure to the real estate market without having to directly buy, manage, or finance properties. REITs are required by law to distribute at least 90% of their taxable income to shareholders in the form of dividends, making them a popular choice for generating passive income.

Master Limited Partnerships (MLPs) are publicly traded partnerships typically involved in the energy, natural resources, or real estate sectors. MLPs are known for their high dividend yields, as they must distribute the majority of their income to shareholders. However, MLPs come with unique tax considerations and may not be suitable for all investors.

Covered Call Writing: Covered call writing is an options trading strategy where an investor sells call options on a stock that they already own. The investor receives a premium from selling the call option, which can provide a source of passive income. If the stock price rises above the call option’s strike price, the investor may be obligated to sell their shares at the strike price, potentially limiting their upside potential.

Selling Put Options: Selling put options is another options trading strategy where an investor sells a put option on a stock that they would be willing to purchase at a certain price (the strike price). If the stock price falls below the put option’s strike price, the investor may be obligated to buy the stock at that price. In exchange for selling the put option, the investor receives a premium, which can generate passive income.

Buy and Hold Strategy: The buy and hold strategy involves purchasing stocks and holding onto them for the long term, regardless of short-term market fluctuations. By holding onto stocks, investors can benefit from capital appreciation and dividends over time, which can provide a source of passive income. This strategy requires patience and a long-term investment horizon.

Index Funds: Index funds are a type of mutual fund or exchange-traded fund (ETF) that aims to replicate the performance of a specific stock market index, such as the S&P 500. By investing in index funds, investors can gain exposure to a broad range of stocks and receive dividends paid by the underlying stocks in the index. This provides a diversified source of passive income, as the index fund automatically adjusts its holdings to match the index it tracks.

Diversification: Diversification is a strategy where investors spread their investments across different asset classes, industries, and geographic regions to reduce risk. By diversifying their stock portfolio, investors can ensure a more stable source of passive income, as they are not overly reliant on the performance of a single stock or sector. Diversification can help to smooth out returns and protect against market downturns.

Long-Term Growth Stocks: Investing in stocks that have the potential for long-term growth can help to increase passive income over time. These stocks are typically from companies that are able to grow their earnings and dividends consistently. By holding onto these stocks for the long term, investors can benefit from capital appreciation and a growing stream of passive income from stocks.

Blue-Chip Stocks: Blue-chip stocks are stocks of well-established companies with a history of stable earnings and dividends. These companies are often market leaders in their respective industries and are known for their financial stability. Investing in blue-chip stocks can provide a reliable source of passive income, as these companies are less likely to experience significant volatility compared to smaller companies.

Buybacks: Some companies use a portion of their profits to buy back their own shares on the open market. By reducing the number of shares outstanding, buybacks can increase the value of the remaining shares. This can provide a source of passive income for investors, as the value of their shares increases without them having to sell their holdings.

Peer-to-Peer Lending: Peer-to-peer lending platforms allow investors to lend money to individuals or businesses in exchange for interest payments. This can provide a source of passive income that is not directly tied to the stock market. However, peer-to-peer lending carries risks, such as borrower default, and investors should carefully evaluate the platform and borrowers before investing.

High-Yield Bonds: High-yield bonds, also known as junk bonds, are bonds issued by companies with lower credit ratings. These bonds offer higher interest rates to compensate for the increased risk of default. Investing in high-yield bonds can provide a source of passive income through the interest payments made by the bond issuer. However, high-yield bonds are generally riskier than investment-grade bonds and may be more susceptible to default.

Fixed Income Securities: Fixed income securities, such as corporate bonds or government bonds, can provide a stable source of passive income through regular interest payments. These securities are generally less risky than stocks but offer lower returns. Investors can choose from a range of fixed income securities with varying levels of risk and return potential.

Automatic Investment Plans: Setting up an automatic investment plan can help to automate the process of investing in stocks and generating passive income. By automatically investing a portion of your income into stocks, you can build a source of passive income over time. Automatic investment plans can help to reduce the impact of emotions on investment decisions and ensure consistent investing behavior.

Tax-Efficient Strategies: Utilizing tax-efficient investment strategies can help to maximize passive income from stocks. Strategies such as investing in tax-advantaged accounts (e.g., 401(k), IRA) or using tax-loss harvesting can help to reduce taxes on passive income generated from stocks. By carefully planning your investments with tax implications in mind, you can increase the after-tax returns of your passive income portfolio.

In conclusion, there are many strategies that investors can use to generate passive income from stocks. By diversifying their portfolio, investing in dividend-paying stocks, and utilizing tax-efficient strategies, investors can build a reliable source of passive income that can help to secure their financial future.

Also Read: Pillars of Stock Market Analysis: Examining the Top 25 Indicators