Central banks play a pivotal role in shaping economic and financial conditions, including stock market trends, through their monetary policy decisions and actions. As the guardians of a nation’s monetary system, central banks are responsible for maintaining price stability, promoting full employment, and supporting economic growth. In pursuit of these objectives, central banks employ various tools and mechanisms that directly and indirectly influence stock market trends. In this comprehensive analysis, we’ll delve into the intricate relationship between central banks and the stock market, exploring how monetary policy decisions, interest rates, quantitative easing, and communication strategies impact stock market dynamics.

Monetary Policy Decisions:

At the heart of central banks’ influence on the stock market lies their monetary policy decisions, which encompass interest rate adjustments, open market operations, reserve requirements, and other measures aimed at controlling the money supply and credit conditions. Changes in monetary policy have profound implications for financial markets, including stock prices, as they affect borrowing costs, investment decisions, and overall economic activity.

Interest Rate Policy:

Interest rates are a primary tool of monetary policy used by central banks to regulate economic conditions. By adjusting benchmark interest rates, such as the federal funds rate in the United States or the European Central Bank’s (ECB) main refinancing rate in the Eurozone, central banks influence the cost of borrowing and lending in the economy. Lowering interest rates stimulates economic activity by reducing borrowing costs for businesses and consumers, thereby boosting investment, consumption, and ultimately stock market sentiment. Conversely, raising interest rates curtails economic growth by increasing the cost of credit, which can dampen stock market performance as investors anticipate slower earnings growth and reduced corporate profitability.

Quantitative Easing (QE):

In times of economic distress or financial instability, central banks may resort to unconventional monetary policy measures, such as quantitative easing (QE), to provide additional stimulus to the economy. QE involves the central bank purchasing government bonds or other financial assets from the market, injecting liquidity into the financial system and lowering long-term interest rates. By reducing borrowing costs and increasing the availability of credit, QE programs aim to stimulate spending, investment, and lending, thereby supporting asset prices, including stocks. The announcement and implementation of QE programs often lead to rallies in stock markets as investors anticipate increased liquidity and favorable financing conditions.

Forward Guidance and Communication:

Central banks’ communication strategies and forward guidance play a crucial role in shaping market expectations and influencing stock market trends. Through speeches, press conferences, and policy statements, central bank officials communicate their outlook on economic conditions, inflation expectations, and future monetary policy actions. Clear and consistent communication helps align market expectations with central bank objectives, reducing uncertainty and volatility in financial markets. Forward guidance, which involves signaling future policy intentions or providing guidance on the likely path of interest rates, allows investors to adjust their investment strategies accordingly, affecting stock prices and market dynamics.

Impact on Investor Sentiment:

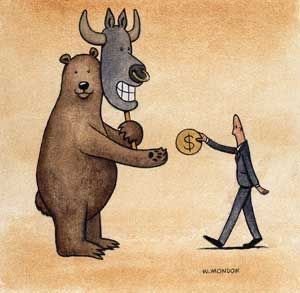

Central banks’ actions and statements have a significant impact on investor sentiment and market psychology, influencing investor behavior and risk appetite. Positive developments, such as interest rate cuts, expansionary monetary policy measures, or dovish policy statements, tend to bolster investor confidence and fuel optimism in the stock market. Conversely, negative surprises, such as unexpected rate hikes, contractionary policy measures, or hawkish signals from central banks, can trigger market volatility and investor anxiety, leading to sell-offs and declines in stock prices. Central banks’ ability to manage market expectations and instill confidence is crucial for maintaining stability and resilience in financial markets.

Regulatory Oversight and Financial Stability:

In addition to their monetary policy mandate, central banks play a critical role in safeguarding financial stability and ensuring the integrity of financial markets. Central banks oversee the banking sector, monitor systemic risks, and implement regulatory measures to mitigate vulnerabilities and prevent excessive risk-taking. By maintaining sound financial systems and effective regulatory frameworks, central banks contribute to investor confidence and market stability, fostering a conducive environment for long-term investment and economic growth.

Central banks wield considerable influence over stock market trends through their monetary policy decisions, interest rate policies, quantitative easing programs, communication strategies, and regulatory oversight. By adjusting interest rates, injecting liquidity, providing forward guidance, and managing market expectations, central banks shape investor sentiment, market psychology, and risk appetite, impacting stock prices and market dynamics. Understanding the role of central banks in influencing stock market trends is essential for investors to navigate financial markets effectively, anticipate policy developments, and make informed investment decisions. As key drivers of economic and financial conditions, central banks play a central role in shaping the trajectory of stock markets and broader economic outcomes.

ALSO READ: What is Option Trading? A Beginner’s Guide