Kirloskar Oil Engines (KOEL), a prominent player in the diesel engine manufacturing industry, presents a potential positional trade opportunity with an entry point above 1110. This detailed analysis aims to provide insights into KOEL’s current market position, assess recent developments, and outline a strategic trade setup with associated risks and potential rewards.

Kirloskar Oil Engines (KOEL) is a leading manufacturer of diesel engines, operating as part of the renowned Kirloskar Group. With a diverse business portfolio spanning multiple sectors including manufacturing, oil and gas, power, construction, mining, agriculture, industry, and transport, KOEL has established itself as a key player in the Indian industrial landscape.

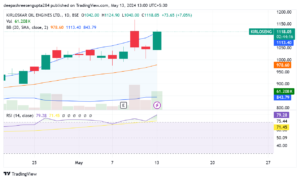

Technical Analysis:

1. Breakout Signal: KOEL is exhibiting signs of a potential breakout above the 1110 level, which serves as a key resistance barrier. The Relative Strength Index (RSI) is showing a shift towards the upper direction, indicating strengthening bullish momentum. A breakout above this level could signify a continuation of the uptrend and present an attractive trading opportunity for investors.

2. Support and Resistance: Recent market analysis suggests a reversal from the bottom, with the RSI shifting in the upper direction. This indicates a potential reversal of the downtrend and a strengthening of bullish sentiment. Additionally, the breakout is anticipated after a period of long consolidation, further supporting the bullish thesis.

Trade Setup:

1. Entry Point: Traders are advised to enter the trade above the 1110 level, anticipating a breakout confirmation. This entry point ensures participation in the potential upward movement while minimizing the risk of entering prematurely.

2. Stop Loss (SL): To manage risk, a stop loss is set at 1050. This level is below the entry point and acts as a safeguard against potential downside risks. Implementing a stop loss helps protect capital and ensures disciplined risk management.

3. Target Levels: Multiple target levels are identified to capture potential gains as the trade progresses. The targets are set at 1150, 1175, 1200, 1225, 1250, 1275, and 1300, reflecting incremental price targets based on the anticipated upward movement in KOEL. Traders can consider scaling out of their positions or adjusting their stop losses as the stock price approaches each target level.

4. Hold Period: The suggested hold period for the trade is a few days, allowing sufficient time for the anticipated breakout to unfold and for the stock price to reach the target levels. Traders should monitor the trade regularly and adjust their strategy based on evolving market conditions and price dynamics.

Market Overview:

KOEL operates in the Capital Goods sector, specifically in the Engineering – Industrial Equipments industry. With a market capitalization of 15,534.31 Cr. and a categorization as a small-cap company, KOEL holds a significant position in the Indian industrial sector. The company’s enterprise value stands at 18,763.47 Cr., reflecting its overall market valuation.

In conclusion, Kirloskar Oil Engines presents a compelling positional trade opportunity for traders seeking to capitalize on potential breakout momentum. With favorable technical indicators, recent market developments, and a strong fundamental backdrop, KOEL is well-positioned to experience further price appreciation in the coming days. However, traders should exercise caution, conduct thorough research, and implement proper risk management strategies to mitigate downside risks. As always, it is recommended to consult with a financial advisor before making any investment decisions.

ALSO READ: Cummins India Positional Trade Analysis for May 13, 2024